State Corporate Income Tax Rates and Brackets, 2025

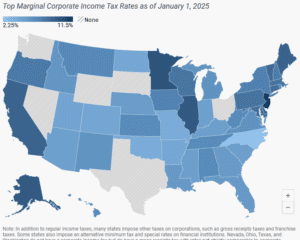

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners.

7 min read

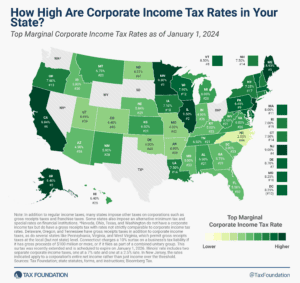

New Jersey levies the highest top statutory corporate tax rate at 11.5 percent, followed by Minnesota (9.8 percent) and Illinois (9.50 percent). Alaska and Pennsylvania levy top statutory corporate tax rates of 9.40 percent and 8.99 percent, respectively.

6 min read

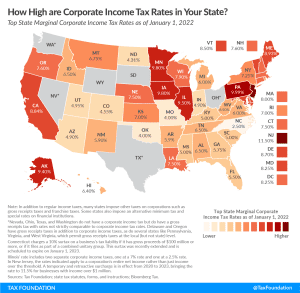

Forty-four states levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 11.5 percent in New Jersey.

8 min read

North Carolina’s 2.5 percent corporate tax rate is the lowest in the country, followed by Missouri (4 percent) and North Dakota (4.31 percent). Seven other states impose top rates at or below 5 percent: Florida (4.458 percent), Colorado (4.55 percent), Arizona (4.9 percent), Utah (4.95 percent), and Kentucky, Mississippi, and South Carolina (5 percent).

7 min read

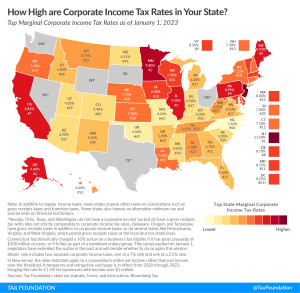

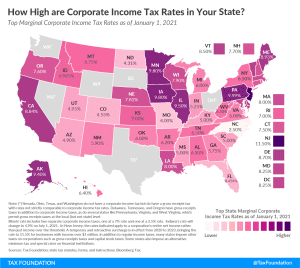

Forty-four states currently levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 12 percent in Iowa. Over the past year, several states, including Florida, Georgia, Indiana, Mississippi, Missouri, and New Jersey, implemented notable corporate income tax changes.

7 min read

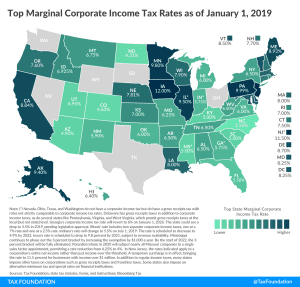

State corporate income tax rates range from 3 percent in North Carolina to 12 percent in Iowa. Download and compare each state’s 2018 rates and brackets here.

6 min read

Corporate income taxes are levied in 44 states. Though often thought of as a major tax type, corporate income taxes account for just 5.4 percent of state tax collections and 2.7 percent of state general revenue. Here’s how corporate income taxes compare across the states.

6 min read