Ben Smith at Politico has posted a video of Hillary Clinton stating that she does not think America's rich are paying their fair share of taxes. She said, "The rich are not paying their fair share in any nation that is facing the kind of employment issues [America currently does]—whether it's individual, corporate or whatever [form of] taxation forms."

She then went on to praise Brazil as a model for the U.S.: "Brazil has the highest taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. -to-GDP rate in the Western Hemisphere and guess what—they're growing like crazy." Clinton concluded, "And the rich are getting richer, but they're pulling people out of poverty."

For now, I will leave aside her bizarre trickle-down assertion that Brazil's high taxes and redistributionist policies are the source of their growth and "lifting all boats" and simply focus on the issue of whether or not the rich are paying their fair share.

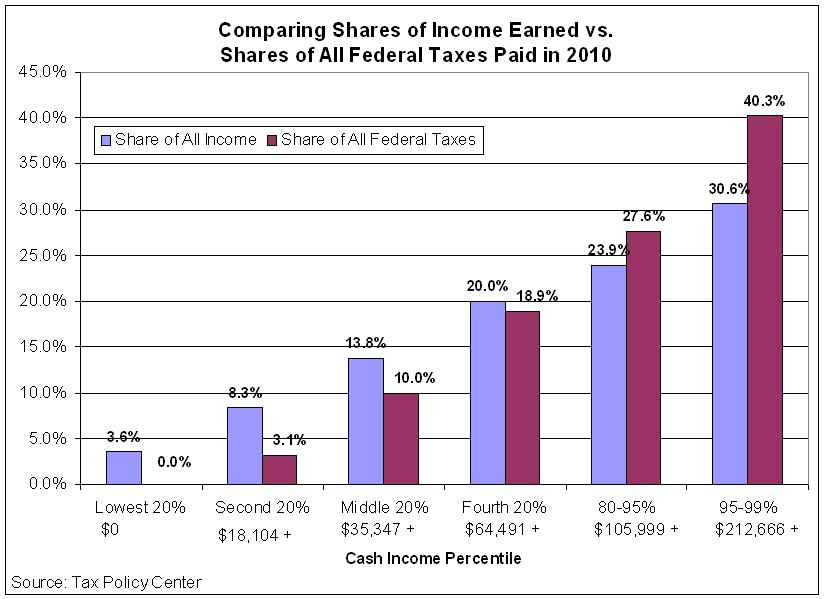

The chart below shows estimates by the Tax Policy Center for 2010 of the distribution of income compared to the distribution of all federal taxes (personal income, payroll, and corporate) by percentile. It shows that households earning over about $212,000 earn about 30 percent of the nation's income but pay more than 40 percent of all federal taxes.

By contrast, those earning less than $105,000 collectively earn about 46 percent of the nation's income but pay 32 percent of the taxes. The bottom quintile pays nothing.

So the question for Mrs. Clinton is, if 40 percent of the nation's tax burden is not enough then what is the rich's fair share of tax?

Share this article