Blog Articles

Senator Van Hollen Introduces Proposal to Raise Taxes on High-Income Households

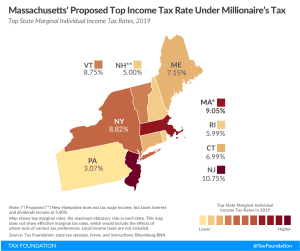

Van Hollen’s proposals add to the long list of Democratic Party tax proposals that attempt to both raise additional revenue from corporations and high-income households and make the tax code more progressive and “equitable.”

3 min read

The Regressivity of Deductions

3 min read

The Economics Behind Thin-Cap Rules

6 min read

How Controlled Foreign Corporation Rules Look Around the World: United States of America

The United States was the first country to enact CFC rules, and it is probably the country with the most complex set of rules that will be presented in this blog series. The rules determine control using a combined ownership test: one for the corporation and the other at the shareholder level. The assessable income under the rules is generally passive income but the amount of foreign income subject to U.S. tax has expanded with the adoption of GILTI.

10 min read

How Patent Boxes Impact Business Decisions

As with every change in tax policy, there are trade-offs. The Modified Nexus Approach adds an additional layer of complexity to the already complex issue of taxing IP income. Linking tax breaks for IP income to its associated R&D activity has changed the game and will likely result in some businesses restructuring and relocating their IP assets and R&D activity. Effective tax rates on IP income will likely play an important role in determining optimal locations, giving measures such as R&D credits more importance. Whether this new approach to IP taxation will impact profit shifting and which countries will be the winners and losers is yet to be seen.

6 min read

CFC Rules Around the World

Our paper undertakes a review of controlled foreign corporation (CFC) rules around the world as a contribution to the global discussion over the possible expansion of existing anti-base erosion CFC regimes or the potential adoption of a minimum tax.

3 min read

In Defense of the “Church Parking Tax”

2 min read

Ripple Effects from Controlled Foreign Corporation Rules

Governments should recognize these trade-offs as they implement controlled foreign corporation (CFC) rules or change their tax policies in ways that increase taxes on foreign subsidiaries.

7 min read