Property taxes are an important tool to help finance state and local governments. In fiscal year 2017, property taxes comprised 31.9 percent of total state and local tax collections in the United States, more than any other source of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue. In that same year, property taxes accounted for a whopping 72 percent of local tax collections and 26 percent of overall local government revenue (according to 2017 “State & Local Government Finance” data available from the United States Census Bureau).

Median property taxes paid vary widely among the 50 states. The lowest bills in the country are in nine counties with median property taxes of less than $200 a year: two in Alaska (Aleutians East Borough and Kusivlak Census Area), six parishes in Louisiana (Allen, Avoyelles, Bienville, East Feliciana, Madison, and Red River), and Alabama’s Choctaw County. The next-lowest median property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. of $210 is found in Winn Parish, near the middle of Louisiana. This is followed by $219 in McDowell, West Virginia, at the southernmost part of the state.

The five counties with the highest median property tax payments all have bills exceeding $10,000— Bergen and Essex Counties in New Jersey, and Nassau, Rockland, and Westchester counties in New York. All five of these counties are located near New York City, as are the next two highest: Union ($9,788) and Passaic ($9,722) counties in New Jersey.

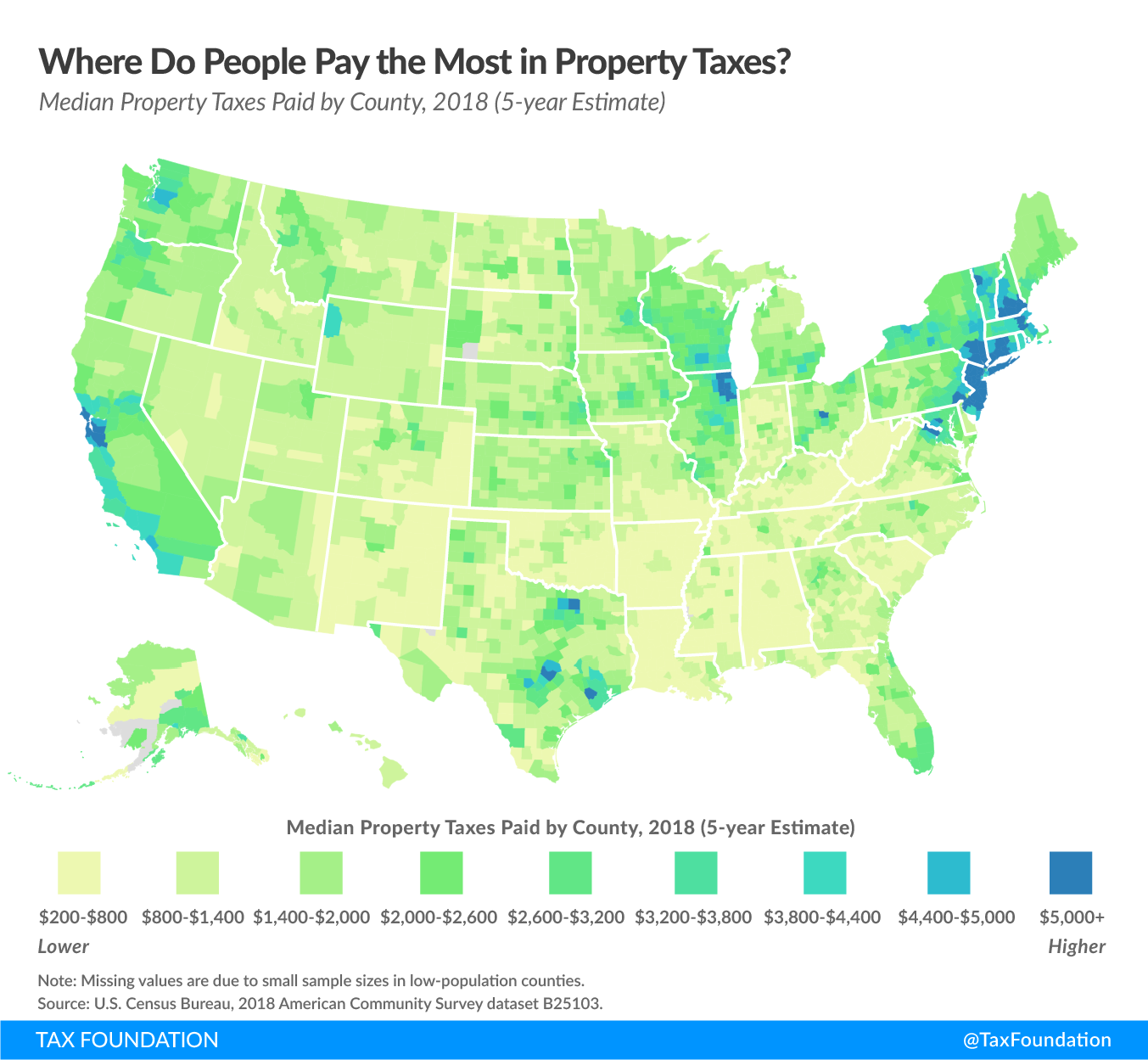

Where Do People Pay the Most in Property Taxes?

Median Property Taxes Paid by County, 2018 (5-year estimate)

Note: Missing values are due to small sample sizes in low-population counties.

Source: U.S. Census Bureau, 2018 American Community Survey dataset B25103.

The above map is interactive — hover the mouse over a given county to see the median amount of property tax residents there pay. Click here to see a larger version

Reliance on property taxes also varies within states. In Georgia, for example, where the median property tax bill is relatively low, median taxes range from $478 in Quitman County (near the Alabama border in the southern part of the state) to $2,901 in Fulton County (a suburb of Atlanta). This is typical among states; higher median payments tend to be concentrated in urban areas. This can be partially explained by the prevalence of above-average home prices in urban cities. Because property taxes are assessed as a percentage of home values, it follows that higher property taxes are paid in places with higher housing prices.

While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, it’s worth noting that property taxes are largely rooted in the “benefit principle” of government finance: the people paying the bills are most often the ones benefiting from the services.

Share this article