UPDATE: On February 22, Kansas Gov. Brownback vetoed H.B. 2178. While the Kansas House voted 85 to 40 to override the veto, the Senate vote was 24 to 16 (27 is needed for a veto override).

H.B. 2178, a bill increasing income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates and ending the tax exclusion of pass-through income, is on Governor Sam Brownback’s desk, after the Kansas House approved it 76 to 48 on February 16 and the Kansas Senate approved it 22 to 18 on February 19. Key provisions of the 13-page bill:

- Repeals the pass-through carveout. Kansas is the only state in the country that completely exempts all non-wage income (income reported on Schedules C, E, and F) earned by pass-through entities like S-corps and LLCs. Since the provision took effect in 2013, pass-through registrations have jumped, but pass-through job creation lags the national and regional averages. The provision costs the state between $250 million and $300 million per year.

- Adds a top income tax bracket of 5.45 percent on income over $50,000 for single filers and $100,000 for married filing jointly. This is below the 6.45 percent top rate Kansas had until 2012, but higher than the current top tax rate of 4.6 percent.

- Raises the (now) middle-income tax bracket from 4.6 percent to 5.25 percent. This applies to income between $15,000 and $50,000 (single filers) and $30,000 and $100,000 (married filing jointly).

- Cancels further automatic tax reductions. The 2012 law, in addition to the steep rate cuts and pass-through exclusion, required further tax reductions by dedicating all revenue above 2 percent growth to be used to reduce individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates to zero and reduce corporate tax rates. By pegging triggers to year-over-year revenue growth, without regard to any static baseline, Kansas could trigger tax cuts without any meaningful economic growth. For instance, if revenues declined by 2 percent in year one and then recovered in year two, two-year revenue growth could be flat, but year-over-year growth would be sufficient to trigger a tax cut. This is approximately what happened, and in 2015 the triggers were increased to 2.5 percent and postponed until 2020. This bill eliminates them completely.

- Expands itemized deductions to include 50 percent of medical expenses declared on federal returns. Unchanged law permits itemized deductions for charitable contributions and 50 percent of mortgage interest and property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. . Standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. and personal exemption levels are not changed.

| Taxable Income | 1992 to 2012 | 2013 | 2014 | 2015 | 2016 | 2017 (under H.B. 2178) |

|---|---|---|---|---|---|---|

| >$0 | 3.50% | 3.00% | 2.70% | 2.70% | 2.70% | 2.70% |

| >$30,000 | 6.25% | 4.90% | 4.80% | 4.60% | 4.60% | 5.25% |

| >$60,000 | 6.45% | |||||

| >$100,000 | 5.45% |

When Kansas adopted the pass-through carveout, we warned that it did not have good economic justification and would “encourage economically inefficient, though tax-reducing” restructuring activity. We also warned that the “tax reductions, while producing positive economic benefits, would cost revenue and ultimately need to be paid for either by cutting spending or increasing taxes elsewhere.” We described the pass-through carveout as “an incentive to game the tax system without doing anything productive for the economy.” We acknowledge that pass-through entities face higher tax burdens than C-corporations, but argue that a tax carveout or reduced rate compared to wage income is administratively challenging and difficult to justify.

Between FY 2013 and FY 2014, revenue dropped by $688 million, which was $293 million more than expected. General fund expenses were reduced just $152 million, opening a structural budget gap. Subsequent years were marked by significant difficulty projecting revenues, as the number of those taking advantage of the pass-through carveout eventually proved twice what was originally projected. (Revenues have fallen short of projections every year since 2013, and officials missed monthly projections 33 times out of 46.) Supporters of the governor’s tax program argued that the gap would be closed by stronger economic growth in a few years (Brownback himself called his tax cuts “a shot of adrenaline into the heart of the Kansas economy”), so the state used one-time measures such as drawing down reserves and delaying a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. cut. By 2015, the cash deficit was masked with a one-time tax amnesty, draining the rainy day fund, raising the sales tax from 6.15 percent to 6.5 percent, raising the cigarette tax from 79 cents to $1.29 per pack, and imposing a new tax on vapor products.

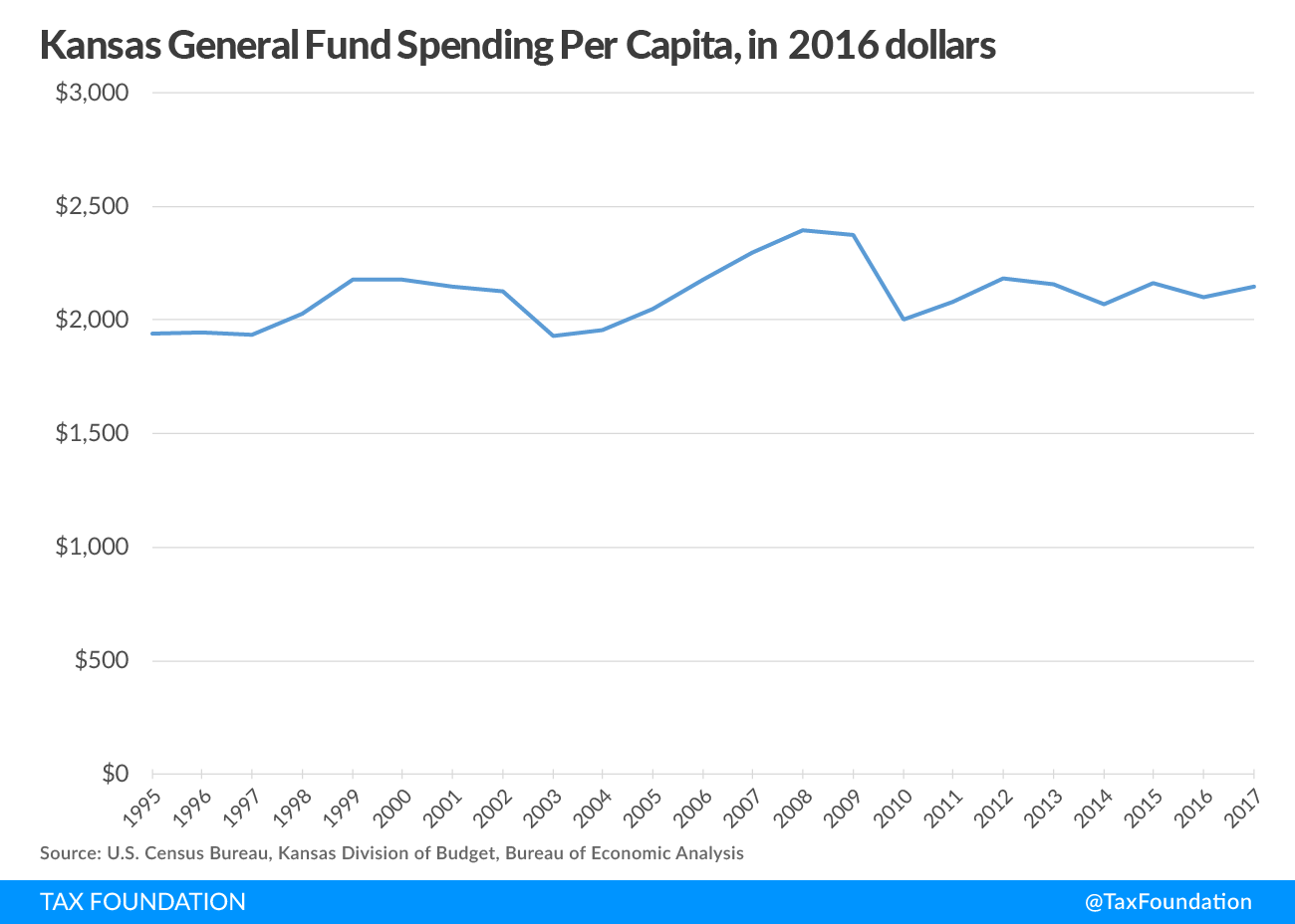

When we testified in Topeka last month and this month, some asked us whether the structural gap is due to Kansas policymakers going on a spending spree since 2012. A chart of general fund spending adjusted for population and inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. shows that not to be the case:

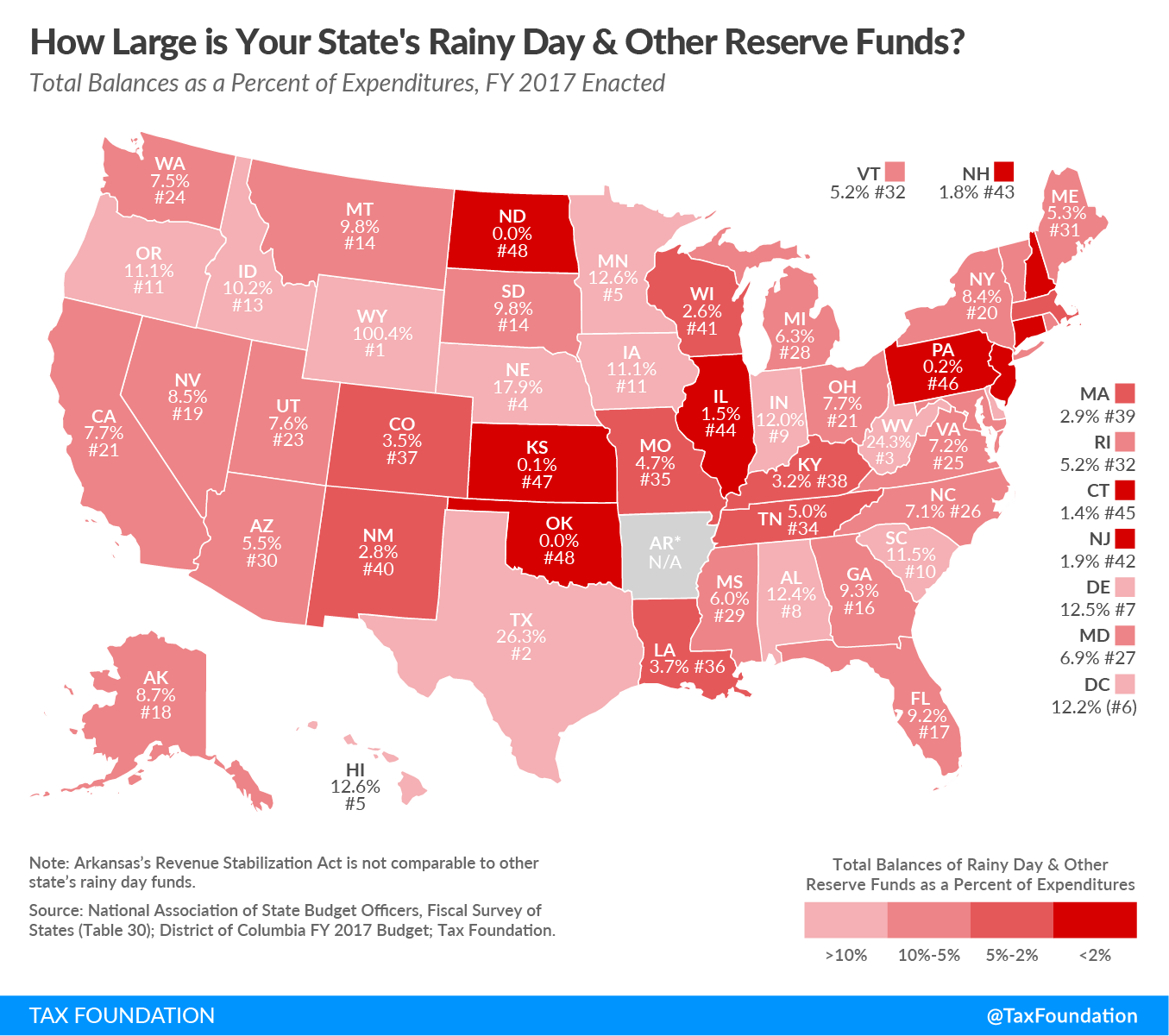

Kansas continues to have a structural budget gap, difficulty projecting revenues, and a negative cash situation. These difficulties are an order of magnitude larger than in any other state (except perhaps for the budget and cash situation in Illinois), even other states suffering from low agriculture or oil prices. Kansas job growth lags Nebraska, a higher-tax neighbor hit just as hard by farm prices; neighboring Missouri has seen strong job growth. Kansas pass-through job creation (8.4 percent from 2012-14) lags the national average (9.5 percent) and both Nebraska (11.7 percent) and Missouri (9.5 percent). Kansas faces a $1.1 billion gap between now and mid-2019 (including $349 million in the current budget ending in June), and the governor proposes further one-time measures such as converting the annual tobacco settlement money payments into one-time money, borrowing against KPERS pension funds, further raising cigarette and liquor taxes, and canceling all new road projects until 2020. Kansas is currently just one of four states with essentially zero in budget reserves:

The Kansas pass-through carveout has no place in a good tax code. It also destabilized the budget and made revenue projections volatile. While there certainly could be spending cut options that lawmakers could use to help balance the state’s budget, that doesn’t justify keeping in place a problematic tax carveout.

Kansas’s prior attempts to resolve its budget issues focused on temporary, short-term solutions–emptying the rainy day fund, raiding program reserve funds, and offering bonds on its tobacco revenue stream. These were not sustainable fiscal solutions. While we have no doubt this was a tough vote for Kansas legislators, good tax policy is often difficult.

Share this article