The Institute on Taxation and Economic Policy is out today with a report recommending how states should approach taxing legalized marijuana. It’s a topic we’ve written about extensively, and based on that research, we have some concerns with the report’s suggestion that states taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. marijuana based on the weight of the amount sold rather than the retail sales price.

ITEP argues that weight-based taxes on the grower and/or processor would be less prone to evasion and easier to collect than price-based taxes at the retail level. I disagree. Washington moved away from taxing growers and processors because they found retail collection simpler, prevented an accidental hefty federal tax on processors and growers, and removed an unintentional incentive for vertical integration.

Not all marijuana is the same, either: more potent “premium” strains weigh the same as other strains. Price, however, is an effective proxy for potency.

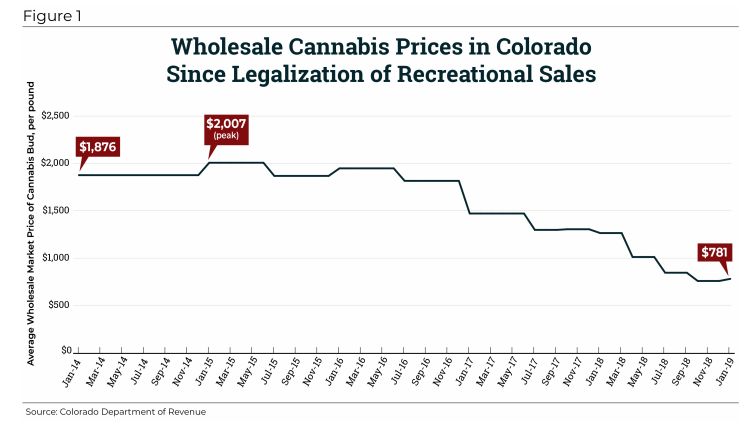

ITEP wants to do this because it says tax revenues will fall otherwise. There is no evidence for that. It is true that marijuana wholesale prices have fallen, but that is a feature, not a bug, of legalization. It allows the legal market to compete effectively with the black market, as one of the goals of the legalization is to wipe out that black market. So while ITEP’s chart on falling wholesale prices in Colorado is accurate:

The drop in wholesale prices has occurred at the same time as soaring state marijuana tax revenues. Colorado’s revenue, for instance, during this period of “collapsing prices”:

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIf revenue growth is not about to collapse under a price-based tax, that undermines ITEP’s main argument. On page 22-24, they acknowledge there’s no sign of an imminent collapse in tax revenues but still predict it anyways: “While there appears to be some leveling-off of revenue growth in states where cannabis taxation has been underway for several years, there are no guarantees that future cannabis tax revenues—particularly those raised by price-based taxes—will plateau for long.” (In an earlier version of this post, I wrote they hadn’t acknowledged marijuana revenue growth in states that have legalized; I was wrong and have corrected this paragraph accordingly.) There is zero evidence state marijuana tax revenues are about to collapse; my reading is that there will be continued growth until it stabilizes at a mature market level and the growth rate (and state tax revenue) plateaus.

These reasons are why contrary to ITEP’s recommendation, states that have legalized marijuana so far primarily rely on price-based taxes.

Share this article