To put it mildly, many in the press and in the public remain unconvinced that Romney can lower taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates without lowering revenue. Ruth Marcus at the Washington Post writes that Romney’s plan:

“hinges on the faith-based assertion that this revenue neutrality can be achieved through the ensuing miracle of faster economic growth. History counsels against counting on tax miracles.”

Well, Reagan counted on just such a miracle, and he got it. So did Kennedy. Let’s look at the Reagan years, since it provides the closest example of what Romney would do, i.e. lower the top marginal income tax rate to 28 percent. As the chart below shows, Reagan lowered the top marginal income tax rate from 70 percent in 1980 to 28 percent in 1988. Individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. revenue increased, even after adjusting for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and population growth.

How did Reagan do it? In much the same way that Romney has said he would: by eliminating tax preferences. In neither of his campaigns did Reagan specify which tax preferences he would eliminate, and nor has Romney. Reagan left the details to his Treasury Department and Congress.

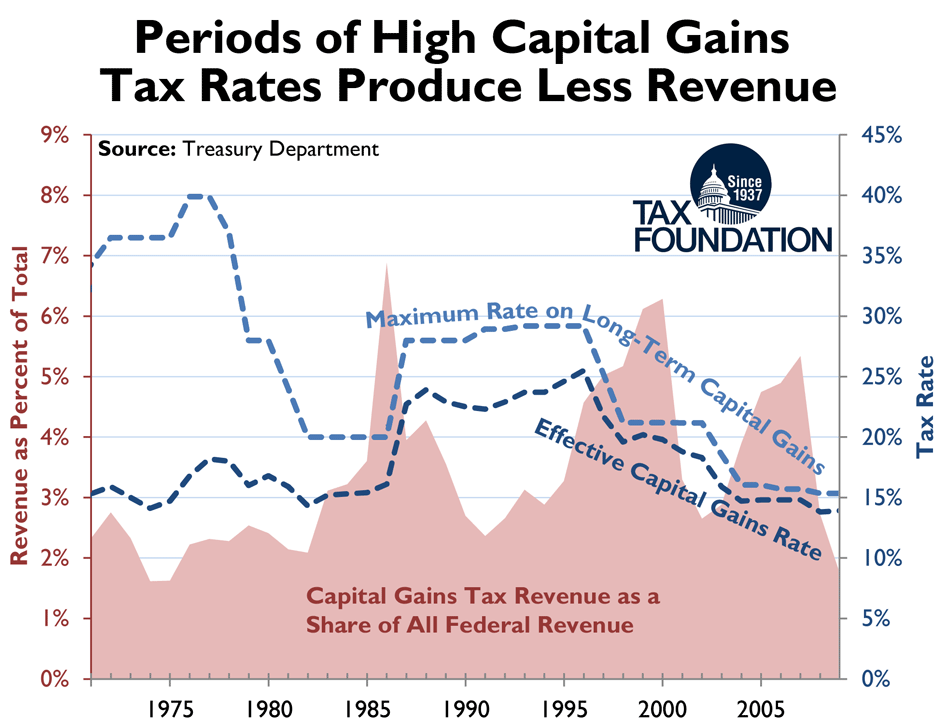

Now, Romney would maintain a lower tax rate on capital gains and dividends than Reagan did, but again the historical record provides no evidence that higher tax rates on investment income produce more revenue. The following chart shows that when the capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate was high, from 1987 to 1996, revenue was low.

See this report for more on the Romney tax plan. Ruth Marcus relies on the Congressional Research Service to support her claim, but that analysis is extremely misleading, as explained here.

Follow William McBride on Twitter @EconWill

Share this article