Blog Articles

Lawmakers May Vote on Making Key Provisions of the TCJA Permanent

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

Gross Receipts Taxes in the Marijuana Industry Found to Cause Distortionary Effects

States considering legalizing and taxing marijuana should pay attention to natural experiments occurring in states across the country.

4 min read

Governor Dayton’s Budget Proposal: Some Pro-Growth Provisions, but Misses the Mark on Others

The proposal includes some good reforms, including conforming to the federal full expensing provision, but also rolls back some recent positive changes.

2 min read

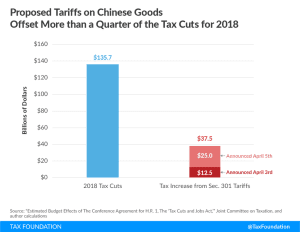

Proposed Chinese Tariffs Will Raise Taxes Following a Large Tax Cut

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read

Inversions under the New Tax Law

The Tax Cuts and Jobs Act was meant to boost growth and deter corporate inversions. What does it mean that an Ohio company is still moving its HQ to the UK?

5 min read

Lessons from the 2002 Bush Steel Tariffs

3 min read

Correct Decision to Exempt Canada and Mexico Assures that New Tariffs Won’t Work as Planned

President Trump’s plan to impose tariffs on all steel and aluminum imports–except those from Mexico and Canada–will not work as the administration hopes. It will increase costs for businesses and raise prices for consumers.

3 min read