Forty miles northwest of Washington, D.C. lies Loudoun County, Virginia, home of Dulles International Airport, Verizon Business, and 19 wineries. Between 1998 and 2008, the county’s population grew 98% as Washington-area workers spread out into the exurbs in search of cheaper, newer, and bigger houses. That flow has now reversed, with Loudoun taking one of the biggest hits in the bursting of the housing bubble.

Loudoun County may have been America’s fastest growing county, but it now has a few other records it might be less proud of. On April 7, Loudoun County supervisors voted 6-3 to approve a 9% increase in property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. rates for the Fiscal Year 2010 budget, taking the rate to $1.245 per $100 in value, the highest of any Northern Virginia county. (TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burdens for many will drop due to the collapse in home values, though overall spending is still going up from 2009.)

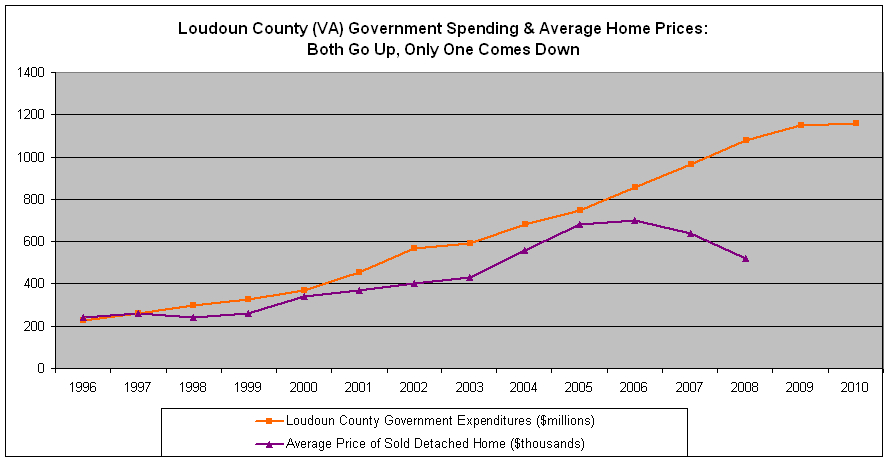

Inconvenient for the argument that tax rates must go up to avoid painful budget cuts is the fact that between 1996 and 2008, Loudoun County government spending grew 466% (from about $230 million a year to $1.1 billion a year), while inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. went up 39% and population went up 146%. In only three years was the growth inflation+population—which were in double digits many years—less than the growth in government spending. That difficult to sustain, especially if you understood that housing growth was not sustainable.

Here are some charts to illustrate. In the first one (click to enlarge), the growth in county government spending (orange) is plotted each year with the growth in inflation (blue), population (yellow), and inflation+population (green). Lots of orange in that graph. This was amazing to me, since Loudoun County was all booming, which seemed to justify an explosion in government spending. But the spending that happened outstripped anything resembling a sustainable growth rate.

The next one (click to enlarge) is a little simpler – it just shows that while county government spending (orange) followed the trend line of housing prices (purple) during the boom, the spending line continued onward as prices collapsed in the bust.

Had Loudoun County officials restrained their spending growth to a sustainable level, the newly enacted tax increase likely would not have been necessary.

Of course, the Loudoun County Real Estate blog would like to note that “the Washington D.C. Metro Area is the most promising real estate market in the world” and that “[t]he future of the Washington D.C. area housing market may be brighter than other parts of the country.”

Share this article