Last week, the Trump administration released a tax proposal. Overall, the outline follows the same contours as Trump’s campaign proposals. It would cut rates for businesses and individuals and would likely be a very large reduction in federal revenues.

However, there are some differences between President Trump’s campaign plan and his administration’s outline. Besides the decline in the level of detail, one of the more notable differences is that Trump’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. plan no longer indicates that the administration is pursuing full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of capital investments. This is something that President Trump partially added to his campaign plan last September by allowing companies to choose between full expensing and the deductibility of interest expense. The goal was to move the plan more in line with the House GOP plan.

Instead, the president’s new plan mainly focuses on cutting the statutory corporate income tax to 15 percent from the current rate of 35 percent. He hopes that a large cut in the corporate income tax rate would boost economic growth.

Cutting the corporate tax would grow the economy. However, the administration’s choice to focus more on the statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rather than moving towards a cash-flow tax through full expensing of capital investment will limit the amount of growth the president should expect from his plan.

Full expensing is generally regarded as a better way to boost the size of the economy in the long run than simply cutting the corporate income tax rate. An intuitive way to understand how is that expensing is aimed entirely at new capital investment, whereas a corporate rate cut is not. Corporations only receive the benefit of expensing if they are investing in new plant and equipment. As such, corporations are encouraged to make investments at the margin.

A lower corporate tax rate splits its benefits. New investments face a lower tax rate on their future returns, which encourages companies to pursue more of them. However, part of the corporate rate cut goes to companies that made investments in the past, which reduces federal revenue with no corresponding incentive to invest. The remaining revenue goes to what economists call “super normal returns.” These returns include things like economic rents and luck and are not as sensitive to taxation as marginal investments that provide ordinary returns.

More fundamentally, full expensing fixes a bias in the corporate tax. Under current law, corporations are required to depreciate the cost of capital investments over several years or decades. The result is that companies cannot fully deduct those investment costs in present-value terms. This essentially brings part of the value of new investments into the tax base.

Economists measure the tax burden on new investment with what is called the “marginal effective tax rate” (METR). The higher the METR, the less willing a company is to make new investments at the margin. Currently, the U.S. levies a relatively high METR.

Full expensing fixes this bias by removing new investments from the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . This brings the METR on new investment all the way down to zero, regardless of what the statutory corporate tax rate is. Put another way, companies would no longer be taxed on marginal investments and discouraged from making them.

A corporate tax rate cut, on the other hand, keeps the underlying bias against investment in the corporate tax, but lessens it to a degree. A lower corporate tax rate may reduce the METR, but it would still be greater than zero.

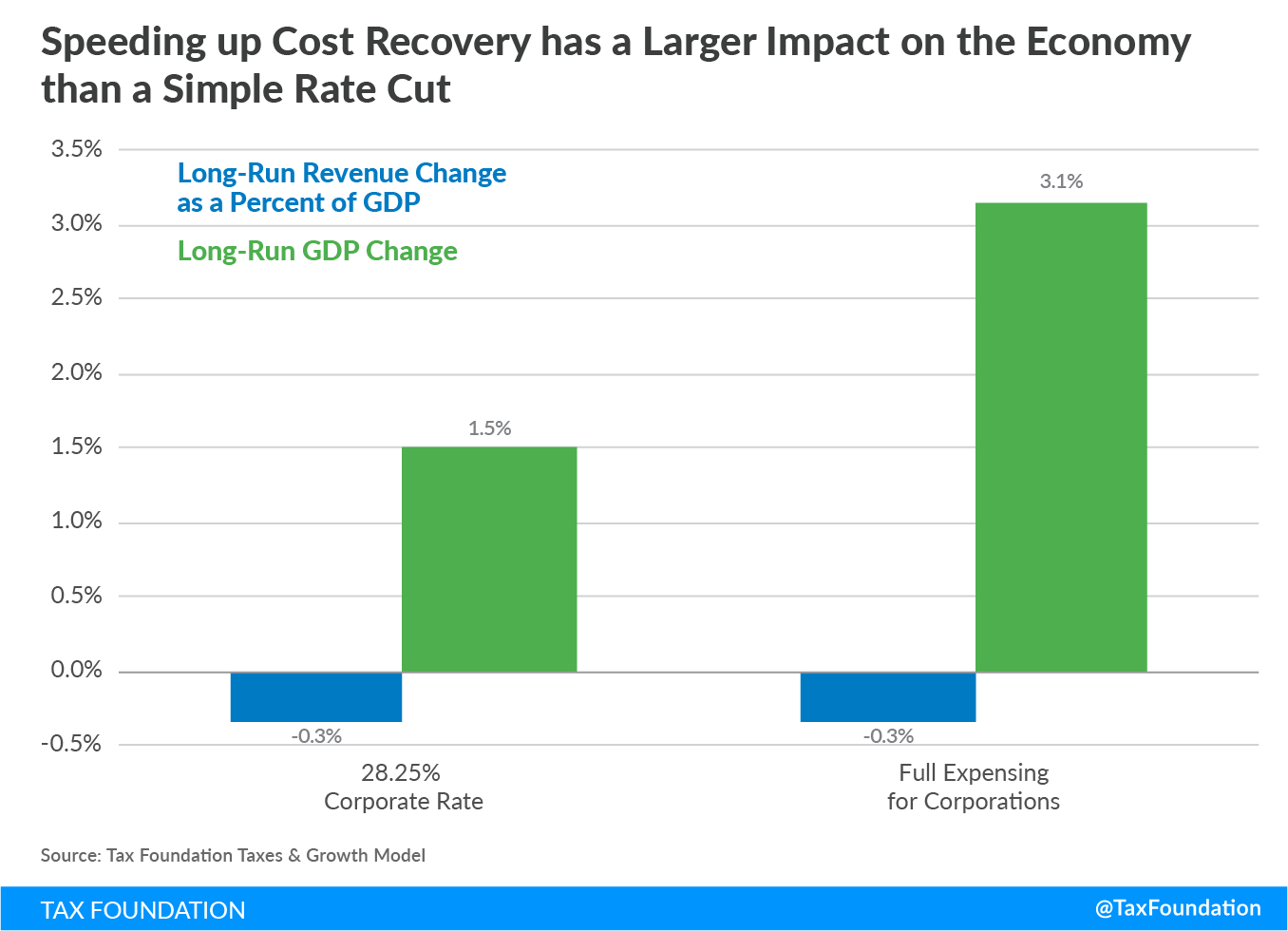

To demonstrate this, I have modeled two tax cuts of equal size. The first is a cut in the corporate income tax rate from 35 percent to 28.25 percent. The second tax cut is providing full expensing to corporations. Both tax cuts, when fully phased in, would reduce revenue by about $62 billion annually in 2017 dollars, or 0.3 percent of GDP.

These equal-sized tax cuts would both boost the long-run size of GDP, but the move to expensing would provide twice the impact. The 6.75 percentage-point cut in the corporate income tax rate from 35 percent to 28.25 percent would boost the long-run size of GDP by 1.5 percent. In contrast, enacting full expensing for corporations and keeping the rate at 35 percent would increase the long-run size of the economy by 3.1 percent.

This result is not unique to the Tax Foundation’s model. Kent Smetters, the architect of one of Tax Policy Center’s models, has made this point about expensing in the past. The Joint Committee on Taxation’s model, in its analysis of the Camp tax reform plan, showed that lengthening asset lives and moving farther from expensing made investing more expensive, which completely offset the benefits of the plan’s lower corporate tax rate.

This isn’t to say that cutting the corporate tax rate is a bad idea. Cutting the rate would help lessen base erosion and profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. by U.S. multinational corporations. This is a good argument for a more competitive corporate tax rate, especially in the absence of fundamental reforms to the corporate tax.

But if economic growth is the goal of your tax reform plan, it is better to focus on moving towards full expensing and a cash-flow tax than simply cutting the statutory corporate income tax rate.

Share this article