Full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. for capital investment is being considered in the upcoming fourth round of coronavirus relief legislation. Though we tend to talk about full expensing as a long-run policy with long-run benefits, that does not mean it is meaningless in the short term. In fact, full expensing is good for both the long run and the short run.

Here is why this matters. The tax code contains a temporary “100 percent bonus depreciation” provision, which extends an immediate deduction for certain kinds of capital investments (primarily machinery and equipment and certain interior changes to buildings) but not for other kinds (buildings, structures, factories, etc.). However, it is scheduled to phase out starting in 2023, along with a change that will prevent companies from immediately deducting their research and development expenses. And all the while, investments that do not qualify for the temporary provision must be depreciated over very long schedules.

These factors contribute to a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy landscape that creates uncertainty and bias against investment in addition to the uncertainty generated by the public health crisis and the state of the economy. This is not an ideal situation for a robust economic recovery, which will require businesses to invest in capital and create new jobs to replace those that have disappeared in the recession.

This brings us to the ongoing discussions for phase four relief legislation. Lawmakers are generally discussing policies that fit into two buckets: short-term relief and long-term recovery, with a heavy focus on the former. Short-term relief efforts are designed to provide liquidity to businesses and households that have seen their income, and thus their cash flow, slow or altogether stop because of the halt in economic activity caused by the COVID-19 pandemic. These efforts include provisions such as unemployment insurance, economic recovery payments to individuals, delays in tax payment deadlines, new tax credits, and expanded net operating loss provisions, and are all crucial to help bridge the gap caused by the virus’ impact on the economy.

On the other hand, long-term recovery efforts are more forward-looking, focused on changes that will help clear the path for workers, businesses, and the economy to renew investment and replace lost jobs. While giving all investment full cost recovery through full expensing and neutral cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. primarily falls into the long-term recovery bucket, it would also have a positive effect on the economy now.

According to the Tax Foundation’s General Equilibrium Model, over the long run, making full expensing permanent and extending improved treatment to structures and buildings (27.5- and 39-year assets) using a neutral cost recovery system (NCRS) would increase the long-run level of gross domestic product (GDP) by 5.1 percent. The capital stock would expand by 13 percent, wages by 4.3 percent, and employment by more than 1 million full-time equivalent jobs.

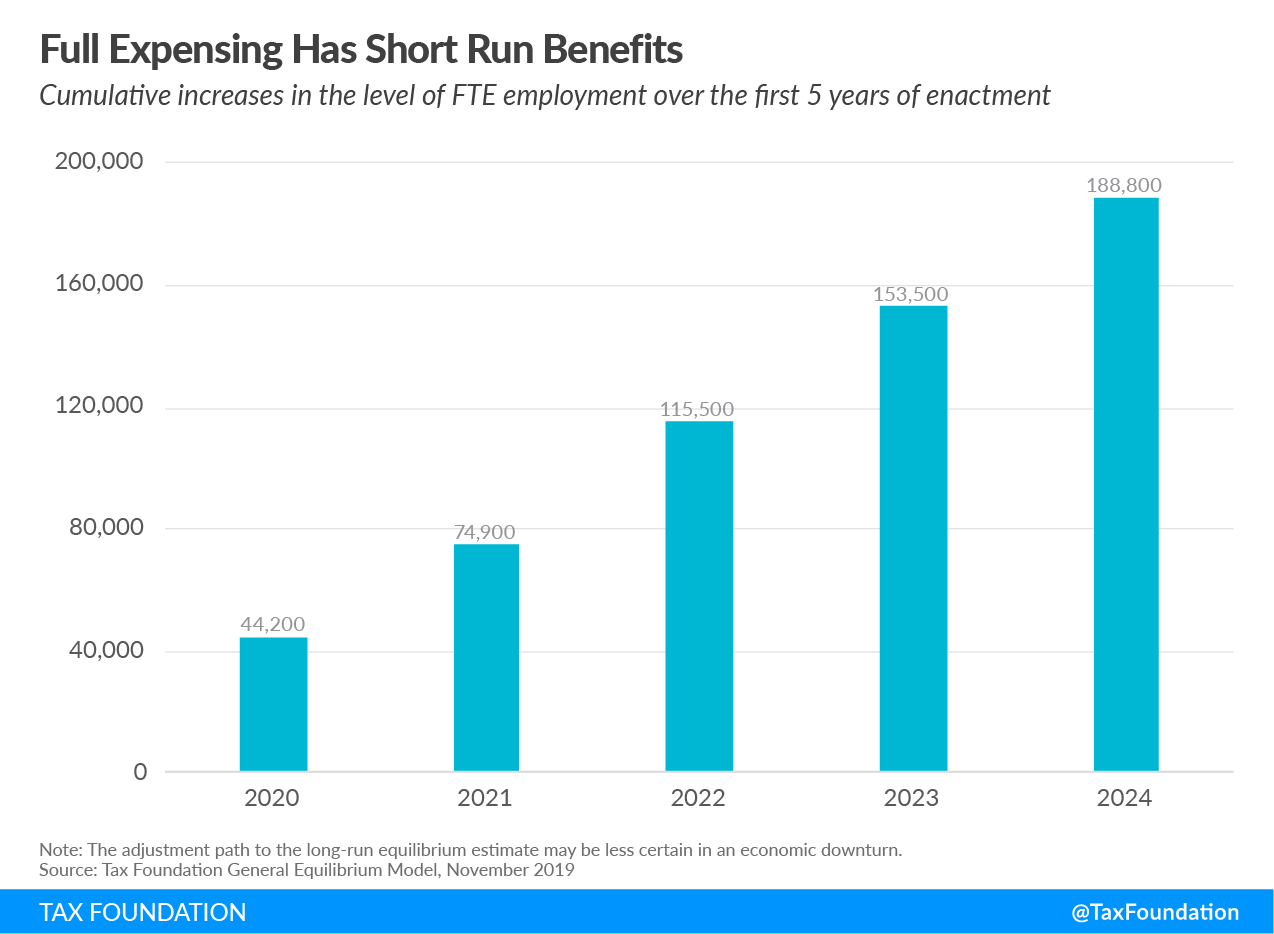

In the first year of enactment alone, we estimate the combination of full expensing and neutral cost recovery would increase full-time equivalent employment by more than 44,000 jobs. The cumulative impact by year five of the policy would be nearly 200,000 new jobs. It is important to note the adjustment path to the long-run equilibrium estimate may be less certain in an economic downturn.

These effects would continue to build up over time to the full long-run effect of more than 1 million jobs, highlighting both the immediate and long-run benefits of better cost recovery treatment.

While it is absolutely true that more short-term relief is still needed to help businesses and individuals weather the ongoing recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. and public health crisis, attention must also be given to strategies that will help the economy recover over the long term. One policy change that would help with the recovery effort is improved cost recovery treatment of capital investment on a permanent basis. Such a change would be good for both the long run and the short run.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe