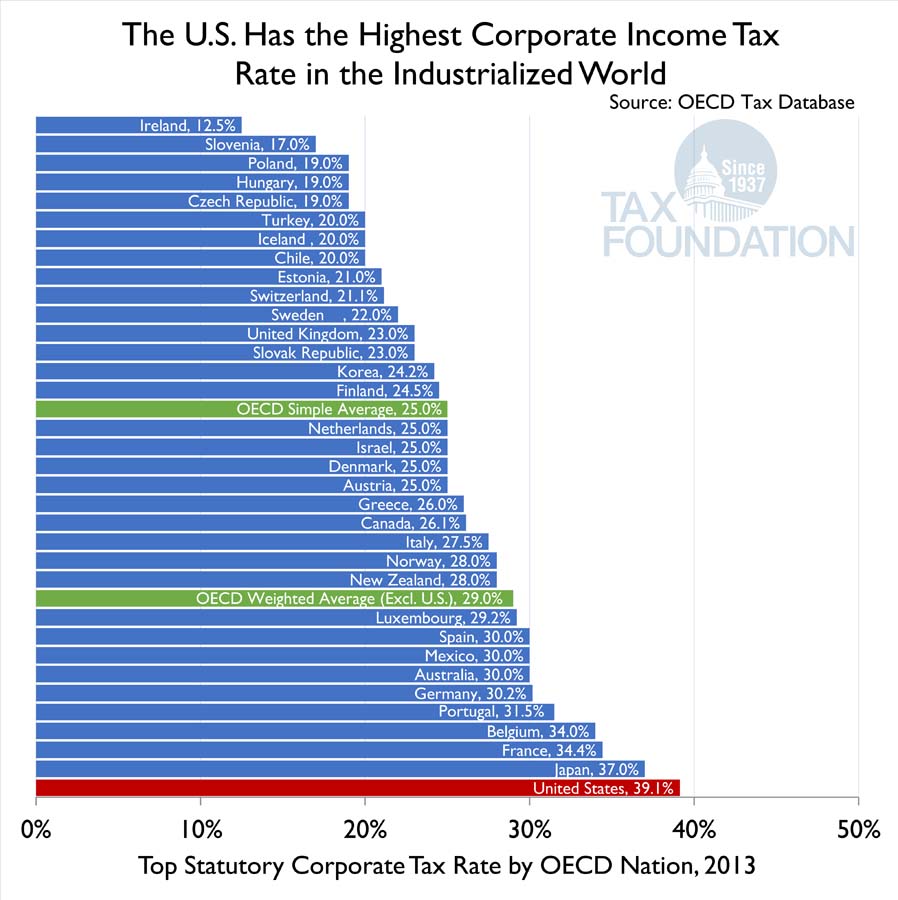

In today’s globalized world, U.S. corporations are increasingly at a competitive disadvantage. They currently face the highest statutory corporate income tax rate in the world at 39.1 percent. This overall rate is a combination of our 35 percent federal rate and the average rate levied by U.S. states. Corporations headquartered in the 33 other industrialized countries that make up the Organization for Economic Cooperation and Development (OECD), however, face an average rate of 25 percent. Even corporations in high-taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. European countries such as Belgium (34 percent), France (34.4 percent), and Sweden (22 percent) face much lower rates than those in the United States. Our largest trading partners—Canada, Japan, and the United Kingdom—have each cut their corporate tax rates over the past few years to become more competitive.

For more charts like the one below, see the second edition of our chart book, Putting a Face on America's Tax Returns.

Share this article