Stay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

What changed in the global economy that disrupted traditional means of taxation? Is it worth finding a way to include tax digital goods and services in the tax base? Why are digital services taxes so problematic? Are there better options—ways to adapt our current system without introducing complex and economically harmful policies?

2 min read

The U.S. Trade Representative (USTR) expanded its digital service tax investigations, announcing Section 301 investigations into digital tax policies in nine countries and the European Union. The announcement follows an investigation of the French digital services tax that was completed in 2019, after which the USTR threatened significant #tariffs in retaliation against France.

5 min read

Taxes on digital services, digital advertising, and the sale or utilization of consumer data, which were already emerging before the #coronavirus crisis, look increasingly attractive to cash-strapped states and localities.

7 min read

What are the best tax policies to encourage a smooth transition and strong economic recovery? How should goals of economic recovery and growth be balanced with revenue needs?

1 min read

With California’s unemployment rate approaching 25 percent, it is somewhat surprising to find policymakers contemplating a literal tax on jobs.

3 min read

The European Commission announced new budget plans including loans, grants, and some revenue offsets. The proposals follow other support mechanisms for workers and businesses that were designed in response to the Covid-19 pandemic and economic shutdown.

5 min read

Alesina’s work suggests that raising taxes to reduce the federal deficit and national debt would be an economic mistake. The less economically damaging path is to cut spending, what some have called austerity policies.

3 min read

Rather than find ways to restrict net operating loss (NOL) carrybacks, lawmakers should focus on ways to improve liquidity by cashing out accrued NOLs, which would benefit startups and new small businesses without taxable income to offset in prior years.

3 min read

To prevent confusion and to ensure taxpayers receive the full benefit of the extended federal deadline, states should consider extending first- and second-quarter estimated tax payment due dates to July 15 or later.

9 min read

While other states are starting to think about the recovery, California is contemplating tax policies that would stand in the way of economic expansion once the health crisis abates. California’s shortfall is all too real, but tax policies which impede recovery are a hindrance, not a help.

5 min readThe HEROES Act adds to the confusion and instability already inherent in the tax code with multiple expiring provisions and reduced filing guidelines.

4 min read

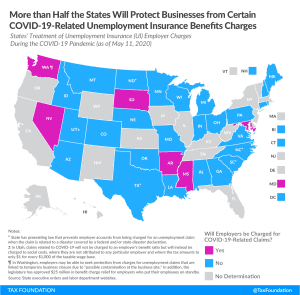

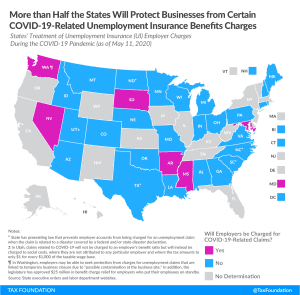

Lawmakers can help expedite their state’s economic recovery by protecting employers from facing higher unemployment insurance tax rates at a time when they can least afford to pay them.

8 min read

The HEROES Act would make notable expansions to all three dependent-related credits, increasing maximum credit amounts, refundability, and income eligibility phaseouts. Practically, this means that certain filers could expect to receive a larger refund for each additional hour of work, eligible dependent, and dependent care expenses if the bill became law.

5 min read

The SMART Act, sponsored by Senators Bob Menendez and Bill Cassidy and Rep. Mikie Sherrill, would provide $500 billion in flexible funding to state and local governments.

6 min read

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

The Tax Foundation’s General Equilibrium Model suggests that allowing businesses to immediately deduct or “expense” their capital investments in the year in which they are purchased delivers the biggest bang for the buck in spurring economic growth and jobs compared to other tax policies.

7 min read

State recovery plans should lessen the burden on businesses by shifting from capital stock taxes and other taxes that are charged regardless of profitability. Louisiana does well to target its Corporation Franchise Tax, a burdensome tax that would target businesses that may already be struggling.

2 min read

The HEROES Act, the $3 trillion relief package proposed by House Democrats, is the first bid to provide additional phase 4 aid for businesses and individuals amid the coronavirus pandemic.

7 min read