All Related Articles

Is EU VAT Compliance Actually Improving?

While the European Commission focuses on improving VAT compliance, policy is a major contributor to VAT revenue losses. The VAT actionable policy gap is 15.65 percent, more than triple the compliance gap.

5 min read

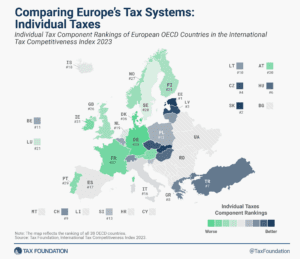

Comparing Europe’s Tax Systems: Individual Taxes

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

Investment in the United Kingdom Increased following Pro-Investment Tax Reforms

The UK economy is experiencing an upsurge in business fixed investment following two pro-growth tax changes. In the second quarter of 2023, business investment was 9.4 percent higher than the same quarter last year.

10 min read

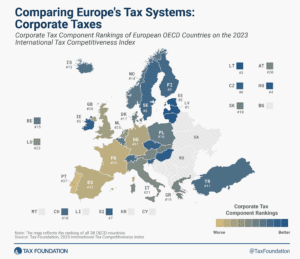

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

European Tax Policy Scorecard: Capital Cost Recovery under BEFIT versus Current Member State Policies

A harmonized EU tax base is a project in the making. Policymakers have a chance to put the Union on a path for increased investment and economic growth by focusing on the details of capital cost recovery.

3 min read

2023 European Tax Policy Scorecard

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

CCCTB vs. BEFIT: How Have the Proposals Changed?

If the EU is going to harmonize its tax base, it should do so in a way that increases the efficiency and competitiveness of tax policy for the EU as a whole, and not just seek out the lowest common denominator.

5 min read

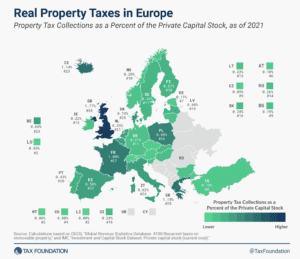

Real Property Taxes in Europe, 2023

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

2023 Spanish Regional Tax Competitiveness Index

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

It Pays to Keep It Simple

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.