Table of Contents

- Key Findings

- Introduction

- Climate Change and Energy Consumption

- Cost Recovery and Expensing, Explained

- Energy Tax Policy in the United States

- Energy Efficiency and Climate Change

- Increased Capital Stock Turnover

- Retrofitting

- Accelerating the Shift Towards Clean Energy

- Housing Investment, Density, and Sprawl

- A Word on Policy Neutrality

- Expensing Is a Great Complement for Green Policies

- Conclusion

Key Findings

-

Expensing for capital investments would increase new investment and capital stock turnover, supporting the replacement of old capital with more environmentally friendly structures, machinery, and equipment.

-

Lowering the cost of investment would eliminate the tax bias against more capital-intensive energy efficiency improvement projects.

-

Neutral cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. for structures would increase apartment building construction, which benefits the environment thanks to both higher energy efficiency in apartments relative to single-family homes, and through increased density, which reduces emissions from transportation.

-

These benefits are in addition to expensing’s large impact on economic growth.

Introduction

As lawmakers continue to grapple with climate change and ways to curb carbon emissions, one policy worth considering is full expensing for capital investment, which is a pro-growth policy that could also have some positive spillover benefits in terms of reducing emissions. By incentivizing new capital investment, expensing would increase turnover in the capital stock, leading to more modern and green investment.

Better cost recovery could also increase investments in retrofitting and other energy efficiency improvements on existing technology, both by reducing taxes on investment broadly and by eliminating a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. bias against more capital-intensive and lower-emission technology.

Additionally, expensing could help accelerate the replacement of fossil fuels with less environmentally harmful energy sources in the power generation sector. Lastly, improved cost recovery for residential structures could promote denser housing development and reduce emissions from transportation.

Climate Change and Energy Consumption

Carbon emissions have been driving changes in global temperatures, imposing costs on economic, human, and natural systems.[1] Under current policies, U.S. greenhouse gases are estimated to be 18 to 22 percent below 2005 levels by 2025, falling short of the 26 to 28 percent the United States committed to in the Paris Agreement prior to the Trump Administration’s decision to pull out of that agreement.[2]

There are two ways to analyze where emissions in the United States come from. The first is through the source: which energy sources produce the most emissions. The second is end-use: which sectors of the economy generate the most emissions.

According to the U.S. Energy Information Administration, 46 percent of U.S. carbon dioxide emissions come from petroleum, 21 percent come from coal, and 33 percent come from natural gas. For context, petroleum is responsible for 37 percent of our energy consumption, while coal is responsible for only 11 percent, natural gas comprises 32 percent, and the remaining 20 percent comes from non-emitting sources like nuclear and renewables.[3]

In terms of end-use, the transportation sector is responsible for just under 37 percent of emissions. The industrial sector produces the second-most (over 28 percent), followed by the residential sector (18.7 percent), and the commercial sector (16.3 percent).[4] Increased investment in new, more energy-efficient capital to replace dirtier machinery, equipment, and structures in each of those sectors would drive down the demand for energy, and reduce carbon emissions, from each of those sectors.

Cost Recovery and Expensing, Explained

Cost recovery is the ability of businesses to recover (deduct) the costs of their investments on their income tax returns. It plays an important role in defining businesses’ tax bases and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker productivity and wages.[5]

Full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. allows companies to deduct the cost of their capital investments in the year that they are made, letting them fully recover the cost. Other policies require companies spread the deductions out over several years. Due to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and the time value of money, companies do not end up deducting the full, real value of their investments under those policies. This creates a bias against capital investment. An alternative to full expensing that would still allow companies to deduct the full value of their investments is neutral cost recovery: spreading the deductions out over time but increasing them by inflation and the time value of money each year.[6]

The Tax Cuts and Jobs Act of 2017 (TCJA) introduced some changes to cost recovery. For assets with lives of 20 years or less, including equipment and machinery, the TCJA allowed 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. , letting companies deduct the full cost of certain investments in the year they are made. However, this provision will begin to phase out in 2023, falling to 80 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. , and declining by 20 percentage points each year until it fully disappears by 2026.[7]

Full expensing is the most powerful pro-growth tax reform available to policymakers. Establishing permanent full expensing for machinery, equipment, and research & development expenses, along with neutral cost recovery for structures, would increase long-run GDP by 5.1 percent, grow the capital stock by 13 percent, increase wages by 4.3 percent, and create over a million new full-time equivalent jobs, according to Tax Foundation’s General Equilibrium Model.[8]

Energy Tax Policy in the United States

Many organizations, such as the Joint Committee on Taxation (JCT), often classify some tax provisions pertaining to the fossil fuel industry as tax expenditures or tax subsidies. For example, oil and gas companies can expense some but not all exploration costs.[9] Though expensing is consistent with neutral tax policy, the Joint Committee on Taxation classifies it as a subsidy.[10] Policies like the tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. for marginal wells are also classified as subsidies, correctly, as they do provide non-neutral support for the fossil fuel industry.[11]

The United States has a collection of tax policies targeted at specific energy sources.[12] The most prominent are the production tax credit and investment tax credit. The production tax credit (PTC) grants cents per kilowatt-hour of energy produced from several different energy sources, but it most prominently benefits wind.[13] It is scheduled to expire at the end of 2021.

On the other hand, investment tax credits (ITCs) allow companies to reduce their total tax liability by a certain percent of the money they spend on investment in renewables, and contrary to PTCs, the ITCs mostly benefit solar. The ITC provided a 30 percent tax credit for projects that began construction in 2019 and are scheduled to come online by 2023, and currently provides a 26 percent tax credit for projects beginning construction before the end of 2022. It is scheduled to continue phasing down until the end of 2023, when it reaches 0 percent for residential projects and 10 percent for commercial projects.[14]

Most of these policies are temporary and expire every few years.[15] At the end of 2020, President Trump signed into law an extension of many temporary tax provisions, including several energy-related tax credits that were scheduled to expire at the end of 2020.[16]

The Tax Cuts and Jobs Act did not change much about energy-specific tax provisions. However, broad policy changes, such as the reduction in the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate to 21 percent and 100 percent bonus depreciation for certain assets, provided benefits to conventional and renewable energy firms alike.[17]

Marathon Capital, an investment bank focused on energy and infrastructure, estimated that 100 percent bonus depreciation would increase project-level returns for wind projects by 50-60 basis points, and solar projects by 40-50 basis points, but the impact on investment was unclear.[18] Analysis by Gilbert Metcalf, professor of economics at Tufts University, indicates that tax policy has a large effect on energy investment, estimating that wind energy investment increases by 1 to 2 percent in response to a 1 percent reduction in the user cost of capital.[19]

Energy Efficiency and Climate Change

One way to reduce carbon emissions is to increase energy efficiency—by reducing the amount of energy needed for everything from office buildings to factory equipment, energy consumption would decline, and as a result, so would emissions.

However, there is not a 1-to-1 relationship between an increase in energy efficiency and emissions reduction. The wealth increase from lower electricity bills thanks to more efficient goods, for example, can lead to an increase in use. Known as the rebound effect, this impact does not fully negate the reduction in energy use thanks to higher efficiency, but it does reduce the net benefits from an environmental perspective.[20]

Still, increased energy efficiency is beneficial for emissions reduction. And there are a few ways that better cost recovery policy could reduce emissions.

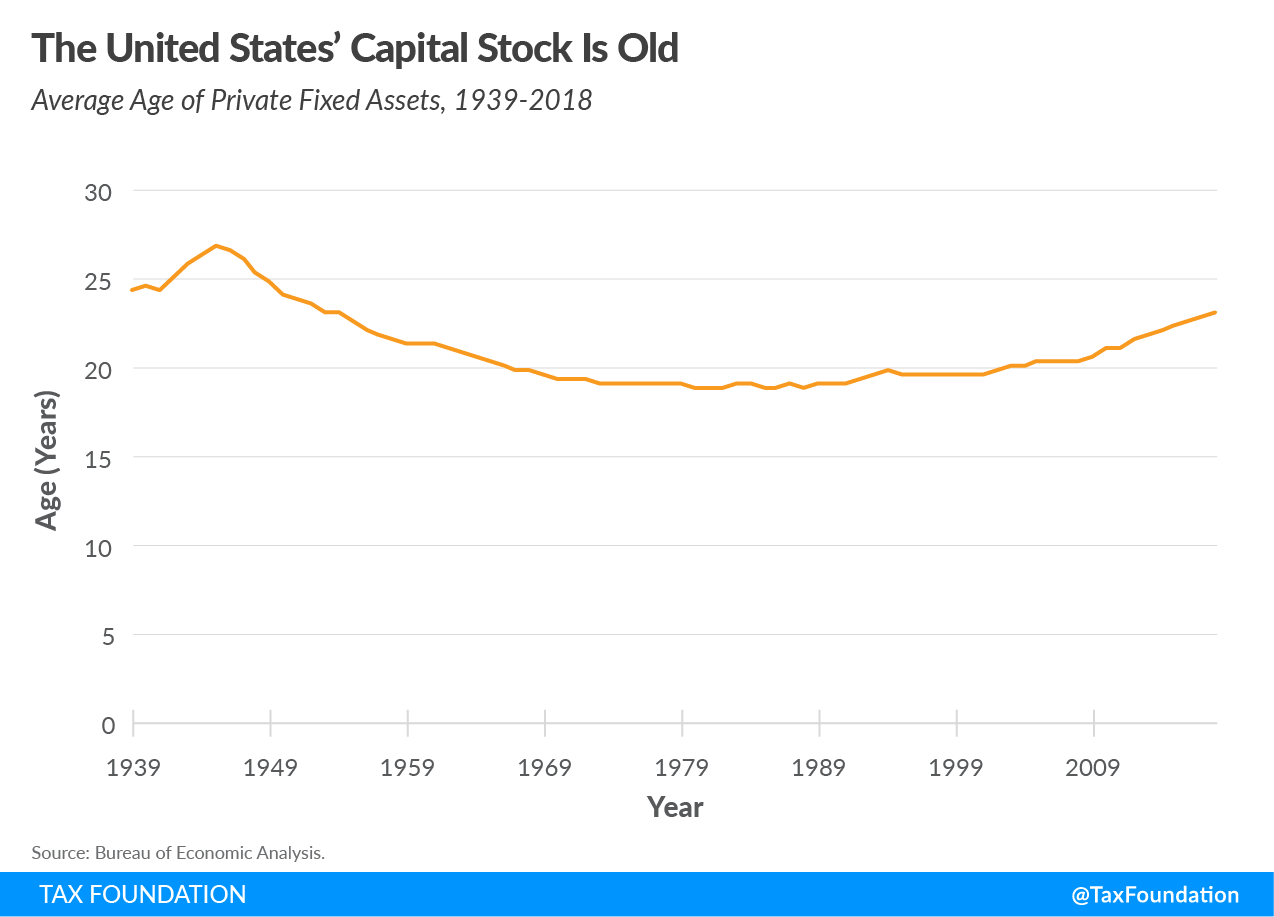

Increased Capital Stock Turnover

The United States’ capital stock is old. Politicians love to focus on aging public (and private) infrastructure, but our equipment, machinery, and structures are getting long in the tooth as well.[21] According to data from the Bureau of Economic Analysis, the average age of fixed private assets in the United States is 23 years—older than at any time since the 1950s.[22] There is some evidence that the trend of increasingly old capital stocks is not limited to the United States but is broadly true across the developed world, at least since the 1970s.[23]

An aging capital stock has important implications for energy efficiency. Older capital, whether structures like office and residential buildings or factory equipment and machinery, tends to be less energy-efficient and more reliant on fossil fuels. For example, a study of electric arc furnaces used in the steel industry from 1990-2002 found that energy efficiency improved by about 1.3 percent per year. Capital stock turnover, or the replacement of old furnaces with new ones, accounted for over half of that improvement, or a 0.7 percent increase in efficiency per year, while retrofitting existing furnaces accounted for 0.5 percent improvement per year.[24]

Evidence points to the effectiveness of improved cost recovery driving more energy-efficient investment. A survey of international examples of various types of energy and energy efficiency policies found that businesses strongly value the upfront cost of clean technology, indicating that tax relief like better cost recovery would be very effective at generating new energy-efficient investment.[25]

Furthermore, cost recovery short of expensing creates a tax bias against energy-efficient capital investment, because energy-efficient tech is more capital-intensive and has a higher upfront cost.[26] Building a new factory with additional electricity-saving technology might cost more now but will result in less spending on electricity over the life of the asset, relative to a less efficient building. However, operating costs like electricity are deducted immediately, while the cost of the factory itself has to be deducted over many years. Not providing full expensing creates a tax bias in favor of the less efficient building with a lower initial capital investment and higher operating costs over time.

Expensing for equipment and machinery would likely help efficiency in the industrial sector the most by increasing turnover. Expensing for structures would help reduce emissions through turnover in the commercial and residential sectors. Generally, expensing would have less of a direct impact in the transportation sector, in which individual-owned cars are the main producer of emissions. However, increased capital investment leading to turnover among corporate-owned car and truck fleets would help.

Similarly, replacing old airplanes would reduce emissions from the air travel industry.[27] According to a 2019 report from the International Council on Clean Transportation, Frontier Airlines and Southwest Airlines became more fuel-efficient from 2017 to 2018 thanks to investments in newer aircraft. These improvements helped slow the increase in emissions from airlines, as demand for air travel has grown steadily in recent years up until the pandemic.

Retrofitting

Depending on the type of asset, retrofitting—adding new technology to old structures—might be more effective than capital stock turnover for improving energy efficiency. For example, it might make more sense to retrofit a 50-story office building but replace a truck that is 10 years old. Retrofitting can be especially beneficial because old buildings are a major source of emissions.[28]

Existing efforts to retrofit buildings have run into problems. One issue is that firms often set required rates of return for energy efficiency investments well above the average cost of capital, meaning firms choose not to make many energy efficiency investments that would be profitable.[29] On the other hand, some energy efficiency programs have substantially underperformed expectations. For example, a study of the Weatherization Assistance Program, a federal program providing subsidies for energy improvements for low-income households, found that the program had an average rate of return of -9.5 percent.[30] Both issues, setting high hurdle rates and experiencing lower-than-expected returns, are challenges to pursuing retrofitting investments that can be helped with changes to the tax code.

For example, the Tax Cuts and Jobs Act’s temporary 100 percent bonus depreciation provisions benefited some retrofitting investments. The TCJA made new HVAC systems and roofs, among other energy efficiency-enhancing investments, eligible for immediate expensing.[31] Jared Blum, then executive director of the EPDM Roofing Association, noted that the TCJA’s expensing reforms lowered the cost of investing in a roof replacement by between 28 and 30 percent.[32]

A drafting error in the TCJA excluded investments in qualified improvement property (QIP) from temporary 100 percent bonus depreciation and assigned them a longer cost recovery life than under prior law.[33] These improvements mostly comprise changes to the interior of properties, such as woodwork, flooring, or (most relevant to our purposes) lighting. Under the TCJA, QIP investments like lighting had to be deducted over 39 years, even though most lighting fixtures only have a useful life of five to 15 years at the most.[34]

The CARES Act, passed in March 2020 in response to the pandemic, included technical corrections to this TCJA provision, assigning QIP investments a 15-year cost recovery period and making them eligible for the TCJA’s temporary 100 percent bonus depreciation.[35]

Energy improvements in lighting have been huge in recent years, largely thanks to the shift from incandescent light bulbs to more efficient fluorescent ones.[36] For example, light-emitting diode (LED) lights use 85 percent less energy than traditional incandescent bulbs. Lighting provides a useful example for how the lack of full expensing can create a bias against capital investment in energy efficiency.

Consider a convenience store with some old incandescent light fixtures that generate $200 per year in electricity expenses. Replacing them with LEDs would cost $1,900, and they would reduce electric expenses by 85 percent, or down to $30 per year. Let us assume both sets of lights will last 15 years. In the absence of tax, replacing the incandescent bulbs with LEDs makes sense, based on the lower costs of the LEDs over 15 years.

However, the tax treatment of capital costs affects the incentives to make this upgrade. Specifically, if the capital investment is not fully deductible in the year it was made, this introduces a tax bias to the decision. Suppose that the convenience store owner must deduct the $1,900 capital cost for LEDs over 15 years rather than immediately. In present value terms, the deductions are only worth $1,436.50. This understates the convenience store owner’s costs and overstates his profits, which results in $97.34 of increased tax liability, making LEDs more costly after-tax than incandescent bulbs.

| Incandescent Bulbs | LED Lights under 15-Year Depreciation | LED Lights under Full Expensing | |

|---|---|---|---|

| Present Value of Pretax Operating Costs | $2,312.62 | $346.89 | $346.89 |

| Present Value of Pretax Capital Costs | – | $1,900 | $1,900 |

| Total Present Value of Pretax Costs | $2,312.62 | $2,246.89 | $2,246.89 |

| Present Value of Operating Cost Deductions | $2,312.62 | $346.89 | $346.89 |

| Present Value of Capital Cost Deductions | – | $1,436.50 | $1,900 |

| Disallowed Cost Recovery | – | $463.50 | – |

| Tax on Disallowed Cost Recovery | – | $97.34 | – |

| Total After-Tax Cost (includes operating costs, capital costs, and any tax on disallowed cost recovery) | $2,312.62 | $2,344.23 | $2,246.89 |

|

Source: Author’s calculations. Assumes a discount rate of 4 percent (1 percent inflation plus a 3 percent real rate of return), a half-year convention, and a corporate tax rate of 21 percent. |

|||

Investment in retrofitting is responsive to marginal tax changes. A paper in the Journal of Public Economics in 1995 studying residential energy conservation investment found that a 10 percentage-point change in the tax price of investment would lead to a 24 percent change in the likelihood of an investment occurring.[37]

Accelerating the Shift Towards Clean Energy

The United States is already shifting towards cleaner sources of energy. In 2000, the U.S. received 22.9 percent of its energy from coal—by 2018, that number had dropped to 13.1 percent.[38] Renewables are growing rapidly, particularly solar and wind. In 2008, solar produced only 2 billion kilowatt-hours of electricity in the United States. By 2018, solar produced 93 billion kilowatt-hours.[39] The U.S. Energy Information Administration projects that renewables will soon pass nuclear and coal as electricity sources.[40]

Natural gas has been rapidly replacing coal. Natural gas increased from 24.1 percent of the United States’ energy consumption in 2000 to 30.7 percent in 2018.[41] The past decade in particular has seen significant shifting from coal to natural gas. According to the International Energy Agency, from 2011 to 2018, switching from coal to natural gas reduced CO2 emissions by 255 million metric tons in the United States alone.[42] Additionally, a paper from Nature Sustainability found that the replacement of coal plants with natural gas reduced mortality in nearby areas, while increasing crop yields.[43]

Energy is a capital-intensive industry: eight of the 25 companies on the Progressive Policy Institute’s annual report on which companies invested the most in the United States are energy companies.[44] Improving cost recovery for capital investment could accelerate current positive trends in the energy industry. Lowering the marginal cost of constructing a new power plant would benefit up-and-coming energy sources more than old ones. For example, estimates from the George Washington Solar Institute found that accelerated depreciation provisions for solar investment were crucial to increasing its competitiveness.[45]

However, there are a few factors that mitigate or obscure expensing’s effects on reducing emissions in the power generation sector. For one, fossil fuel plants tend to be more capital-intensive than renewable plants, which suggests eliminating a tax bias against capital intensity would help fossil fuels more.[46] Furthermore, the regulatory environment for the utility sector varies widely across state lines, and as a result, investment incentives vary widely as well, although this is beyond the scope of this paper.[47] More generally, while expensing may shift the economy towards clean energy, it also grows the economy and thus energy consumption (and other sources of carbon emissions), which means the overall effect of expensing on carbon emissions is unclear.

Housing Investment, Density, and Sprawl

Most of this paper focuses on expensing’s impact on technological change: that expensing would improve adoption of newer, more energy-efficient or green technology. However, expensing for residential structures has some possible added benefits in terms of reducing sprawl.

Sprawl is development spread outside cities. By creating longer distances among home, social life, and work, sprawl leads to more emissions from increased car travel.[48] Additionally, sprawl development tends to be less dense: it’s more heavily composed of single-family units rather than apartment buildings, and apartment buildings are much more energy-efficient than single-family homes.[49]

Several factors helped drive sprawl, including lengthening depreciation schedules for residential structures.

The 1980s saw several significant policy changes related to real estate.[50] Most importantly, the 1986 tax reform eliminated accelerated depreciation for residential structures and extended the asset lives of residential structures from 19 years to 27.5 years.

The overall effect of the 1986 tax reform benefited owner-occupied housing over rental housing, and as a result, single-family over multifamily construction.[51]

Multifamily housing construction collapsed after the Tax Reform Act of 1986.[52] While many factors contributed to this slowdown, it is reasonable to believe that raising the cost of capital for investment in apartment construction was part of the cause.[53],[54]

The potential environmental benefits of expensing for residential structures stretch beyond just newer structures or retrofitting if the policy can shift the composition of the American housing stock back towards multifamily housing.

Expensing (or neutral cost recovery) for structures is a powerful pro-growth policy: either of these options would increase long-run economic growth by 2.8 percent, the capital stock by 7 percent, wages by 2.4 percent, while creating 569,000 full-time equivalent jobs, according to Tax Foundation’s macroeconomic model.[55] Improved cost recovery for residential structures could also help expand the housing supply and thus put downward pressure on rents.[56]

The impact of this policy would vary according to how stringent local regulations are on how much new housing can be built. In some major coastal cities, zoning regulations heavily restrict the construction of new housing, driving sky-high rents.[57] Changing the cost of capital would not lead to many new apartment buildings if zoning and other land use policies effectively ban multifamily housing construction. On the other hand, some cities less constrained by zoning, predominantly in the South, are showing signs of sprawl development.[58] In those places, reducing the tax bias between owner-occupied and rental housing could spur denser development.

As a result, capital stock turnover is not the only way in which neutral cost recovery for residential structures would reduce emissions. Neutral cost recovery could also reduce emissions from the residential sector by shifting the composition of the housing stock towards apartment buildings and away from single-family homes, along with reducing emissions from the transportation sector thanks to denser development.

A Word on Policy Neutrality

Historically, the government created accelerated depreciation policies for different energy sources to provide a lower effective marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. .[59] Ideally, cost recovery should be neutral across technologies and industries: all companies should be able to deduct the full cost of investment the year it is made.

In the energy space, fossil fuels do create negative externalities because of emissions, creating the justification for a carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. .[60] Renewable technology might deserve subsidies to get the technology off the ground faster. But it would be a mistake to try and implement a Pigouvian tax on fossil fuels (or a Pigouvian subsidy for renewable energy) indirectly by having different cost recovery schedules for different industries. It would be better to tackle the problem of negative externalities directly, rather than using a less-than-ideal tax treatment for investment overall.

Expensing Is a Great Complement for Green Policies

Expensing would have some marginal benefits for climate change mitigation on its own, but it also can coexist with and complement various green policies. For example, one of the concerns about putting a tax on carbon is that it will slow economic growth, hurt businesses, and raise energy prices for consumers.

Expensing can help with the latter by spurring more energy-efficient technology and address the former by growing the economy. According to the Tax Foundation General Equilibrium Model, a revenue-neutral plan of a $50 per ton carbon tax along with reducing the corporate tax rate to 11 percent and making bonus depreciation for machinery, equipment, and R&D permanent would increase long-run output by 0.8 percent and raise wages by 0.5 percent.[61]

One concern about carbon taxes and environmental regulations more broadly is that they can lead to leakages.[62] In industries exposed to international competition, the consequence of tighter environmental regulation often is not lower emissions from a domestic industry, but the shifting of industry to jurisdictions with less environmental regulations. For carbon taxes, this problem can be addressed with a border adjustment that would tax emissions from imports the same as ones from domestic goods.[63]

Carbon taxes are not the only environmental policy that could lead to shifting—numerous emissions standards that already exist produce this result. Expensing would ease the cost of transition to more green operations and technology. This is especially true for domestic manufacturing firms. Expensing would lower the cost of investing in new low-emissions technology, while eliminating the tax bias against capital-intensive businesses like manufacturing.[64]

Another complementary feature of expensing is that it can help enhance the benefits of a carbon tax on lowering emissions. A carbon tax can have two effects: by placing a tax on carbon emissions, it incentivizes companies to invest in new, lower-emission technology to reduce their tax burden. However, some of the carbon tax is passed onto consumers in the form of higher prices, and that is especially true if companies do not invest in upgrading their technology. Expensing would provide an additional incentive for companies to put in the large capital investments necessary to reduce their carbon emissions.

Conclusion

Expensing for capital investments is a powerful tax policy for economic growth. But expensing can also help shift the economy to a more sustainable future through increased investment in new, less carbon-intensive technology. Increased capital investment would lead to less efficient machinery, equipment, and structures getting replaced faster with more energy-efficient capital.

Similarly, expensing for capital investment would eliminate a tax bias against energy efficiency improvements that reduce operating costs but involve high upfront investments. Finally, it could serve to accelerate the existing trend of movement towards more green energy power sources.

[1] Intergovernmental Panel on Climate Change, “Special Report: Global Warming of 1.5°C: Summary for Policymakers,” Oct. 6, 2018, https://www.ipcc.ch/sr15/chapter/spm/.

[2] John Larsen, Shashank Mohan, Peter Marsters, and Whitney Herndon, “Energy and Environmental Implications of a Carbon Tax in the United States,” Columbia SIPA Center on Global Energy Policy, July 17, 2018, https://energypolicy.columbia.edu/research/report/energy-and-environmental-implications-carbon-tax-united-states.

[3] U.S. Energy Information Administration, “Energy and the Environment Explained: Where Greenhouse Gases Come From,” U.S. Department of Energy, Updated Aug. 11, 2020, https://www.eia.gov/energyexplained/energy-and-the-environment/where-greenhouse-gases-come-from.php.

[4] Ibid.

[5] Tax Foundation, “Cost Recovery,” Tax Basics, https://taxfoundation.org/tax-basics/cost-recovery/.

[6] Erica York, Alex Muresianu, and Garrett Watson, “FAQ on Neutral Cost Recovery and Expensing,” Tax Foundation, July 10, 2020, https://taxfoundation.org/neutral-cost-recovery-full-expensing-faq/.

[7] Erica York and Alex Muresianu, “The TCJA’s Expensing Alleviated the Tax Code’s Bias Against Certain Investments,” Tax Foundation, Sept. 5, 2018, https://taxfoundation.org/tcja-expensing-provision-benefits/.

[8] Erica York and Huaquan Li, “Reviewing the Economic and Revenue Implications of Cost Recovery Options,” Tax Foundation, Apr. 28, 2020, https://taxfoundation.org/full-immediate-expensing/.

[9] Exploration costs that are categorized as geophysical and geological are amortized over two years for independent producers or seven years for integrated producers. Exploration costs that are categorized as intangible drilling costs are fully expensed for independent producers but only partially expensed for integrated producers (70 percent expensed, 30 percent deductible over five years).

[10] Nicole Kaeding, “Examining Energy Provisions in the Tax Code,” National Taxpayers Union Foundation, Nov. 11, 2019, https://www.ntu.org/foundation/detail/examining-energy-provisions-in-the-tax-code.

[11] Josiah Neeley and William Murray, “Bringing Tax Reform to the Energy Sector,” R Street Institute, Policy Study No. 117, November 2017, https://www.rstreet.org/wp-content/uploads/2018/04/117-1.pdf.

[12] Molly F. Sherlock, “The Value of Energy Tax Incentives for Different Types of Energy Resources,” Congressional Research Service, Mar. 19, 2019, https://fas.org/sgp/crs/misc/R44852.pdf.

[13] Molly F. Sherlock, “The Renewable Electricity Production Tax Credit: In Brief,” Congressional Research Service, Updated Apr. 29, 2020, https://fas.org/sgp/crs/misc/R43453.pdf.

[14] U.S. House of Representatives Committee on Ways and Means, “Section by Section: Tax Provisions Division EE – Taxpayer Certainty and Disaster Relief Tax Act of 2020.”

[15] Erica York, “Recommendations to Congress on the 2018 Tax Extenders,” Tax Foundation, Apr. 17, 2018, https://taxfoundation.org/2018-tax-extenders.

[16] Erica York, “Tax Extenders Hitch a Ride on Omnibus and COVID-19 Relief Deal,” Tax Foundation, Dec. 21, 2020, https://taxfoundation.org/tax-extenders-omnibus-covid-19-relief-deal/.

[17] Wolfram Pohl, “Energy Taxation: Impact of the Tax Cuts and Jobs Act,” Orrick, Jan. 5, 2018, https://www.orrick.com/en/Insights/2018/01/Energy-Taxation-Impact-of-the-Tax-Cuts-and-Jobs-Act.

[18] Matt Shanahan and Greg Andiorio, “Tax Cuts and Jobs Act—Impact on U.S. Renewable Energy Financing,” Marathon Capital, Apr. 27, 2018, https://www.marathoncapital.com/news/tax-cuts-and-jobs-act-impact-on-u-s-renewable-energy-financing.

[19] Gilbert E. Metcalf, “Investment in Energy Infrastructure and the Tax Code,” National Bureau of Economic Research, Working Paper No. 15429, October 2009, https://www.journals.uchicago.edu/doi/pdfplus/10.1086/649826.

[20] Severin Borenstein, “A Microeconomic Framework for Evaluating Energy Efficiency Rebound and Some Implications,” National Bureau of Economic Research, Working Paper No. 19044, May 2013, https://www.nber.org/papers/w19044.

[21] Jennifer Bennett, Robert Kornfeld, Daniel Sichel, and David Wasshausen, “Measuring Infrastructure in BEA’s National Accounts,” National Bureau of Economic Research, Working Paper No. 27446, June 2020, https://www.nber.org/papers/w27446.

[22] Bureau of Economic Analysis, “Table 2.9. Current-Cost Average Age at Year End of Private Fixed Assets, Equipment, Structures, and Intellectual Property Products by Type,” Revised Aug. 8, 2019, https://www.bea.gov/data/investment-fixed-assets.

[23] Antonin Beauregard, Gilbert Cette, and Rémy Lecat, “Productivity Trends in Advanced Countries between 1890 and 2012,” Review of Income and Wealth 62:3 (September 2016), https://onlinelibrary.wiley.com/doi/abs/10.1111/roiw.12185.

[24] Ernst Worrell and Gijs Biermans, “Move Over! Stock Turnover, Retrofit, and Industrial Energy Efficiency,” Energy Policy 33:7 (May 2005), https://www.sciencedirect.com/science/article/pii/S0301421503003203.

[25] Lynn Price, Christina Galitsky, Jonathan Sinton, Ernst Worrell, and Wina Graus, “Tax and Fiscal Policies for Promotion of Industrial Energy Efficiency: A Survey of International Evidence,” U.S. Department of Energy, Sept. 15, 2005, https://www.osti.gov/biblio/861361.

[26] Marylin A. Brown and Sharon (Jess) Chandler, “Governing Confusion: How Statutes, Fiscal Policy, and Regulations Impede Green Energy Technologies,” Stanford Law and Policy Review 19:3 (Summer 2008), https://smartech.gatech.edu/bitstream/handle/1853/23053/wp28.pdf.

[27] Xinyi Sola Zheng, Brandon Graver, and Dan Rutherford, “U.S. Domestic Airline Fuel Efficiency Ranking, 2017-2018,” The International Council on Clean Transportation, September 2019, https://theicct.org/sites/default/files/publications/Domestic_Air_Efficiency_Ranking_2018_20190912_2.pdf.

[28] Iain Campbell and Koben Calhoun, “Old Buildings are U.S. Cities’ Biggest Sustainability Challenge,” Harvard Business Review, Jan. 21, 2016, https://hbr.org/2016/01/old-buildings-are-u-s-cities-biggest-sustainability-challenge.

[29] Stephen J. DeCanio, “Barriers Within Firms to Energy-Efficiency Investments,” Energy Policy 21:9 (September 1993), https://www.sciencedirect.com/science/article/abs/pii/030142159390178I.

[30] Meredith Fowlie, Michael Greenstone, and Catherine Wolfram, “Do Energy Efficiency Investments Deliver? Evidence from the Weatherization Assistance Program,” National Bureau of Economic Research, Working Paper No. 21331, July 2015, https://www.nber.org/papers/w21331.pdf.

[31] Clean Energy Business Network, “How Does New Tax Law Change Expensing for Energy Efficiency Improvements,” Alliance to Save Energy, Jan. 30, 2018, http://ase.org/blog/how-does-new-tax-law-change-expensing-energy-efficiency-improvements.

[32] Ibid.

[33] Erica York, “The Fixtures Fix: Correcting the Drafting Error Involving the Expensing of Qualified Improvement Property,” Tax Foundation, May 30, 2018, https://taxfoundation.org/fixtures-fix-qualified-improvement-property/.

[34] Bob Hinkle, “The Energy Efficiency Glitch,” Alliance to Save Energy, Sept. 24, 2019, https://www.ase.org/blog/energy-efficiency-glitch.

[35] Alex Muresianu, “How the CARES Act Fixed a Tax Bias Against Green Investment,” Tax Foundation, Aug. 20, 2020, https://taxfoundation.org/cares-act-fixed-tax-bias-green-investment/.

[36] Nadja Popovich, “America’s Light Bulb Revolution,” The New York Times, Mar. 8, 2019, https://www.nytimes.com/interactive/2019/03/08/climate/light-bulb-efficiency.html.

[37] Kevin A. Hassett and Gilbert E. Metcalf, “Energy Tax Credits and Residential Conservation Investment: Evidence from Panel Data,” Journal of Public Economics 57:2 (June 1995), https://www.sciencedirect.com/science/article/abs/pii/004727279401452T.

[38] Drew DeSilver, “Renewable Energy is Growing Fast in the United States, but Fossil Fuels Still Dominate,” Pew Research Center, Jan. 15, 2020, https://www.pewresearch.org/fact-tank/2020/01/15/renewable-energy-is-growing-fast-in-the-u-s-but-fossil-fuels-still-dominate/.

[39] Ibid.

[40] U.S. Energy Information Administration, “EIA Expects U.S. Electricity Generation from Renewables to Soon Surpass Nuclear and Coal,” U.S. Department of Energy, Annual Energy Outlook 2020, Jan. 30, 2020, https://www.eia.gov/todayinenergy/detail.php?id=42655.

[41] Ibid.

[42] International Energy Agency, “The Role of Gas in Today’s Energy Transitions,” World Energy Outlook Special Report, July 2019, https://www.iea.org/reports/the-role-of-gas-in-todays-energy-transitions.

[43] Jennifer A. Burney, “The Downstream Air Pollution Impacts of the Transition from Coal to Natural Gas in the United States,” Nature Sustainability 3 (Jan. 6, 2020) https://www.nature.com/articles/s41893-019-0453-5.

[44] Michael Mandel and Elliot Long, “Investment Heroes 2019: Boosting U.S. Growth,” Progressive Policy Institute, December 2019, https://www.progressivepolicy.org/wp-content/uploads/2019/12/PPI_InvestmentHeroes2019_V4.pdf.

[45] James Mueller and Amit Ronen, “Tax Reform, a Looming Threat to the Solar Industry,” GW Solar Institute, September 2014, https://www.researchgate.net/publication/276268129_Tax_Reform_a_Looming_Threat_to_a_Booming_Solar_Industry.

[46] U.S. Energy Information Administration, “Capital Cost and Performance Characteristic Estimates for Utility Scale Electric Power Generating Technologies,” U.S. Department of Energy, February 2020, https://www.eia.gov/analysis/studies/powerplants/capitalcost/pdf/capital_cost_AEO2020.pdf.

[47] Federal Energy Regulatory Commission, “Energy Primer: A Handbook for Energy Market Basics,” April 2020, https://www.ferc.gov/sites/default/files/2020-06/energy-primer-2020.pdf.

[48] Christopher Jones and Daniel M. Kammen, “Spatial Distribution of U.S. Household Carbon Footprints Reveals Suburbanization Undermines Greenhouse Gas Benefits of Urban Population Density,” Environmental Science and Technology 48:2 (Dec. 13, 2013), https://pubs.acs.org/doi/abs/10.1021/es4034364.

[49] William Larson, Feng Liu, and Anthony Yezer, “Energy Footprint of the City: Effects of Urban Land Use and Transportation Policies,” Journal of Urban Economics 72 (Apr. 23, 2012), http://www.socsci.uci.edu/~jkbrueck/course%20readings/larson.pdf.

[50] Alex Muresianu, “1980s Tax Reform, Cost Recovery, and the Real Estate Industry: Lessons for Today,” Tax Foundation, July 23, 2020, https://taxfoundation.org/1980s-tax-reform-cost-recovery-and-the-real-estate-industry-lessons-for-today/.

[51] Alan J. Auerbach and Joel Slemrod, “The Economic Effects of the Tax Reform Act of 1986,” Journal of Economic Literature 35:2 (June 1997), www.jstor.org/stable/2729788.

[52] Thomas Davidoff, “Tax Reform and Sprawl,” Joint Center for Housing Studies at Harvard University, September 2013, https://www.jchs.harvard.edu/sites/default/files/hbtl-05.pdf.

[53] James M. Poterba, “Taxation and Housing: Old Questions, New Answers,” National Bureau of Economic Research, Working Paper No. 3963, January 1992, https://www.nber.org/papers/w3963.pdf.

[54] James Follian, Donald Leavens, and Orawin Velz, “Identifying the Effects of Tax Reform on Multifamily Rental Housing,” Journal of Urban Economics 34:2 (September 1993), https://www.sciencedirect.com/science/article/pii/S0094119083710375.

[55] Erica York, “5 Options for Improving the Tax Treatment of Structures,” Tax Foundation, May 19, 2020, https://taxfoundation.org/neutral-cost-recovery-for-buildings/.

[56] Alex Muresianu, “Did the 1986 Tax Reform Hurt Affordable Housing?” Tax Foundation, July 1, 2020, https://taxfoundation.org/1986-tax-reform-hurt-affordable-housing/.

[57] Edward L. Glaeser and Joseph Gyourko, “The Impact of Zoning on Housing Affordability,” National Bureau of Economic Research, Working Paper No. 8835, March 2002, https://www.nber.org/papers/w8835.

[58] Adam Terando, Jennifer Costanza, Curtis Belyea, Robert R. Dunn, Alexa McKerrow, and Jamie Collazo, “The Southern Megalopolis: Using the Past to Predict the Future of Urban Sprawl in the Southeast United States,” PloS One 9:7 (2014), https://pubs.er.usgs.gov/publication/70118544.

[59] Gilbert E. Metcalf, “Federal Tax Policy Towards Energy,” National Bureau of Economic Research, Working Paper No. 12568, October 2006, https://www.nber.org/papers/w12568.pdf.

[60] Kyle Pomerleau and Elke Asen, “Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications,” Tax Foundation, Nov. 6, 2019, https://taxfoundation.org/carbon-tax/.

[61] Ibid.

[62] Antoine Dechezleprêtre and Misato Sato, “The Impacts of Environmental Regulations on Competitiveness,” Review of Environmental Economics and Policy 11:2 (Summer 2017), https://www.journals.uchicago.edu/doi/10.1093/reep/rex013.

[63] Kyle Pomerleau and Elke Asen, “Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications.”

[64] Matthew Lesh, “Abolishing the Factory Tax: How to Boost Investment and Level Up Britain,” Adam Smith Institute, Feb. 19, 2020, https://www.adamsmith.org/research/abolishing-the-factory-tax.

Share this article