Next month, Colorado voters will be asked to consider a measure that would legalize sports betting in the state. Proposition DD would authorize sports betting for people 21 or older in-person at casinos and online through internet sports betting operators contracted by casinos.

The operators will be charged a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of 10 percent on their net sports betting proceeds, meaning the total amount wagered minus the winnings. The system is forecasted to raise tax revenue of $6.5 million in the 2019-20 fiscal year and up to $29 million in the 2020-21 fiscal year. According to the Legislative Council of the Colorado General Assembly, revenue over the first five years will be around $16 million per year.

The tax revenue is earmarked for $130,000 going to gambling addiction services; 6 percent going to the Hold Harmless Fund, which will refund businesses and communities that might lose revenue due to the sports betting legalization (for example casinos, horse racing, cities, community colleges, and the State Historical Fund); and the remainder (between $15 million and $27.2 million) dedicated to water projects and other water-related obligations under the Colorado Water Plan.

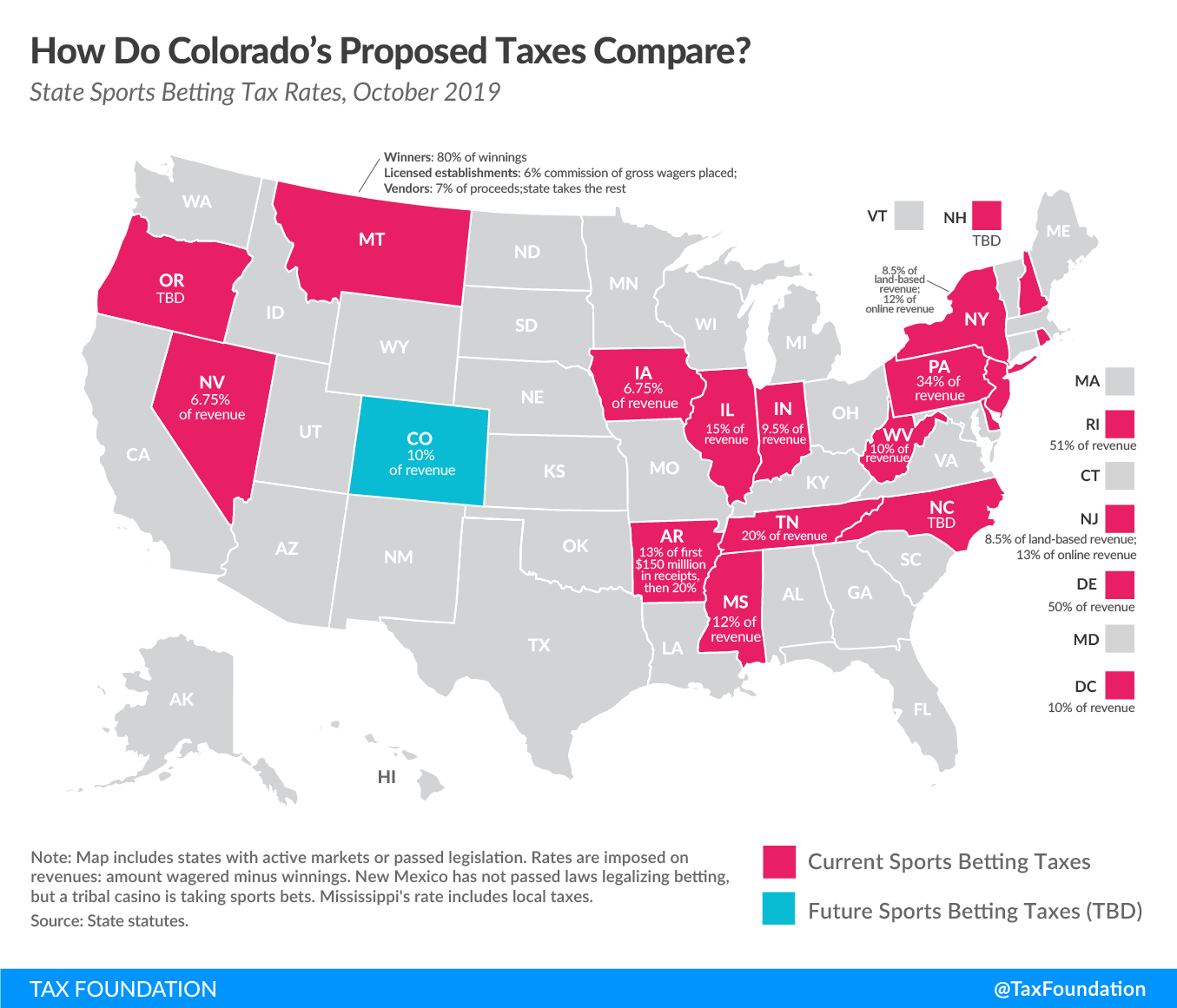

Since the Supreme Court’s decision in Murphy v. NCAA in May 2018, multiple states have legalized and taxed sports betting. Currently, 13 states have legalized and launched sports betting at some level, with another five states close to launching.

Like issues raised by marijuana legalization, brick-and-mortar sports betting facilities will be competing with black and gray markets. According to the American Gaming Association, Americans spend close to $150 billion on illegal bets each year. States, localities, and professional leagues all want a piece of that pie. To put the number in perspective, the much debated legal and illegal market for marijuana is around $50 billion.

Lawmakers looking to capitalize on gambling should be careful when setting tax rates, as setting them too high could keep bettors in well-established untaxed markets. This was evident in Pennsylvania, where high tax rates discouraged investment early on. This seems to have been taken seriously in Colorado, which proposes one of the lowest rates in the country after the Colorado Department of Revenue suggested a rate between 6.5 and 16 percent.

However, Proposition DD includes very little detail about specific water-related projects to be funded, or the cost of the Water Plan as such. Thought should have been given to whether tax revenue from excise taxes—such as taxes on sports betting—are appropriate for targeted spending programs. High excise taxes applied to small tax bases are volatile, making it difficult to sufficiently fund designated priorities from year to year.

Four out of six states with legal sports betting fell far short of revenue projections the first year. Similarly, many states are increasing the rates of—and relying on revenue from—tobacco excise taxes. They are now experiencing budget deficits from declining smoking rates. As a rule of thumb: sin taxes generally do not generate stable revenue and should not be relied on to do so.

States legalizing sports betting in hopes of balancing their budgets might get a bump in revenue, but it is not a long-term solution to budget woes. States should rely on broad-based, low-rate taxes instead. Gambling can be part of that revenue picture—but states shouldn’t bet the house on it.

Share this article