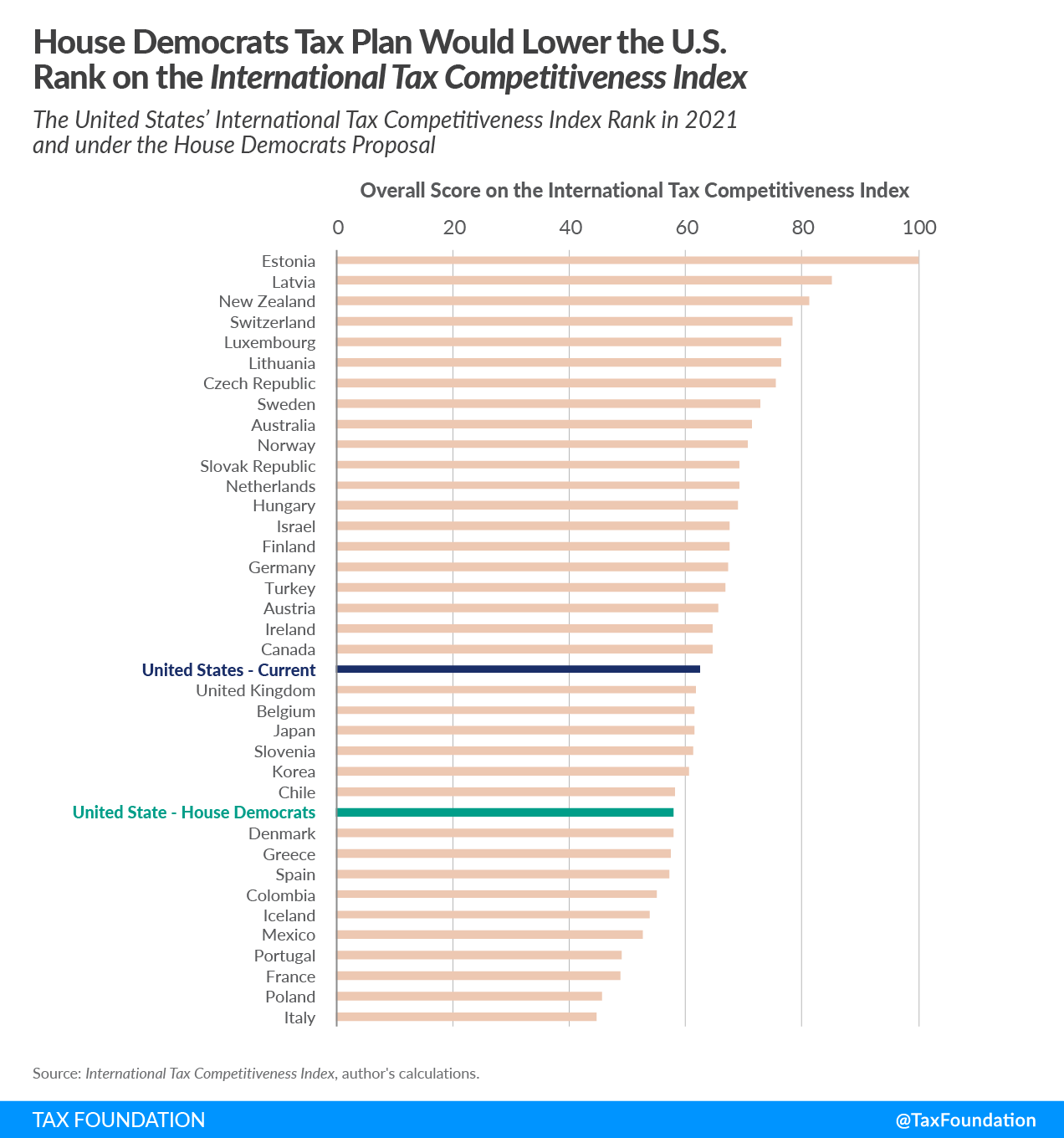

The International Tax Competitiveness Index has been used to compare the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. systems of OECD countries since 2014. At that time, the United States ranked 31st out of 37 countries in the Index. Following the 2017 tax reform, the rank improved dramatically, to 24th, and the U.S. now ranks 21st.

The legislation put forward by Democratic members of the House of Representatives would reverse many of the 2017 reforms while increasing burdens on businesses and workers.

From the standpoint of the International Tax Competitiveness Index, the corporate and individual tax hikes envisioned by the House Democrats would drop the U.S. to 27th in the rankings, just one place better than the U.S. ranking in 2017 prior to tax reform. On corporate taxes, the U.S. rank would fall from 20th to 31st. On individual taxes, the U.S. rank would fall from 26th to 32nd.

While some policymakers in Congress are focused on making changes to the tax code that would increase the burden faced by higher-income individuals, this also comes with a consequence of making the U.S. a less attractive place for businesses and workers.

Competitiveness is not necessarily about low taxes, however. For instance, Sweden, which has one of the largest tax burdens in the world, ranks 8th on the Index because the way it raises that revenue is less distortive to economic activity and worker decisions. Instead, competition is about designing tax systems in line with the goal of minimizing economic distortions while raising sufficient revenue in the context of a global economy where firms and workers can move across borders.

From the standpoint of the International Tax Competitiveness Index, this effort from House Democrats would make the U.S. tax system less competitive.

| ITCI Rank Category | Final Rank | Corporate Rank | Income Rank | Consumption Rank | Property Rank | International Rank |

|---|---|---|---|---|---|---|

| 2017 Rank | 28 | 35 | 28 | 5 | 28 | 34 |

| 2021 Rank | 21 | 20 | 26 | 5 | 28 | 32 |

| Biden Plan Rank | 31 | 35 | 36 | 5 | 28 | 32 |

| House Democrats Plan Rank | 27 | 31 | 32 | 5 | 28 | 32 |

|

Source: Author’s analysis of the Biden and House Democrats’ tax plans using the International Tax Competitiveness Index. |

||||||

Note: This analysis was originally published on September 17, 2021 and has been updated on October 26, 2021 to reflect the most recent edition of the International Tax Competitiveness Index.

Share this article