The New York Times reports that Canada now has the most affluent middle class in the world. The United States and Canada are in a virtual tie with an after-tax median per capita income of $18,700, or about $75,000 for a family of four.

There are many factors for the continued rise of median incomes in Canada, which increased 20 percent between 2000 and 2010, but their move to good taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy certainly has not hurt.

It All Starts with the Cost of Investment

Over the last decade and a half Canada has worked to improve their business environment. They have significantly cut corporate taxes, eliminated sales taxes on business inputs, and essentially maintained rates on investment taxes. They have done this with the goal of improving their country's competitiveness and have succeeded. New businesses have been created or moved to Canada and with it jobs with wages good enough to give Canada the world's most affluent middle class.

Economic theory tells us that investment leads to higher wages—higher investment leads a larger capital stock (computers, machines, equipment, factories, etc.) and a larger capital stock leads higher productivity because workers have more things that help them work.

This chart, below, shows the changes in marginal effective tax rates on capital investment in Canada and the U.S. since 2005. This measure represents the amount of tax paid on an additional dollar of investment, or the total tax cost for a new investment. Businesses would use this metric to estimate the after-tax return on an investment, so it can determine whether or not it will be worth it.

Between 2005 and 2013, the Canadian rate dropped by over half, changing from 38.8 percent to 18.6 percent. This make Canada a much more desirable place to build or move a business.

Canada’s Corporate Tax Rate Cut

Corporate tax reform is a big factor in Canada’s drop in marginal effective tax rate on investment.

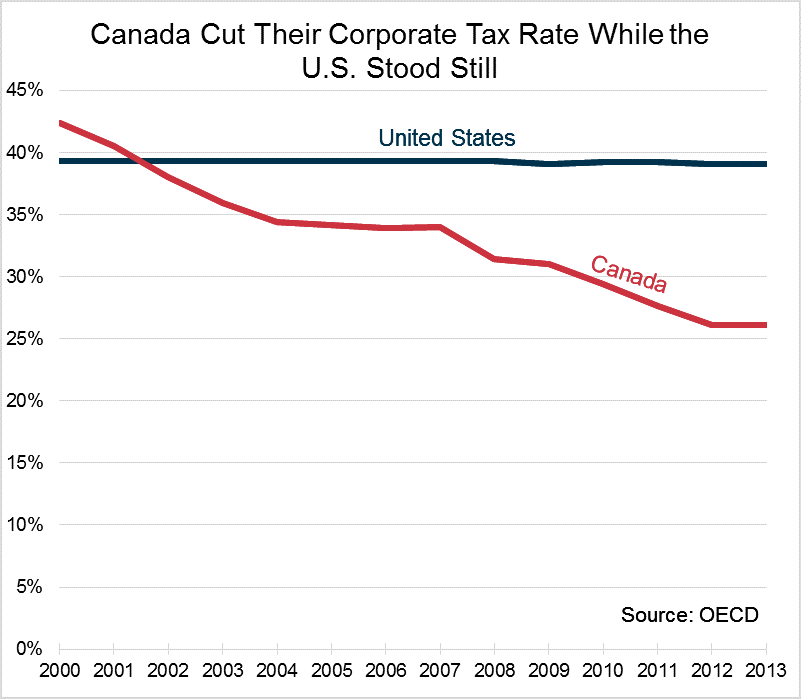

Since 2000, Canada has taken major steps to increase the competitiveness of their corporate tax system. They have cut the federal corporate tax rate from 29.1 percent to 15 percent. The average provincial tax rate has followed, going from 13.3 percent to 11.1 percent. Additionally, they removed sales taxes on capital goods, moving to their Goods and Services Tax (which is a type of value-added tax), and removed other taxes on capital.

Meanwhile, the U.S. corporate tax rate has remained stagnant at about 39 percent.

Growth of Investment in Canada

Since Canada began its business tax overhaul, the U.S. and Canada have traded places on levels of investment as a percentage of GDP. The level of investment in Canada has continued to increase, from 19 percent in the early 2000s to above 23 percent in 2012. Over that same time frame, the U.S. saw a slow decline and then a significant drop following the financial crisis and has yet to rebound.

Foreign direct investment in Canada has also seen a nice boost in recent years.

Taxes on Dividends

In Canada, dividend tax rates are slightly higher than those in the U.S., at 33.8 percent to 30.3 percent. The Bush tax cuts in 2003 cut the top dividend tax rate from about 45 percent to 20.8 percent (including state dividend taxes). Afterwards the implementation of the package that included bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. and cuts in the capital gains and dividend tax rate, investment saw an increase.

Taxes on Capital Gains

Canada is now also ahead of the United States on capital gains taxes. In 2013, the U.S. increased its taxes on capital gains from the Bush era levels of about 19 percent (including state tax rates) to 28.7 percent, which account for the 20 percent federal rate, the 3.8 percent surcharge from the Affordable Care Act, and the average state rate. Meanwhile, Canada’s rate has remained steady at about 22.5 percent between 2011 and 2014.

Why Does All this Matter?

Investment is the “true engine of economic growth.” It drives higher future wages and higher quality of life. Corporate, capital gain, and dividend taxes all serve to make investment more expensive. This has the effect of decreasing investment, which has a negative effect on jobs, wages, and economic growth.

Canadian tax policy over the last 15 years has focused on decreasing the cost of investment and Canadian workers have shared in the reward. American policymakers would be wise to follow the lead of the neighbor to the north.

Share this article