Kansas continues to grapple with a years-long budget problem. Since Kansas adopted a problematic pass-through carve-out in 2012, the state has been facing structural issues. Revenues have fallen, officials have missed revenue projections, and general fund expenses have been reduced only slightly.

This year, the legislature took steps to correct the problem by passing HB 2178, which repealed the pass-through carve-out, reinstituted a top marginal income tax bracket, raised the middle-income tax bracket, canceled further automatic reductions, and expanded itemized deductions. Governor Brownback (R), however, vetoed the bill and policymakers fell three votes short of overriding his veto.

Still facing the distortionary pass-through carve-out, policymakers are seeking to raise revenue from another source. One option, HB 2384, which will be heard in the House Taxation Committee next Tuesday, would expand the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. base to some personal services (see below), raising $51 million in 2018. The expansion of the sales tax to services is an important step toward a properly structured taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code. As a rule of public finance, sales taxes should apply to all final retail sales of goods and services, but not intermediate business-to-business transactions in the production chain. This ensures the taxes capture all consumption and tax each dollar once and only once.

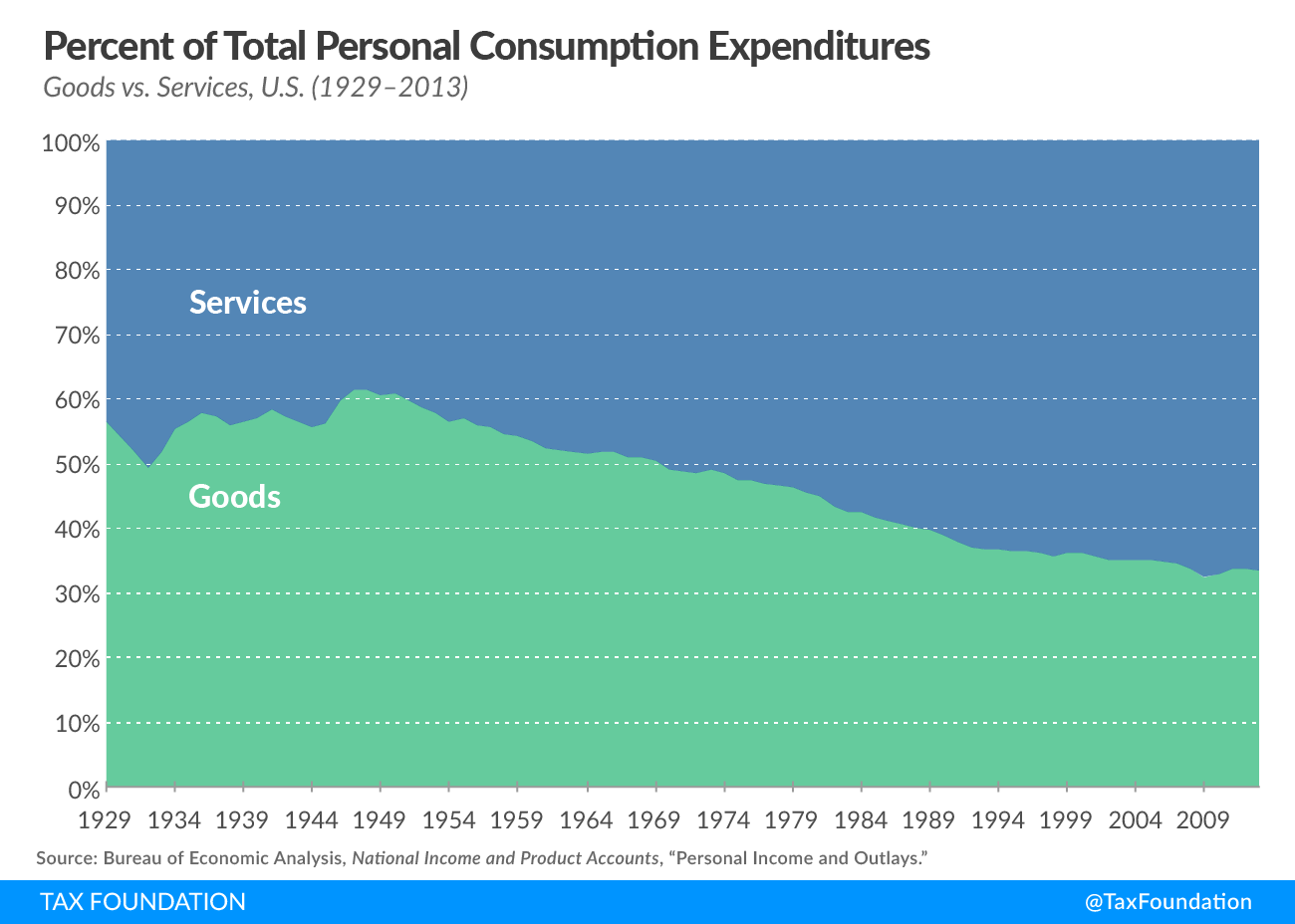

The exemption of services in the tax code is a historical accident, not an intentional policy choice. When Mississippi adopted the country’s first sales tax in 1930, its economy was comprised almost entirely of goods. The economy did not have a formidable service sector, so the sales tax statute did not include services. As other states adopted Mississippi’s sales tax structure, services were broadly exempted in all states.

Below is a list of the services in the expanded sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. in HB 2384:

- Hair styling/cuts/color/etc.

- Manicure/Pedicure

- Other personal care services including hair removal, massage, tanning, tattooing, some spa services that are nonmedical, saunas/baths

- Gym memberships (nonprofit business)

- Dating services

- Towing

- Parking garage/Parking

- Rental of equipment with operator, such as limousine or cab

- Rental of equipment with operator use in construction where labor is taxable

- Digital goods, automated services, remote access software

- Installation of customized computer software

- Detective services

- Security services (monitoring, security guards, etc.)

- Nonresidential cleaning services (Real property)

- Pet care (excludes veterinary services)

Broadening the sales tax base would also improve Kansas’s ranking in our State Business Tax Climate Index, as the sales tax ranking rewards states with systems that tax final consumer goods and services, but exempt business inputs.

Three elements of the bill that might raise skepticism are the inclusion of security services, rental of equipment used in construction, and nonresidential cleaning services, which are arguably purchased primarily by businesses and are necessary for some companies to operate. Including language exempting instances where those services are a business input would be a straightforward way for policymakers to exempt business inputs while still taxing those items when they are consumed by final consumers.

Kansas has fewer options than it did before the governor’s veto of the last tax plan. Expanding the sales tax base to include some services may prove an attractive option for closing the budget gap this session.

Share this article