Cigarette Taxes in Europe, 2023

3 min readBy:Taxes dominate the cigarette market in the European Union (EU). The EU Tobacco TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Directive requires Member States to levy a minimum excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. rate on cigarettes and other tobacco products. EU cigarette taxes include both a specific cigarette tax (a fixed euro amount per pack of cigarettes) and an ad valorem tax (an added percentage of the retail selling price).

The current minimum cigarette excise taxes in the EU are €1.80 (US $1.89) per 20-cigarette pack and the total excise duty must be at least 60 percent of an EU country’s weighted average retail selling price (certain exceptions apply). These tobacco excise taxes come in addition to the broad consumption value-added taxes (VATs). EU legislation only establishes minimum rates. Most countries levy higher rates.

EU Average Tax Types and Rates on a Pack of 20 Cigarettes as of July 2023

| Tax | Average Rates and Prices |

|---|---|

| Base Market Price (excluding taxes) | € 1.02 |

| + Excise duty (min. 60% of RSP) | €3.63 (64.1% of RSP) |

| Equals Pre-VAT Price | €4.65 |

| + VAT | €1.01 (21.7%) |

| Equals Retail Selling Price (incl. all taxes) | €5.66 |

In 2023, the average EU member state levied taxes on cigarettes that exceed 80 percent of the retail selling price. This is an average tax-induced price increase of more than 450 percent.

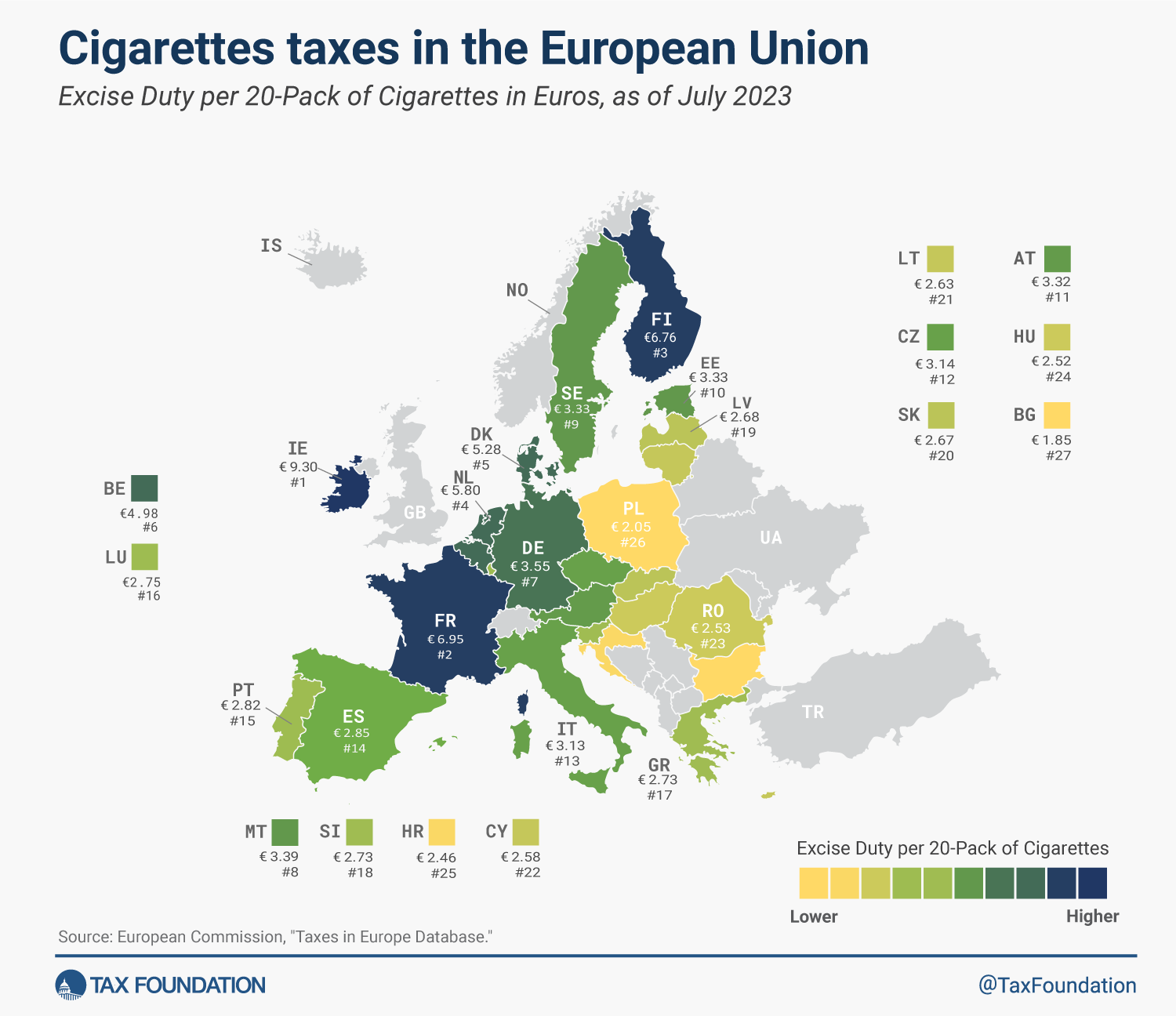

The map below illustrates that taxes vary considerably across EU member states. Ireland levies the heaviest tax in the EU at €9.30 ($11.97) per pack of 20 cigarettes. France and Finland apply the next highest rates at €6.95 ($7.31) and €6.76 ($7.11), respectively.

Bulgaria levies the lightest tax in the EU at €1.85 ($1.95). The next lowest tax rates are applied by Poland at €2.05 ($2.15), and Croatia at €2.46 (2.59).

Research finds that cigarette taxes are regressive and use a narrow base to generate a volatile revenue source that isn’t used to address problems related to smoking. Recent tax increases have also fueled growth in global cigarette smuggling and illicit trade.

KPMG estimates that more than 30 billion counterfeit and contraband cigarettes were consumed in the EU in 2020, representing 7.8 percent of total cigarette consumption and a loss of €8.5 billion ($9.7 billion) in tax revenues. The largest consumers of illicit cigarettes as a percentage of total consumption were France (23.1 percent), Greece (22.4 percent), and Lithuania (20.2 percent).

Tobacco policy will likely be a major issue in the next year, as an update to the EU Tobacco Tax Directive is considered. Any revisions to the EU Tobacco Tax Directive would have a major impact on well-being in the EU.

Excise Duties on Cigarettes in EU Member States as of July 1, 2023

| Excise Duty per 20-Pack | Total Tax per 20-Pack (Excise Duty and VAT) | Average Retail Selling Price per 20-Pack (Including Tax) | Tax as a Share of Final Selling Price (Includes Excise Duties and VAT) | ||||

|---|---|---|---|---|---|---|---|

| EUR | USD | EUR | USD | EUR | USD | ||

| Austria (AT) | € 3.32 | $3.49 | € 4.23 | $4.45 | € 5.50 | $5.79 | 77.0% |

| Belgium (BE) | € 4.98 | $5.24 | € 6.25 | $6.57 | € 7.29 | $7.66 | 85.7% |

| Bulgaria (BG) | € 1.85 | $1.95 | € 2.32 | $2.44 | € 2.78 | $2.92 | 83.4% |

| Croatia (HR) | € 2.46 | $2.59 | € 3.28 | $3.45 | € 4.11 | $4.32 | 79.8% |

| Cyprus (CY) | € 2.58 | $2.72 | € 3.28 | $3.45 | € 4.36 | $4.58 | 75.2% |

| Czech Republic (CZ) | € 3.14 | $3.30 | € 4.02 | $4.23 | € 5.11 | $5.37 | 78.8% |

| Denmark (DK) | € 5.28 | $5.55 | € 6.73 | $7.07 | € 7.25 | $7.63 | 92.8% |

| Estonia (EE) | € 3.33 | $3.50 | € 4.11 | $4.32 | € 4.67 | $4.91 | 87.9% |

| Finland (FI) | € 6.76 | $7.11 | € 8.58 | $9.02 | € 9.38 | $9.86 | 91.5% |

| France (FR) | € 6.95 | $7.31 | € 8.64 | $9.09 | € 10.16 | $10.68 | 85.1% |

| Germany (DE) | € 3.55 | $3.73 | € 4.61 | $4.85 | € 6.65 | $7.00 | 69.3% |

| Greece (GR) | € 2.73 | $2.87 | € 3.54 | $3.72 | € 4.17 | $4.38 | 84.9% |

| Hungary (HU) | € 2.52 | $2.65 | € 3.52 | $3.70 | € 4.71 | $4.95 | 74.7% |

| Ireland (IE) | € 9.30 | $9.78 | € 11.97 | $12.59 | € 14.32 | $15.05 | 83.6% |

| Italy (IT) | € 3.13 | $3.30 | € 4.07 | $4.28 | € 5.20 | $5.47 | 78.3% |

| Latvia (LV) | € 2.68 | $2.81 | € 3.37 | $3.54 | € 3.97 | $4.18 | 84.7% |

| Lithuania (LT) | € 2.63 | $2.77 | € 3.36 | $3.53 | € 4.17 | $4.38 | 80.5% |

| Luxembourg (LU) | € 2.75 | $2.90 | € 3.47 | $3.64 | € 4.90 | $5.15 | 70.8% |

| Malta (MT) | € 3.39 | $3.57 | € 4.21 | $4.43 | € 5.35 | $5.63 | 78.6% |

| Netherlands (NL) | € 5.80 | $6.10 | € 7.11 | $7.48 | € 7.56 | $7.95 | 94.1% |

| Poland (PL) | € 2.05 | $2.15 | € 2.64 | $2.77 | € 3.15 | $2.87 | 83.8% |

| Portugal (PT) | € 2.82 | $2.97 | € 3.72 | $3.91 | € 4.78 | $5.03 | 77.8% |

| Romania (RO) | € 2.53 | $2.66 | € 3.24 | $3.41 | € 4.45 | $4.67 | 72.9% |

| Slovakia (SK) | € 2.67 | $2.81 | € 3.38 | $3.55 | € 4.25 | $4.47 | 79.5% |

| Slovenia (SI) | € 2.73 | $2.87 | € 3.49 | $3.67 | € 4.18 | $4.40 | 83.4% |

| Spain (ES) | € 2.85 | $3.00 | € 3.65 | $3.84 | € 4.62 | $4.85 | 79.1% |

| Sweden (SE) | € 3.33 | $3.50 | € 4.51 | $4.74 | € 5.88 | $6.18 | 76.7% |

| Average | € 3.63 | $3.82 | € 4.64 | $4.88 | € 5.66 | $5.95 | 81.1% |

Source: European Commission, “Taxes in Europe Database,” accessed September 2023, https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribePrevious Versions

-

Cigarette Taxes in Europe, 2022

3 min read -

Cigarette Taxes in Europe, 2021

3 min read -

Cigarette Taxes in Europe, 2020

3 min read -

Cigarette Taxes in Europe, 2019

3 min read