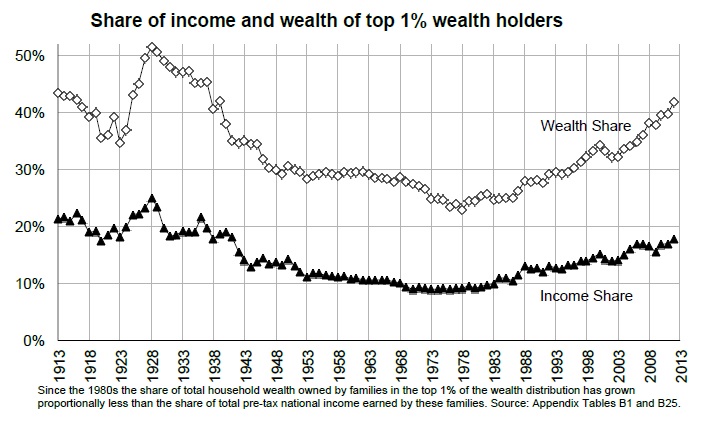

A new paper by French economists Emmanual Saez and Gabriel Zucman discusses a new technique for using taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. returns to estimate top wealth shares. They find that wealth inequality has been increasing such that the top 1 percent now control about 40 percent of all household wealth, as the chart below illustrates.

The authors attribute the rise of wealth inequality to all sorts of evils, including low taxes on the wealthy and financial deregulation. They also buy into the notion that the wealthy enjoy higher rates of return on their wealth, a theory without evidence that Thomas Piketty also has advanced. Like Piketty, Saez and Zucman call for higher, more progressive taxes on wealth, such as estate taxes.

However, the authors fail to mention the role of market volatility, and particularly the role that central banks have in creating volatility. For instance, today the Central Bank of Japan announced a huge monetary stimulus that sent both Japanese and American stock markets to new highs.

To test the role of market volatility alone, I ran an experiment using a simple excel spreadsheet. If you take 100 individuals and give them each a random rate of return every year for 100 years, it turns out that market volatility alone generates a tremendous amount of wealth inequality.

The chart below shows what happens when this random rate of return is in the range of plus or minus 30 percent a year. Lest you think that is unrealistic, the S&P 500 rose 30 percent last year. That sort of volatility eventually generates a situation where the top 1 percent control about 40 percent of all wealth – the same wealth inequality now found in the U.S., according to the French economists.

In contrast, if the range of the random rate of return is reduced to plus or minus 10 percent a year, the top 1 percent wealth share never exceeds 4 percent.

These results are generated strictly by volatility, without assuming any privilege at all. In other words, this is a perfectly egalitarian society in that everyone has the same chance of winning. All it takes is randomly distributed rates of return and property rights, so people get to keep their wealth.

Of course, the French economists’ solution is to take away the property rights, i.e. confiscate the wealth through taxation. However, a much more beneficial approach is to reduce volatility. That means getting the Federal Reserve under control, principally. The Fed's loose and novel policy innovations over the last 15 years or so have almost certainly contributed to inequality, by blowing bubbles in the housing and stock markets. Policy makers should address that problem first, before wrecking the economy with higher tax rates.

Follow William McBride on Twitter

Share this article