Cigarette smokers in Indiana may be asked to pay a 200 percent higher state excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on their cigarettes if lawmakers move ahead with a recent proposal from legislative leaders. The current state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate is 99.5 cents per pack but the proposal would increase this rate to $3 per pack. That rate does not include the federal tax, which is $1.01 per pack, and the state sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. of 7 percent.

Excise taxes on tobacco products are legitimate because these products cause negative externalities. For instance, some health-care costs of smoking are covered by government, i.e., secondhand smoke affects nonsmokers. Levying an excise tax allows a state to recover the costs related to these externalities—thereby internalizing them. Nonetheless, it is hard to justify punitive level regressive taxA regressive tax is one where the average tax burden decreases with income. Low-income taxpayers pay a disproportionate share of the tax burden, while middle- and high-income taxpayers shoulder a relatively small tax burden. ation of cigarettes at the levels suggested in Indiana.

Indiana House Speaker Todd Huston (R) has acknowledged that cigarette tax revenue is volatile—especially following an increase. Speaker Huston is correct because of the narrow nature of the tax and the declining demand for tobacco products. In fact, in years following tax increases, revenue tends to decline rather quickly after the initial increase. For this reason, revenue from cigarette taxes should not be allocated to general spending priorities but rather to internalize the negative externalities associated with smoking. As a positive note, this seems to be a well-understood principle in Indiana.

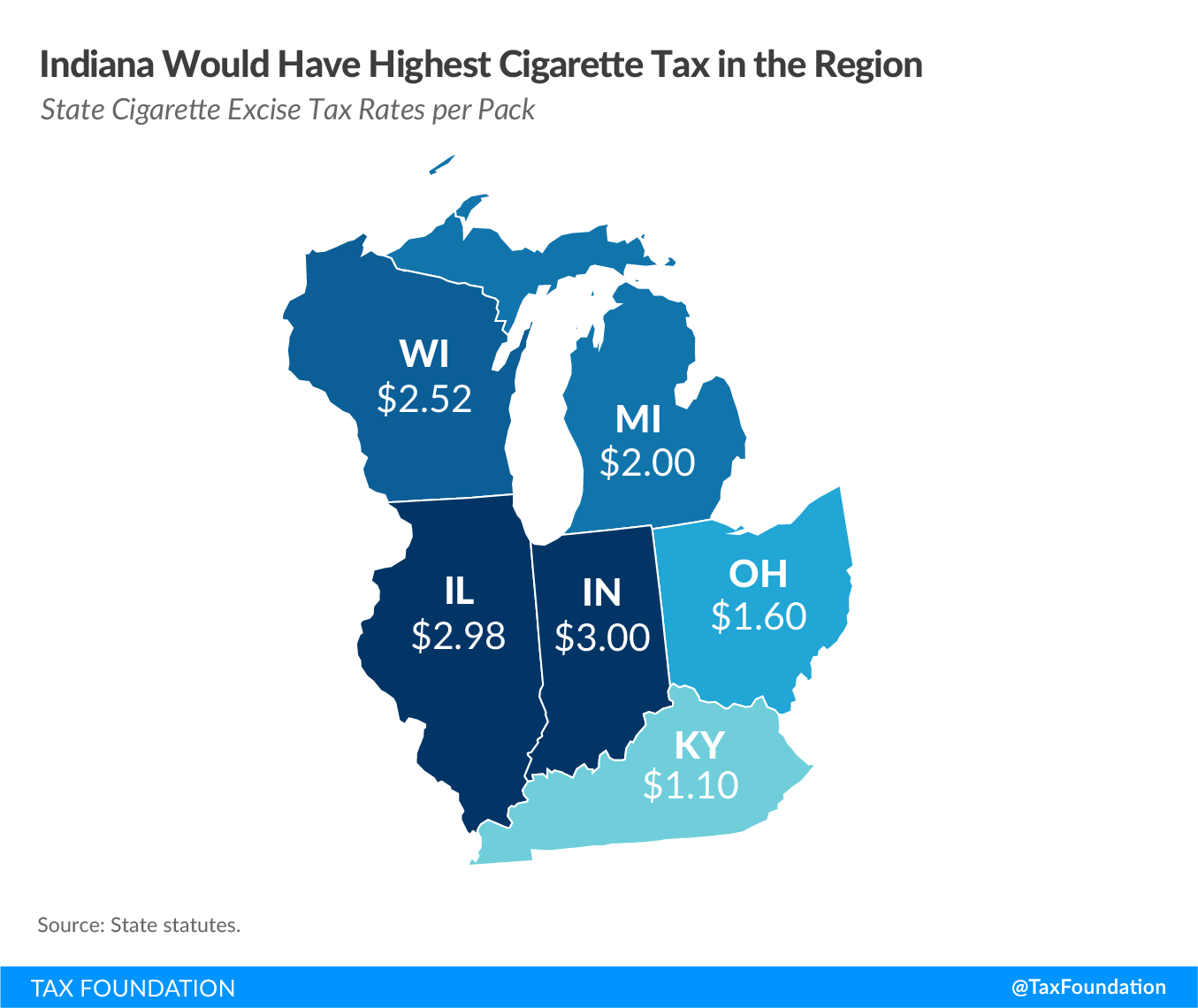

The impetus of the proposal is to promote smoking cessation, and increasing cigarette taxes has a proven track record of impacting demand. However, lawmakers should remember that tax policy is all about trade-offs. While increasing taxes on cigarettes may limit demand, a 200 percent hike may also result in a number of unintended consequences, such as increased smuggling. Indiana currently enjoys limited cigarette smuggling due to its relatively low tax rate, but a $2 increase means that Indiana would have the highest state cigarette tax rate in the region (and ninth-highest nationwide). A significant shift in smuggling would not only severely limit the positive revenue potential of the tax increase and the public health benefits but could also boost criminal activity in the state.

Increased smuggling as a result of tax disparities is not a theoretical issue. In states with high tax rates smuggling rates can make up over 50 percent of the market harming consumers, businesses, and tax collections. In addition to taxes, bans can also impact smuggling. In Massachusetts, the state estimated a revenue loss of $93 million after it banned flavored tobacco products. While the intent of the ban was to limit tobacco purchases, it certainly was not the intent of lawmakers to simply shift purchases out of state.

Smuggling counteracts the positive effects of limiting local demand as illicit products tend to be more harmful to consumers, are sold to minors, and cost governments billions of dollars in lost tax revenue. Lawmakers should not lose sight of the unintended consequences when discussing increasing tobacco taxes. This is even more true when those increases are as significant as the proposal in Indiana.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe