The House GOP Blueprint for tax reform would cut business and individual taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates, allow immediate expensing of capital outlays (instead of depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. ) for tax purposes, and end the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. . It would replace current business income taxes with a “destination-based cash flow tax” or DBCFT. The tax rate would be 20% for corporations, and 25% for noncorporate or “pass-through” businesses that are subject to tax only at the owners’ or shareholders’ levels. Dividends and capital gains would be taxed at rates applied to ordinary income, but with a 50 percent exclusion.

The DBCFT Treatment of Traded Goods and Services Has Raised Concerns about Import Prices

The DBCFT would impose a tax on goods and services sold in the United states, including the full cost of imports, but it would exclude tax on exports. This arrangement is called “border adjustment.” The cost of imported goods would not be allowed as a deduction, and would thus be subject to the tax. In its operation, it would resemble a sales tax. Importers fear that the tax, which is larger than their profit margins, would wipe out their earnings and/or force a price hike. Some observers have written that this would push up living costs for low-income consumers.

Most economists would expect a different outcome. The tax would initially tend to increase export sales and discourage import purchases, which would increase the demand for the dollar and reduce demand for foreign currencies. These demand shifts would raise the value of the dollar relative to foreign currencies by roughly the amount of the tax rate. Imports would become cheaper in dollar terms, before tax, and cost about the same after tax as they do now. Importers would not need to raise prices charged to U.S. consumers, and would see no profit squeeze.

To accomplish this outcome, foreign currencies would have to fall 20 percent relative to the dollar, or, looking at it the other way around, the dollar would have to rise 25 percent relative to other currencies.[1]

Many retailers and other observers have expressed concern that such exchange rate moves in response to the border adjustment tax are unlikely.

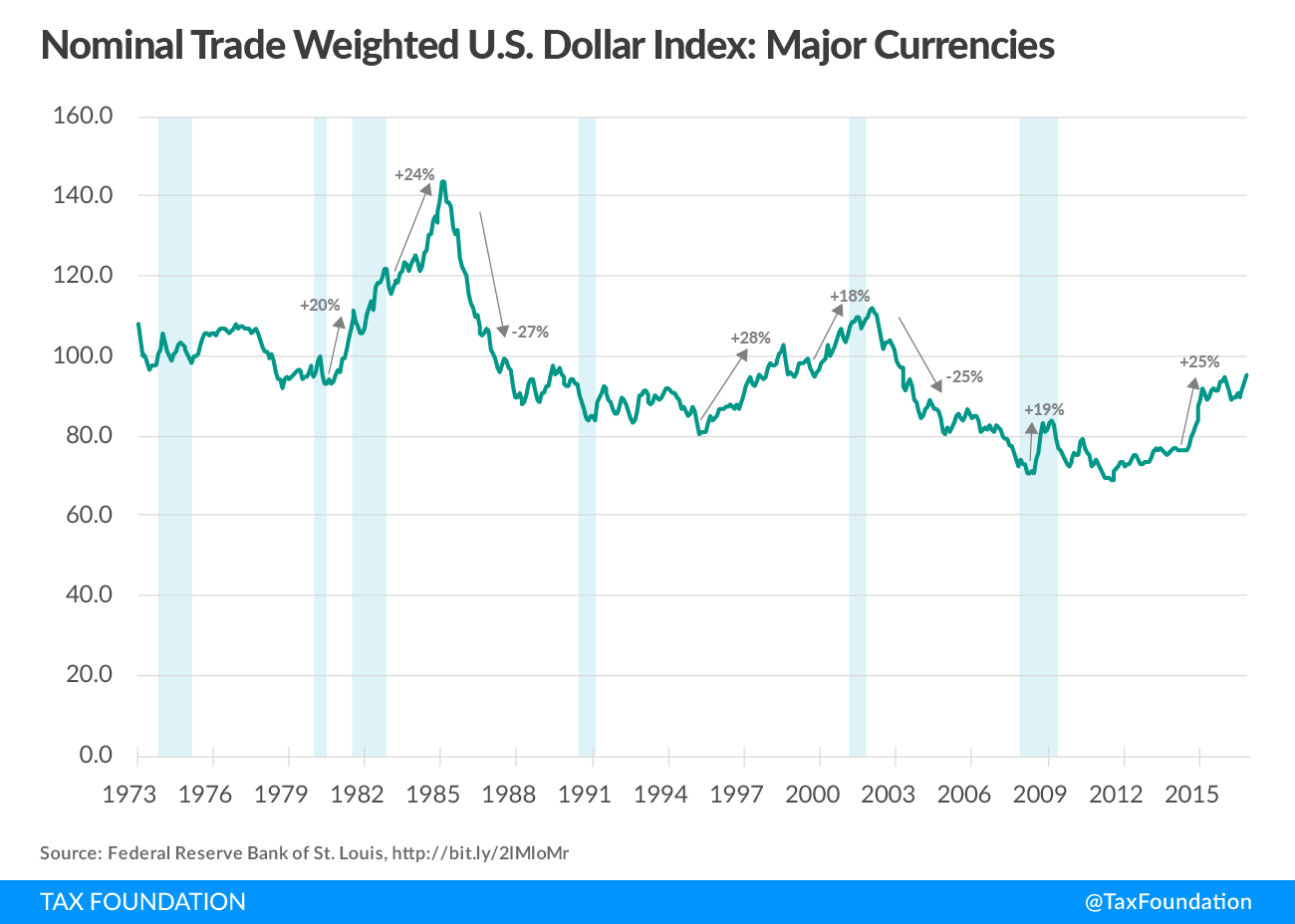

We believe these concerns are unfounded, for two reasons. First, other provisions of the Blueprint would reinforce the upward rise in the dollar; the border adjustment would not have to do all the lifting. Second, swings of that magnitude in the exchange rates have been quite common in the past.

Dollar Rise Due to Other Provisions in the House GOP Blueprint

Many other features of the House GOP Blueprint, besides the border adjustment, would support an even larger rise in the exchange rate. The Blueprint would significantly cut tax rates on capital, raising the after-tax returns and encouraging a large increase in capital formation. The immediate expensing of buildings, plant, and equipment outlays would do the most in that regard, followed by the reduction in the corporate tax rate, lower tax rates on capital gains and dividends, and the reduction in the individual tax rate on pass-through businesses. The individual tax rate cuts would also encourage the employment of U.S. labor. All these factors would encourage U.S. saving to be invested at home instead of abroad, and would attract foreign capital. The result would be a rise in the net capital inflow into the United States, which would further boost the dollar. The tax provisions relating to the cost of capital formation in the United States would have at least as much impact on the dollar exchange rate as the border adjustment.

Historical Examples of Tax-related Changes in the Dollar

The period following the Economic Recovery Tax Act of 1981 provides the best historical example of how dramatically exchange rates can adjust after pro-growth tax reform. The Economic Recovery Tax Act of 1981 reduced taxes on capital by accelerating depreciation, increasing the investment tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. , and lowering marginal tax rates on pass-through investors and on capital gains and dividends. At the same time, the Federal Reserve allowed interest rates to rise, as it is preparing to do today. The dollar rose by more than 40 percent compared to major foreign currencies between 1980 and 1985, in two great upward swoops. That tax reform had no border adjustment provision, yet the dollar rose sharply.

Several provisions of the 1981 Act relating to capital formation were roughly comparable to the provisions of the House GOP Blueprint. The corporate rate reduction and increase in the investment tax credit crudely approximated expensing, at then-prevailing inflation rates. The capital gains and dividend relief in 1981 was somewhat greater than in the Blueprint. However, the 1981 Act offered no reduction in the corporate tax rate. (That came later, in 1986.) In total, there was a smaller reduction in the “hurdle rate” of return on capital in the 1981 Act than in the Blueprint. One should expect more impetus to capital formation, and at least as strong an encouragement for a capital inflow, under the Blueprint as under the 1981 Act, suggesting a notable strengthening of the dollar.

The Role of Monetary Policy

Only part of the dollar’s rise in the early 1980s was due to the tax changes. The Federal Reserve contributed to the increase in the dollar by tightening monetary policy to fight the double-digit inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. of the late 1970s. Higher interest rates and lower inflation attract foreign capital and raise the dollar’s exchange rate. Lower inflation reduces the tax burden on capital investment, because it reduces the erosion by inflation of the capital consumption (depreciation) allowances. The Federal Reserve may have been the main source of the first uptick in the value of the dollar between 1980 and 1981, with the tax changes and further Fed action adding to the rise in 1983-85. The final surge in the dollar in 1985 was widely attributed to Fed action. The dollar’s rise was so great that it disrupted trade and international capital markets. At the Group of Five meeting at the Plaza Hotel in New York on September 22, 1985, Treasury Secretary James Baker, the other four Finance Ministers, and the heads of the other four central banks prevailed on Paul Volcker, Chairman of the Federal Reserve Board, to ease monetary policy and bring the dollar back down to earth. This agreement became known as the Plaza Accord. The dollar declined more than 25 percent in the months following the Fed easing.

Other Tax Changes and Exchange Rate Moves

The Tax Reform Act of 1986 slightly raised tax burdens on capital, and may have contributed to the gradual decline in the dollar over the next few years. The 1986 Act cut corporate and individual tax rates, but offset these changes with a lengthening of depreciation lives, repeal of the investment tax credit, higher taxes on capital gains, and tighter “passive loss” rules restricting deductions for the cost of real estate.

The tax rate on capital gains, which had been increased in the 1986 Act, was reduced to pre-1986 levels in 1997. The tax cut, along with declining inflation, may have contributed to a rise in the dollar in the months following. The dollar rose more than 25 percent between 1996 and 1999.

The first Bush tax cut in 2001 did virtually nothing for capital formation. It contained no improvement in capital consumption allowances and no corporate tax rate reduction. This omission was corrected in the second Bush tax reduction in 2003, which allowed immediate expensing of half of equipment outlays and lowered the double taxation of corporate income by lowering tax rates on dividends and capital gains. Capital investment in plant and equipment was strong following enactment. By itself, the 2003 Act should have increased the value of the dollar. However, the Federal Reserve was extraordinarily easy from 2001 onward, driving interest rates to near-record lows on government notes and bonds, and the dollar fell by more than 20 percent between 2002 and 2004.

The Bush tax cuts were extended in 2008, and may have been partly responsible for the bump in the dollar in 2008-09. More recent sharp swings in the dollar exchange rate, such as the rise in 2015, may have been due to easier monetary policy in the European Union and elsewhere, making the dollar relatively more attractive.

Conclusion

The border adjustment feature of the House Republican tax reform Blueprint is expected to increase the exchange rate of the dollar against foreign currencies, offsetting negative effects of the tax change on the cost of imports. Some observers are skeptical that a significant rise in the dollar is possible, or that the border adjustment, by itself, would be enough to bring it about.

History suggests that large swings in currency exchange rates are not only possible, but common. The exchange rate of the dollar has risen or fallen relative to other currencies by between 15 percent and 30 percent in very short periods many times in the last forty years. Furthermore, the border adjustment is not the only provision of the Blueprint that would increase the value of the dollar. Expensing, the reductions in corporate and noncorporate business taxes, and reduced taxes on capital gains and dividends found in the Blueprint would generate a rise in the dollar by raising returns on capital in the United States and encouraging capital to flow into the country. The best historical example is the rise in the dollar after the 1981 tax cuts, even though they did not contain a border adjustment provision. The 1981 tax provisions that boosted capital formation and encouraged the increase in the dollar were similar in type and magnitude to features in the House GOP tax reform Blueprint.

Monetary policy is another major factor in exchange rate swings. It contributed to the rise in the exchange rate following the 1981 tax cut by encouraging a rise in real, inflation-adjusted interest rates. However, easy money following the 2003 tax cuts held down the dollar. Today, the Federal Reserve is on record as favoring a gradual rise in interest rates. If implemented, the combined effect of the Blueprint’s tax changes on capital investment and the announced shift in monetary policy should lift the dollar significantly. These policies would reinforce the predicted effects on the exchange rate of the border adjustment feature of the Blueprint.

[1] Why the difference? Suppose 100 Euros are used to buy 100 dollars, but now only buy 80 dollars. Then 100/80=1.25, a 25 percent increase in the cost of the dollar for the foreign currency holder. Alternatively, it now only takes 80 dollars to buy 100 Euros. Then 80/100=.8, a 20 percent decline in the cost of foreign currency for the dollar holder.

Share this article