In his upcoming budget, President Obama will propose adjusting the Cadillac TaxThe Cadillac Tax is a 40 percent tax on employer-sponsored health care coverage that exceeds a certain value. The aim: to curb health-care cost growth, reduce favorable tax treatment of employer-provided insurance, and help fund the Affordable Care Act (ACA). It was repealed in late 2019 before taking effect. to account for geographic variations in health costs, according to an article published on Wednesday by two White House economists. The proposed changes would further weaken the ability of the Cadillac Tax to raise revenue and restrain healthcare costs, but they might be necessary to ensure the viability of the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. in the long-run.

Lately, the Cadillac Tax has been on increasingly thin ice. The tax was passed as part of the Affordable Care Act: both as a source of revenue and a measure to lower healthcare costs. However, the tax has long been unpopular with businesses, labor unions, and politicians on both sides of the aisle. In last December’s omnibus tax bill, Congress scaled back the Cadillac tax and delayed its implementation until 2020, which many see as the beginning of the end for the tax.

Now, the Obama administration is set to propose an additional set of changes that would weaken the Cadillac Tax. As economists Jason Furman and Matthew Fiedler describe:

The President’s fiscal year 2017 budget proposal would further improve the tax’s targeting. The most significant provision specifies that in any state where the average premium for “gold” coverage on the state’s individual health insurance marketplace would exceed the Cadillac-tax threshold under current law, the threshold would instead be set at the level of that average gold premium. This policy prevents the tax from creating unintended burdens for firms located in areas where health care is particularly expensive, while ensuring that the policy remains targeted at overly generous plans over the long term if health costs rise faster than the tax thresholds (which will rise with the overall Consumer Price Index).

Under current law, the Cadillac Tax kicks in as soon as the healthcare premium paid by an employer rises above a certain fixed threshold – $10,200 for individual plans and $27,500 for family plans, in 2018. This threshold is the same for all employers, across the country.

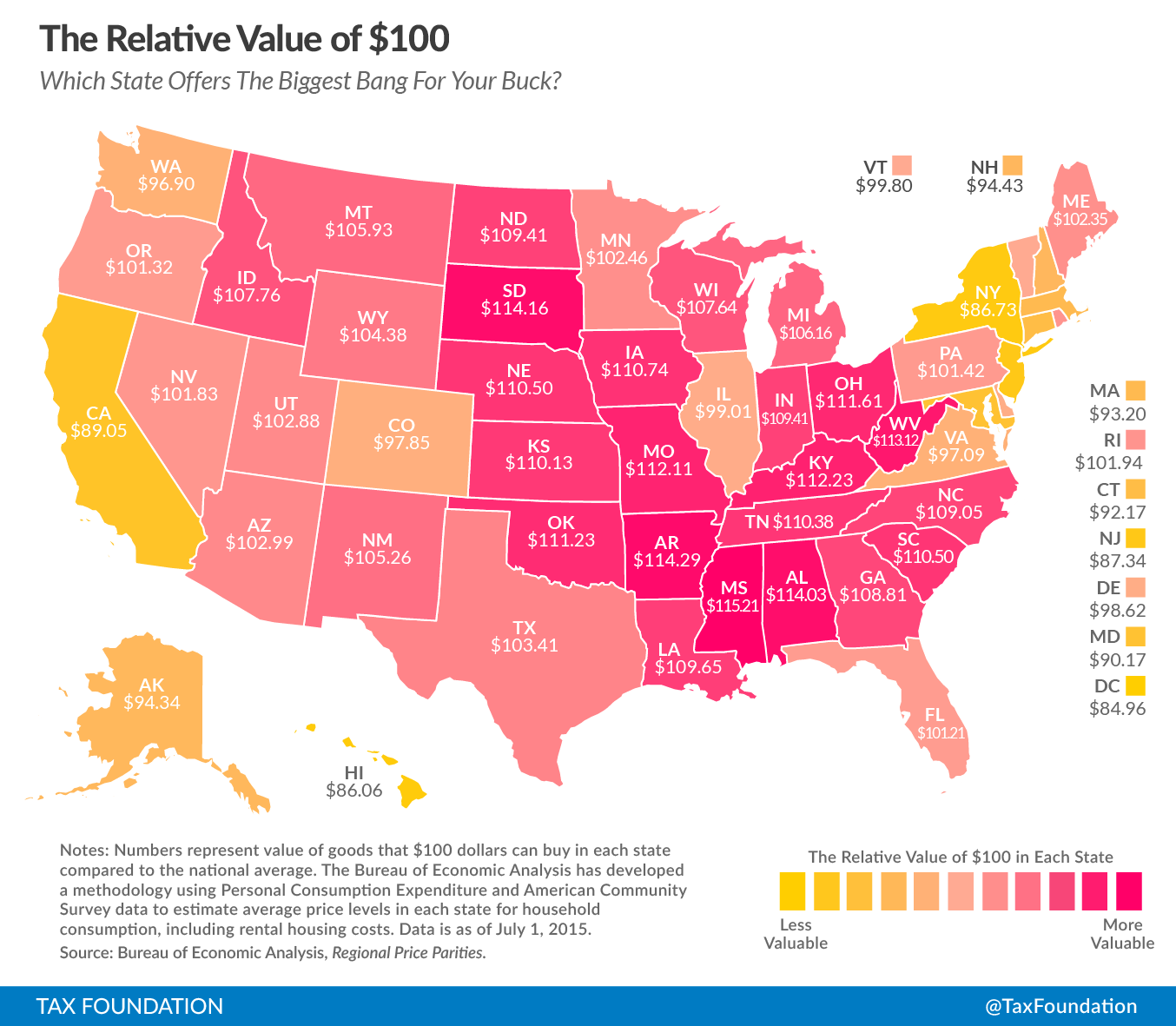

However, as the Tax Foundation has written about before, the purchasing power of a dollar varies widely across the United States. And it is well known that healthcare costs also vary significantly by geographical region. A $27,500 healthcare plan in Utah might be able to buy a lot more medical care than a $27,500 healthcare plan in New Jersey.

Because the Cadillac Tax threshold is currently the same for every state, is imposes a larger tax burden on states with higher healthcare costs. This is what the Obama administration proposal seeks to change: it would set the Cadillac Tax threshold at a higher level for some states with higher healthcare costs.

This would be significant shift in how the Cadillac Tax works: instead of a tax on healthcare plans with high absolute costs, the Cadillac Tax would shift towards being a tax on healthcare plans with high relative costs. Because fewer plans would be subject to the tax, these changes would also decrease the amount of revenue that the Cadillac Tax raises.

Why would the White House propose changes that would weaken the Cadillac Tax – a central part of the administration’s most significant policy achievement? In fact, these changes might be necessary to secure the continued existence of the tax. The White House has been fighting a losing battle to defend the Cadillac Tax, and these proposed changes may placate some of the tax’s opponents, particularly employers in states with high healthcare costs.

Share this article