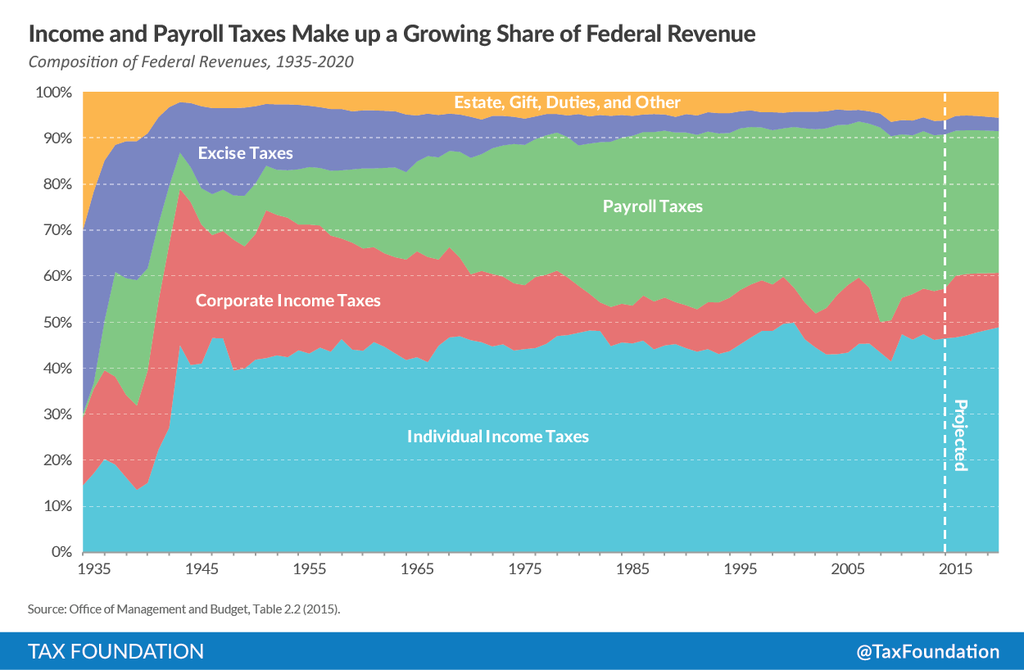

In 2015, the vast majority of federal revenue came from just two sources: individual income taxes and payroll taxes. But it wasn’t always that way. In fact, the sources of federal revenue have changed dramatically over the course of the last century.

Let’s travel back one hundred years, to 1915. Back then, the main sources of federal revenue were very different. Almost half of all federal revenue came from excise taxes, such as taxes on liquor and tobacco.[1] Another 30.1 percent of federal revenue came from customs duties, or tariffs, on imported foreign goods.

|

Sources of Federal Revenue, 1915 |

||

|

Source of Revenue |

Amount of Revenue |

Percent of Total Revenue |

|

$335,367,887.14 |

48.1% |

|

|

Customs Duties |

$209,786,672.21 |

30.1% |

|

Miscellaneous Revenues |

$70,287,372.90 |

10.1% |

|

$41,046,162.09 |

5.9% |

|

|

$39,155,596.77 |

5.6% |

|

|

Sale of Public Lands |

$2,167,136.47 |

0.3% |

|

Source: Combined Statement of the Receipts and Disbursements, Balances, etc., of the United States During the Fiscal Year Ended June 30, 1915, Treasury Department, 1915. |

As the table above shows, income taxes made up only a small portion of federal revenue in 1915. Individual income taxes accounted for 5.9 percent of federal revenue, while corporate income taxes accounted for 5.6 percent. At the time, both taxes were relatively low: the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. had a top rate of 7 percent, while the top corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate was 1 percent.

Over the next century, the main sources of federal revenue in 1915 faded away. The U.S. followed suit as nations around the world gradually eliminated most of their customs duties. And Congress left most federal excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. rates steady, causing overall excise tax revenues to grow more slowly than the size of the federal government.

Meanwhile, several other federal taxes grew more prominent:

- Corporate income taxes briefly became the largest source of federal revenue after the Revenue Act of 1942 raised the top corporate rate to 40 percent.

- Individual income taxes were also transformed by the Revenue Act of 1942 – from a narrow levy on wealthy Americans to a broad-based tax on 50 million households. Because of these changes, individual income taxes rose from 13.6 percent of federal revenues in 1940 to 45 percent of revenues in 1944, becoming the largest source of federal revenue.

- Payroll taxes rose substantially throughout the 20th century, following the enactment and expansion of Social Security and Medicare.

Over the next ten years, the Congressional Budget Office projects that individual income taxes will continue to grow as a source of federal revenue, while corporate income taxes will become less important. As for a century from now? No one really knows how different the sources of federal revenue will be then.

For more charts like these, check out Income Taxes Illustrated.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe