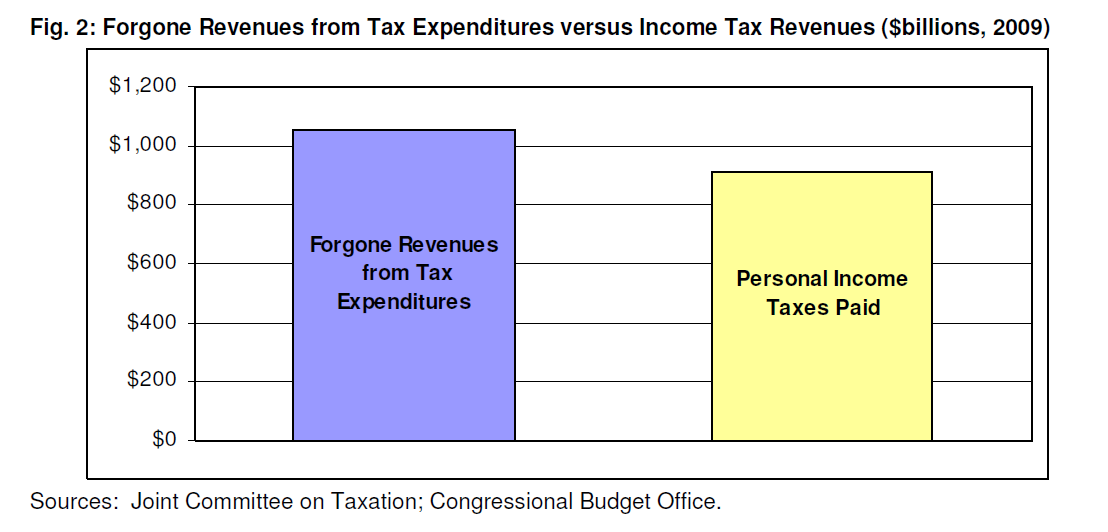

The above chart is taken from a short report by the Committee for a Responsible Federal Budget (CRFB) regarding federal income tax expenditures. Income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

expenditures are special tax benefits for targeted groups and are unnecessary for the basic revenue-raising function of the income tax. They result either in reduced revenues or increased taxes elsewhere, or some combination of the two. Tax expenditures are really just government spending cleverly hidden in the tax code. According to the report, tax expenditures “result in more than $1 trillion in forgone revenue a year – more than 6 percent of GDP. These revenue losses were larger than all income taxes paid by individuals last year.”

The above chart is taken from a short report by the Committee for a Responsible Federal Budget (CRFB) regarding federal income tax expenditures. Income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

expenditures are special tax benefits for targeted groups and are unnecessary for the basic revenue-raising function of the income tax. They result either in reduced revenues or increased taxes elsewhere, or some combination of the two. Tax expenditures are really just government spending cleverly hidden in the tax code. According to the report, tax expenditures “result in more than $1 trillion in forgone revenue a year – more than 6 percent of GDP. These revenue losses were larger than all income taxes paid by individuals last year.”

One of the problems-indeed, the great political appeal-of tax expenditures is that they are not subject to annual budget review: they are created without the same level of scrutiny received by other areas of the budget, and then run open-ended with little review. Because they escape the normal budget process, policymakers have found them particularly attractive, and the tax expenditureTax expenditures are a departure from the “normal” tax code that lower the tax burden of individuals or businesses, through an exemption, deduction, credit, or preferential rate. Expenditures can result in significant revenue losses to the government and include provisions such as the earned income tax credit (EITC), child tax credit (CTC), deduction for employer health-care contributions, and tax-advantaged savings plans. budget has grown tremendously.

The tax code contains around 250 tax expenditures, double the number from only a few years ago. Adoption of these deductions, credits, exemptions, exclusions, and other tax preferences has undercut the effectiveness, efficiency, transparency, and fundamental fairness of the tax system. The result is a Swiss-cheese tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. filled with rifle-shot tax breaks which, much like entitlement programs, are on automatic pilot and do not receive sufficient scrutiny as part of the budget process.

While CRFB recommends some ambitious reforms, such as eliminating the deduction for state and local taxes paid, others are fairly modest, such as their proposal to limit deductible mortgage interest to the interest paid on mortgages with a value of $500,000 or less (the current limit it $1 million) and disallowing the deduction for second homes. Most policy experts believe that we need fundamental tax reform, and that can only be accomplished if tax expenditures are vastly curbed. The only question is one of political will.

More on tax expenditures here:

The Growing Problem of Tax Expenditures

Budget Estimates the Cost of Tax Preferences

America’s Shrinking Income Tax base Requires Higher Rates for Everyone

Share this article