The Arkansas TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Reform and Relief Task Force concluded its work earlier this month, referring several tax changes to the General Assembly for its consideration in January when the legislative session begins. Amidst the flurry of activity, it’s difficult for everyday Arkansans to know how these tax reforms will impact their budget and their tax bills.

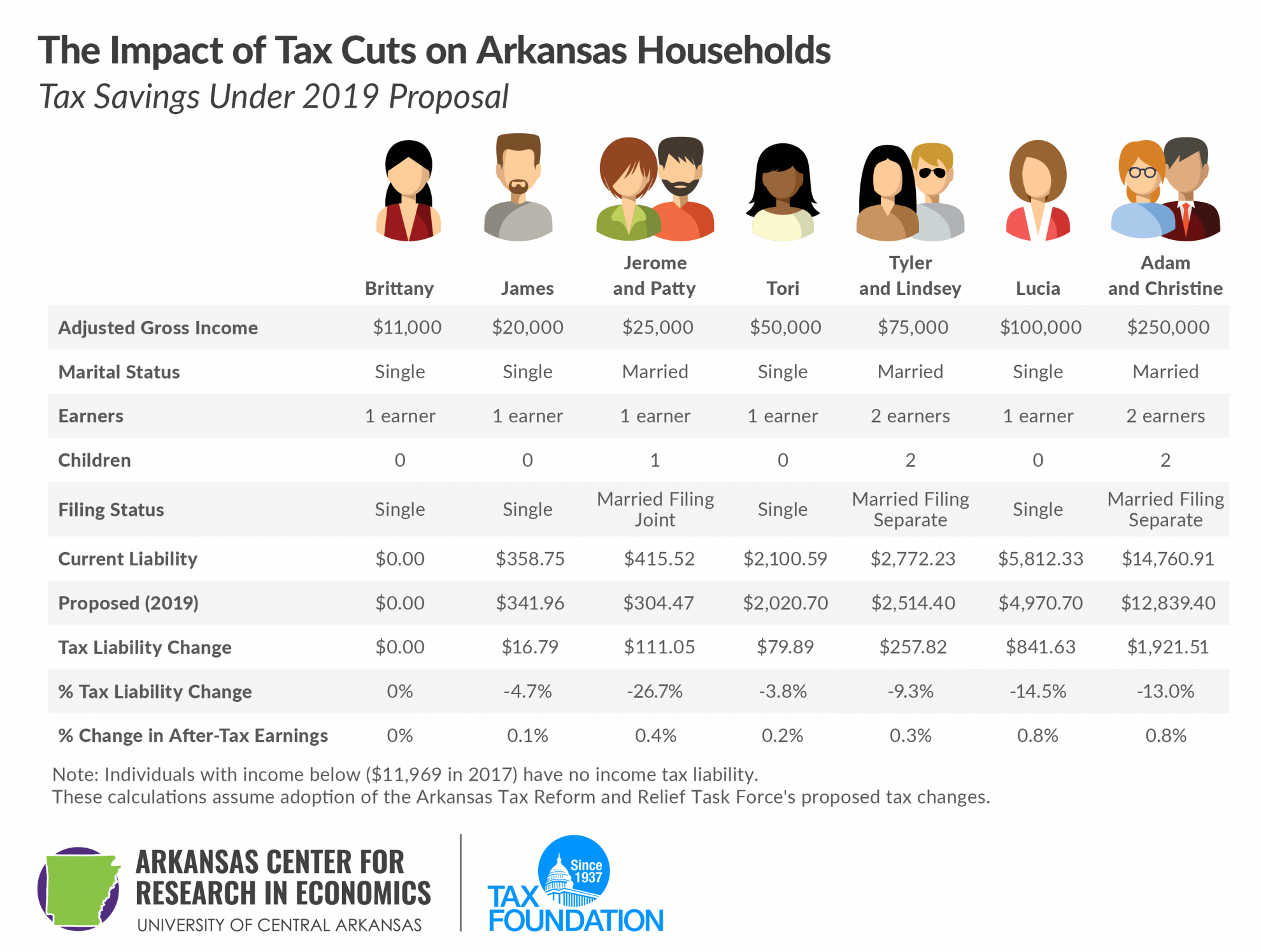

We have constructed seven sample taxpayers in Arkansas, using a combination of family sizes, income levels, and filing status to illustrate how the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. changes in the task force’s recommendations, known as the “2/4/5.9% Plan,” impact Arkansas families. These changes do not include the impact of any other tax changes, such as the business-side changes or any accelerated economic growth that could be spurred by the plan.

As the illustrations above show, individuals at a variety of income levels would see tax cuts due to the proposed changes. However, those tax cuts appear to be skewed towards higher-income individuals. The sample taxpayers with incomes in excess of $100,000 receive the tax cut change when comparing total tax liability change, percent of tax liability change, and change in after-tax earnings.

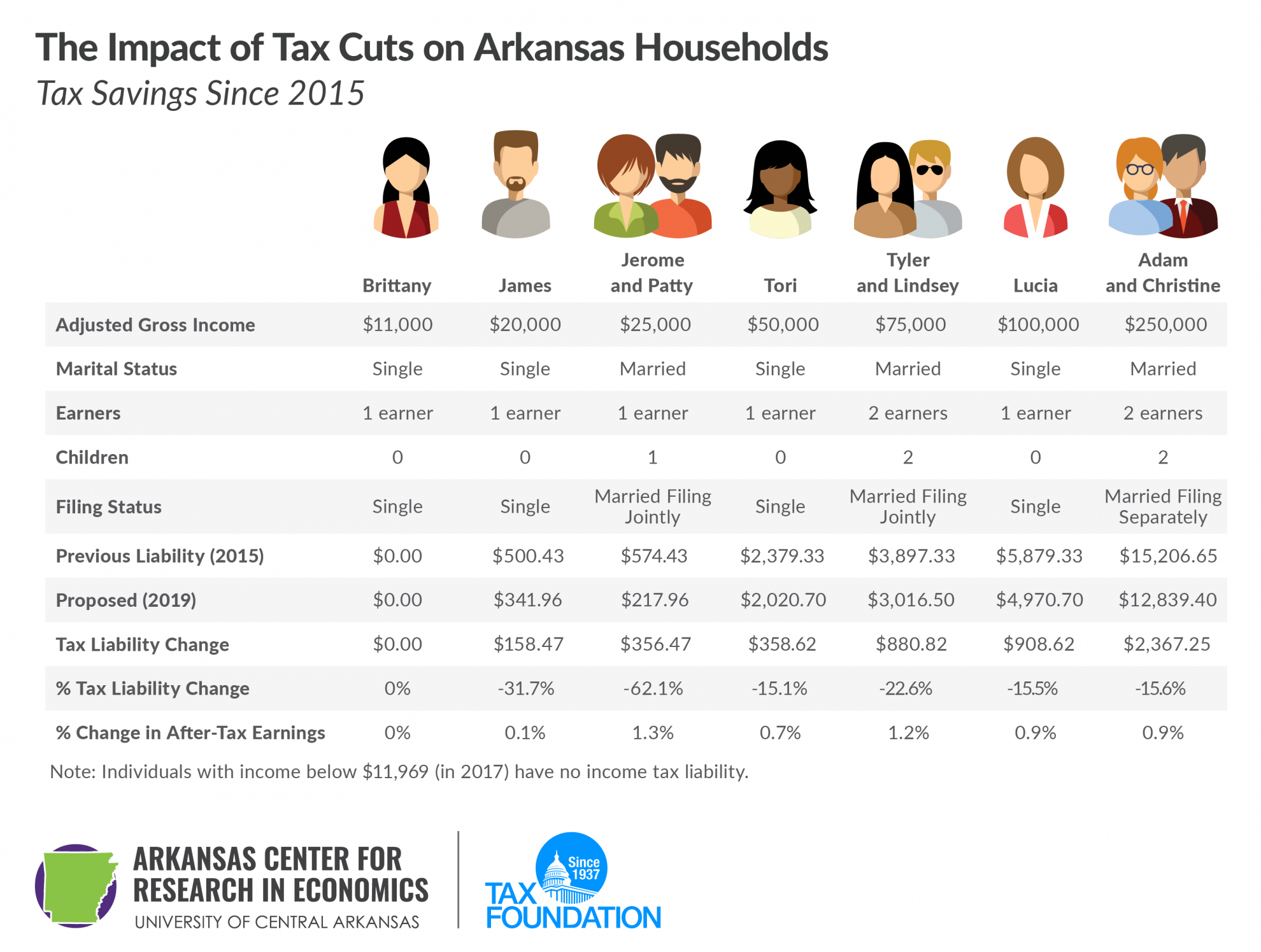

But this doesn’t show the entire picture. Arkansas has implemented individual income tax cuts in three distinct phases. First, in 2015, it passed tax cuts for individuals with incomes between $21,000 and $75,000. Second, in 2017, it passed tax cuts for individuals with incomes below $21,000. (Single individuals with income below $11,969 have no income tax liability due to Arkansas’s low-income tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. first adopted in 1991 and expanded in 2007.) So, this final plan brings those with incomes above $75,000 closer to the cuts already passed in 2015 and 2017, and returns Arkansas to a single set of tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. as it had in 2015. (Since then there have been three sets of brackets.) To better illustrate that, we have calculated tax cuts for the same sample taxpayers for all the individual income tax cuts since 2015. Here, things look more proportional as a percent of after-tax earnings.

Since 2015, all filers, except for Brittany (whose tax liability has always been $0), received a tax cut, with the largest tax cut going to Jerome and Patty, who had an income of $25,000. Adam and Christine received the largest tax cut in total dollars, $2,367.25, but that is because their income is the largest. Instead, it is better to compare the tax cuts based on a percentage of tax liability or income. Jerome and Patty saw a tax savings of 62.1 percent, or 1.3 percent of their income. For comparison, Adam and Christine saw a tax cut of 15.6 percent of their tax liability, or 0.9 percent of their income. Jerome and Patty saw a much larger tax cut proportionally.

Calculation Assumptions

For our calculations, we used the Arkansas tax system as it exists on both January 1, 2015 and January 1, 2019. For the 2019 calculations, these are after the scheduled phase-in of the low-income tax changes effective on January 1. We assumed all filers used the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. , for simplicity and comparisons, and we did account for the more than tripled standard deduction under the “2/4/5.9% Plan.” These calculations assume the rate structure under the “2/4/5.9 Plan” when it’s fully phased in. The task force is currently debating how quickly to phase in the marginal rate changes under the plan.

These calculations do not include any other tax changes, such as taxing online transactions under a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , other sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. changes, or any business-side changes.

Erratum: An earlier version of this post included an error in the tax calculations. The post has been revised and republished.