In the U.S. economy, there are tens of millions of businesses, including more than 30 million pass-through businesses and more than a million C corporations. These firms are spread throughout a variety of industries, providing services and producing goods. Understanding how much firms produce and how many workers firms employ within each industry can help policymakers understand how particular taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policies will impact the economy.

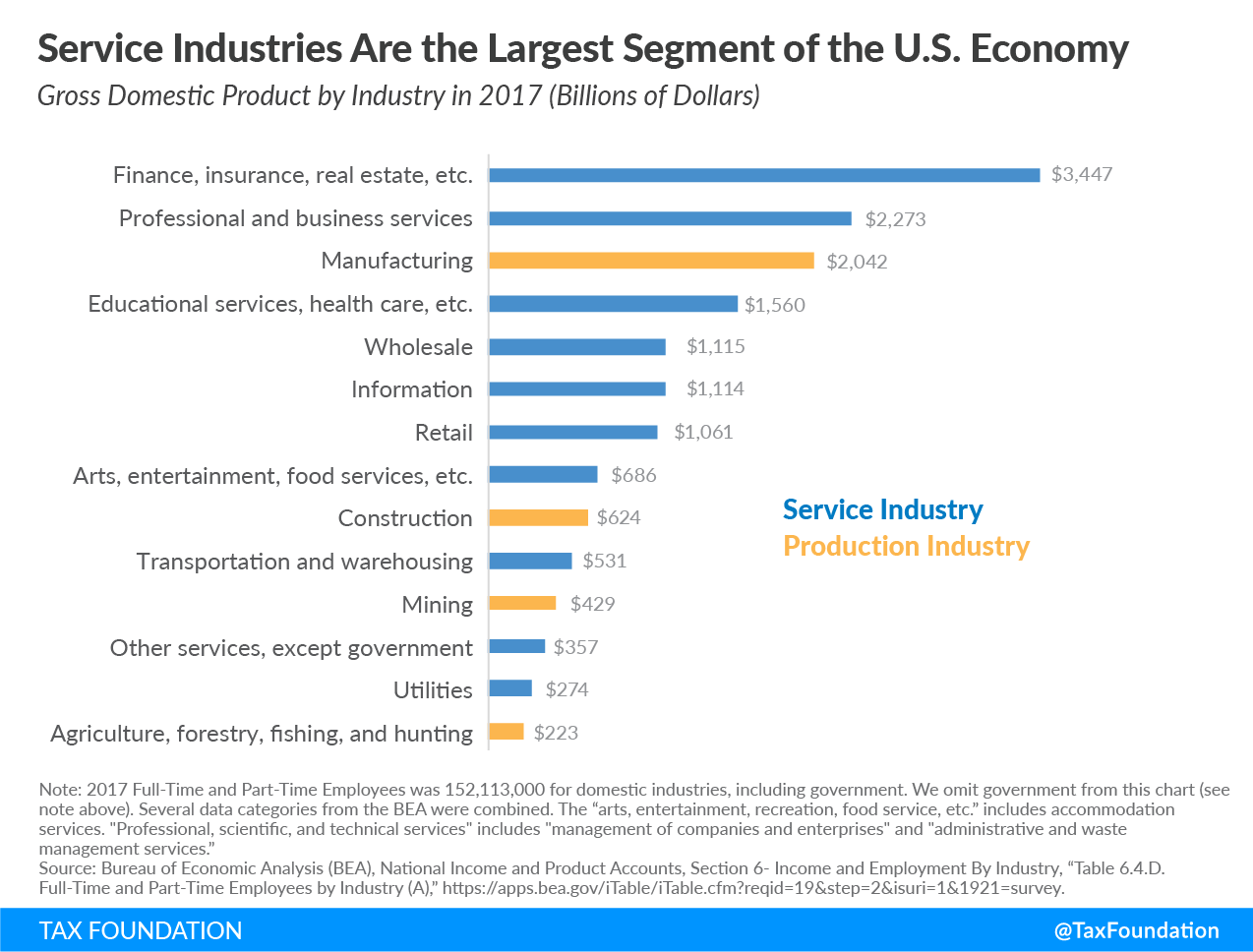

The U.S. economy is dominated by service industries. In 2017, firms related to “finance, insurance, and real estate” generated more than $3.4 trillion in gross domestic product (GDP), making it the most productive segment of industries in the U.S. economy. Recall that GDP measures the value of goods and services produced in the U.S. economy, and its growth is the most popular indicator of the nation’s overall economic health. The “professional and business services” industry—which includes both legal and computer services— was the second most productive, adding $2.3 trillion to the nation’s GDP. Overall, private sector service industries accounted for more than $12 trillion, or 68 percent of GDP in 2017.

Production industries together, such as “manufacturing,” “construction,” “mining,” and “agriculture, forestry, fishing, and hunting,” accounted for $3.3 trillion in GDP. Manufacturing alone was the third most productive industry overall, contributing just more than $2 trillion.

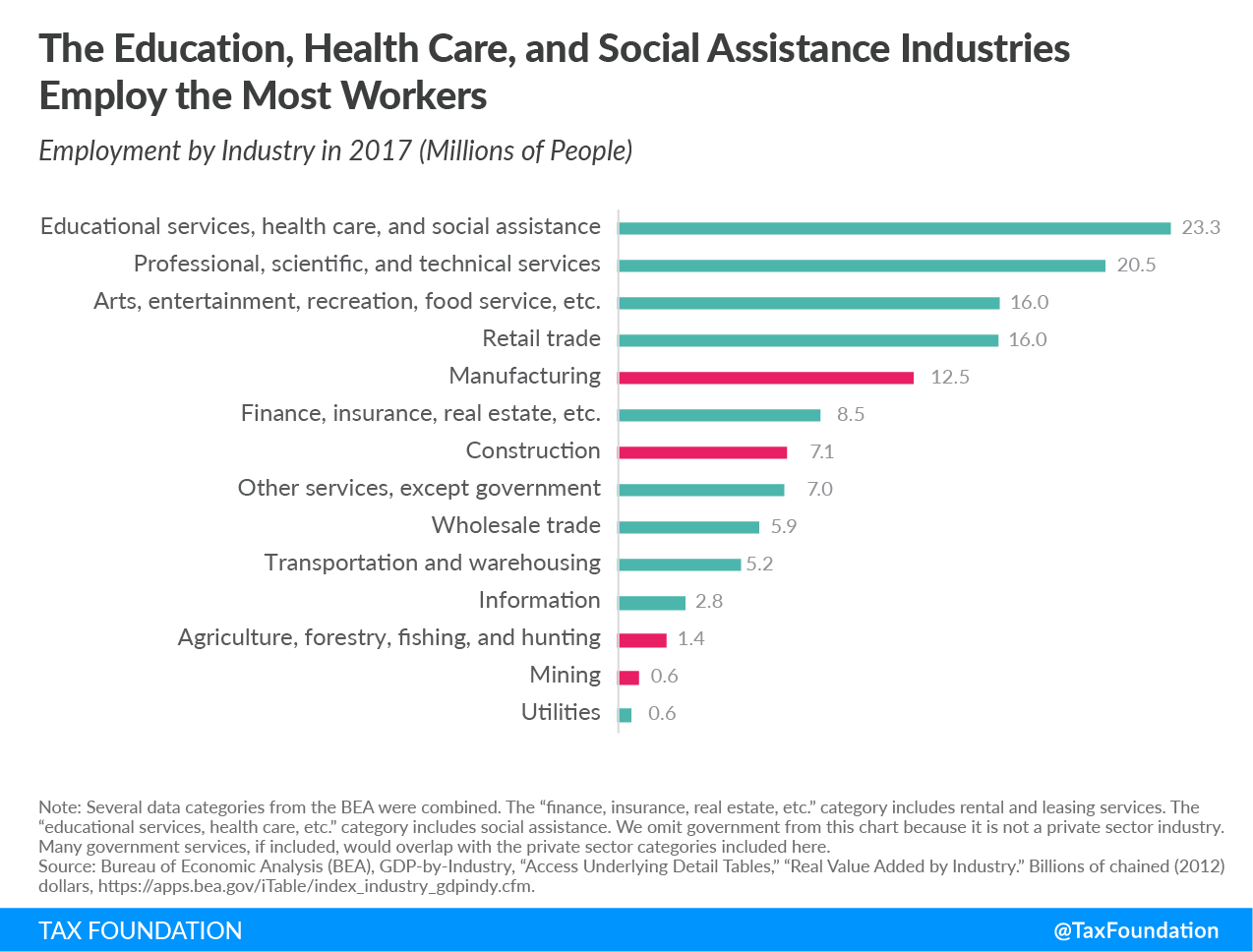

Service sector industries also employed the most people in 2017 at more than 100 million employees, compared to just more than 20 million employees for production industries. Overall, the “educational services, health care, and social assistance” industry employed the most private sector workers at 23.3 million, followed by the “professional, scientific, and technical services” industry at 20.5 million and the “arts, entertainment, recreation, food service, etc.” industry at 16 million. In 2017, manufacturing was the biggest production industry employer, employing more than 12 million people.

Business in America is not monolithic. Businesses vary based on whether they provide services or produce goods, as well as in the level of output they create and the number of workers they employ. Most output and employment come from firms that provide services to consumers—such as education, health care, and social assistance services—though a large share of output and employment still comes from firms in production industries, particularly manufacturing.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNote: This is part of our “Business in America” blog series

- The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

- Corporate and Pass-through Business Income and Returns Since 1980

- Firm Variation by Employment and Taxes

- Pass-Through Businesses Q&A

- State Corporate Income Taxes Increase Tax Burden on Corporate Profits

- Marginal Tax Rates for Pass-through Businesses Vary by State

- Taxes on Capital Income Are More Than Just the Corporate Income Tax

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal