In a recent report that reviews inheritance taxAn inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. ation in OECD countries, the Organisation of Economic Co-operation and Development (OECD) concludes that inheritance taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es could play a key role in reducing inequality while increasing countries’ tax revenues.

When analyzing the wealth distribution in 27 OECD countries, the report finds that in 2015, on average, the 1 percent wealthiest households owned 18 percent of households’ wealth, while the wealthiest 10 percent owned 50 percent of all households’ wealth.

However, during the 20th century, for the countries where data was available, wealth inequality, measured as the share of net wealth held by the top 1 percent wealthiest households, declined sharply. It was only in the past four decades that the share of net wealth held by the top 1 percent wealthiest households increased slightly on average, from roughly 20 percent to 25 percent. However, this slight increase occurred during a period when household wealth grew substantially. Between 1995 and 2019, per capita wealth tripled in France and more than doubled in the United Kingdom and Canada.

Checking only for inequality obviates the fact that all households are better off today than they were in past decades.

The report considers that wealth transfers to heirs have the potential to reinforce inequality and therefore advocates for improving the design of the inheritance and gift taxA gift tax is a tax on the transfer of property by a living individual, without payment or a valuable exchange in return. The donor, not the recipient of the gift, is typically liable for the tax. es to reduce wealth gaps. However, this conclusion, and the policy implications that derive from it, are not as straightforward as they appear.

A recent study finds that inheritances and gifts account for half of the parent-child wealth correlation, while earnings and education account for a quarter. Nevertheless, this correlation drops over time, as grandparent-grandchild correlation is lower than parent-child correlation. Another study revealed that inheritances can in fact reduce wealth inequality as transfers are proportionately larger (relative to their pre-inheritance wealth) for households lower in the wealth distribution. This has an equalizing effect on the overall wealth distribution.

On average, 40 percent of the richest households reported having received an inheritance or gift. On the other hand, among the poorest 20 percent of households, between 3 percent in Italy and 26 percent in Finland reported receiving an inheritance or a gift. This and the fact that poorer households inherit more relative to their pre-inheritance wealth than rich households does show the potential that inheritances have to increase wealth at the bottom of the wealth distribution.

A relatively large number of OECD countries, 24, levy estate, inheritance, or gift taxes, which according to the OECD report can potentially reduce wealth concentration. Among those 24 countries, 19 levy recipient-based inheritance taxes. Korea, Denmark, the United Kingdom, and the United States levy estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. es on donors. Ireland levies a recipient-based inheritance and gift tax on lifetime wealth transfers. And across countries, there is a wide variation in the tax design. For example, the level of wealth that a child can inherit from their parents tax-free ranges from $17,000 in Belgium to $11 million in the United States.

When looking at effective tax rates, the wealthiest households are generally taxed at higher rates. However, surprisingly, in four out of the five countries analyzed, the effective tax rates are also higher at the bottom of the wealth distribution. For example, in Lithuania, the poorest 10 percent of households face an effective tax rate of 3.3 percent, while taxpayers in the middle of the wealth distribution face effective tax rates that ranged between 2.2 and 3.2 percent.

Statutory tax rates can reach levels as high as 81.6 percent, in Spain, depending not only on the level of the amount inherited but also on the level of pre-inheritance wealth of the inheritor and familial closeness to the inheritor.

Other countries, like Estonia and Latvia, never levied inheritance taxes, and since 1961, 10 OECD countries have repealed their inheritance and estate taxes. Apart from the OECD countries, Singapore, Liechtenstein, Hong Kong, Brunei, and Macau have also abolished these taxes for various reasons, such as their high administrative cost and the lack of political and social support, in addition to the relatively small amount of revenue collected. Additionally, a Tax Foundation report previous to the Tax Cuts and Jobs Act of 2017 found out that repealing the United States estate tax would gradually increase capital stock by 2.2 percent, boost GDP, create 139,000 jobs, and eventually increase federal revenue.

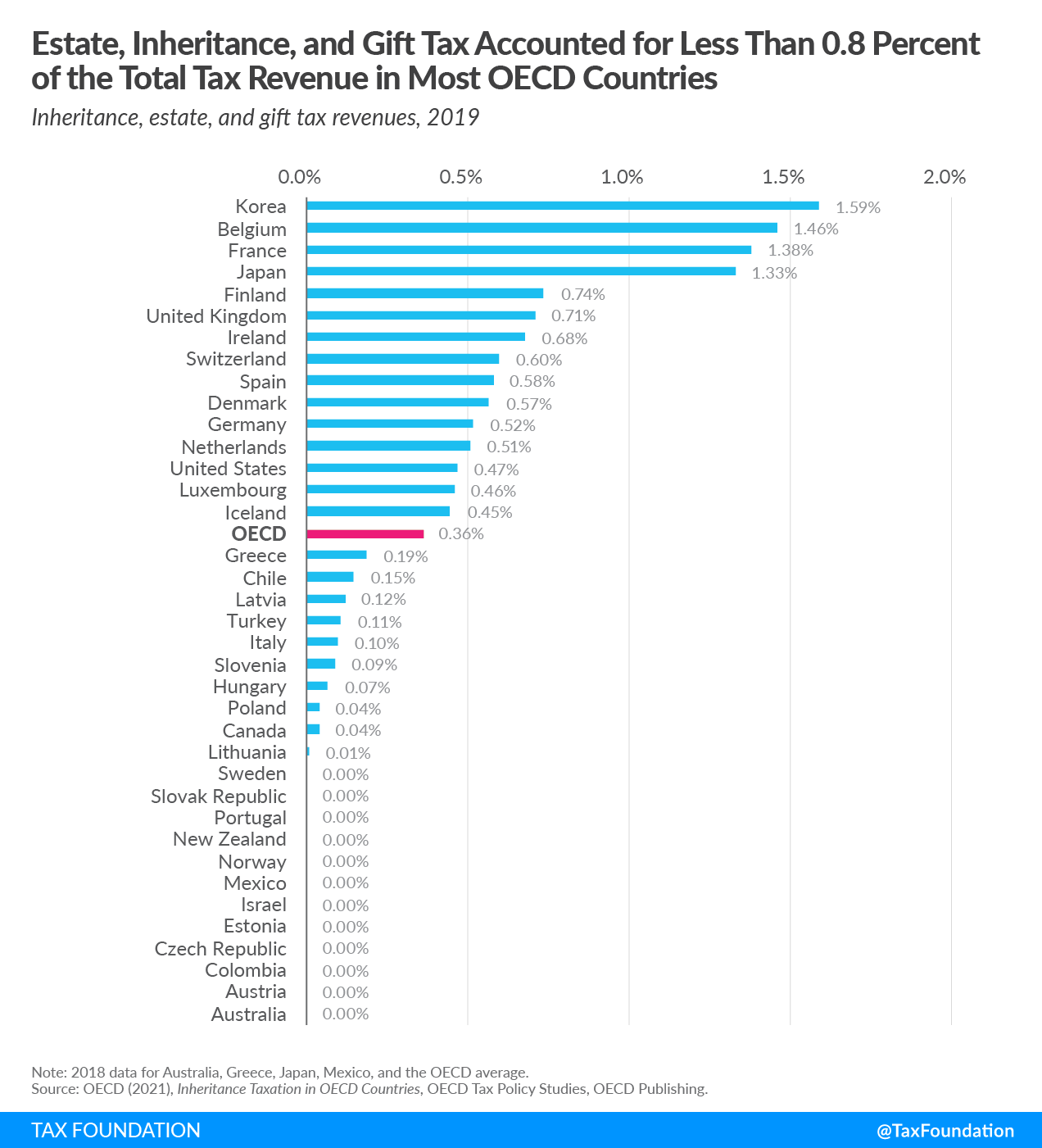

Revenues from inheritance, estate, and gift taxes have historically accounted for a very small portion of total tax revenues. Collected revenues reached their peak in 1965 when 1.27 percent of government revenue came from the inheritance, estate, and gift taxes. In 2019, on average, these taxes accounted for only 0.36 percent of the total OECD tax revenue, and among the OECD countries collecting revenues from these taxes, revenues made up just 0.56 percent of the total revenue.

Korea, one of the four countries that levy an estate tax on donors, relies the most on inheritance, estate, and gift taxes, with 1.6 percent of its overall tax revenue coming from estate taxes. The OECD’s recommendation is to tax recipients in order to promote equality of opportunity.

Inheritance and estate taxes are relatively ineffective at equalizing opportunities and reducing wealth gaps, not only due to their low revenues but also because a solid redistribution mechanism would need to be in place, and that would create new impacts on its own. Also, if the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. for these policies were to be broadened, it would make households further down the wealth distribution worse off.

As tempting as inheritance, estate, and gift taxes might look especially when the OECD notes them as a way to reduce wealth inequality, their limited capacity to collect revenue and their negative impact on entrepreneurial activity, savings, and work should make policymakers consider their repeal instead of boosting them.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe