Excise Taxes and Fees on Wireless Services Increased 8.8 Percent in 2024

Wireless taxes and fees set a new record high in 2024.

23 min read

Wireless taxes and fees set a new record high in 2024.

23 min read

To alleviate the regressive impact on wireless consumers, states should examine their existing communications tax structures and consider policies that transition their tax systems away from narrowly based wireless taxes and toward broad-based tax sources.

18 min read

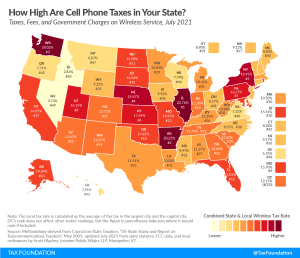

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read

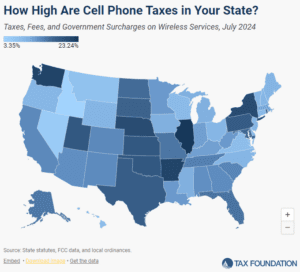

Taxes and fees on the typical American wireless consumer increased again this year, to a record 24.96 percent.

32 min read

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

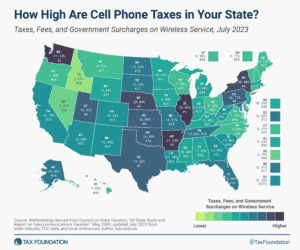

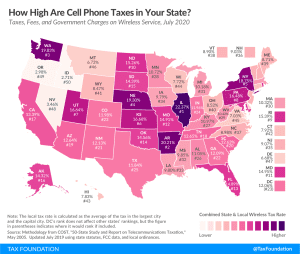

Wireless taxes, fees, and surcharges make up over 20% of the average customer’s bill–the highest rate ever. Illinois has the highest wireless taxes in the country at over 30%, followed by Washington, Nebraska, New York, and Utah. How high are cell phone taxes in your state?

36 min read

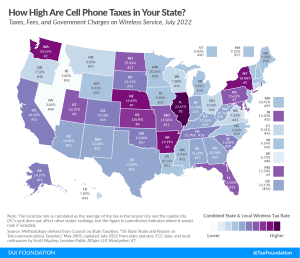

A typical family with four cell phones paying $100 per month for service can expect to pay about $229 per year in wireless taxes, fees, and surcharges. Nationally, these impositions make up about 19.1 percent of the average customer’s cell phone bill.

35 min read

A typical American household with four wireless phones paying $100 per month for wireless voice service can expect to pay about $221 per year in wireless taxes, fees, and surcharges.

34 min read