Nicole Kaeding was Vice President of Federal and Special Projects at the Tax Foundation, where she researched federal and state tax issues. Her analysis has been featured in The New York Times, The Wall Street Journal, The Washington Post, National Public Radio, and numerous other national, state, and local publications.

Nicole has testified or presented to officials in 17 states and has testified before Congress.

Previously, Nicole was a budget analyst for the Cato Institute focused on federal and state fiscal policy, and the state policy manager for Americans for Prosperity Foundation where she oversaw the policy activities of AFPF’s 34 state chapters. Prior to working in public policy, Nicole managed retail banking locations for seven years in Indiana and Illinois.

She graduated from DePaul University with a master’s degree in Economics and Policy Analysis, and completed her undergraduate studies at Miami University majoring in Finance and Political Science.

Nicole lives in Arlington, Virginia with her husband and two children.

Latest Work

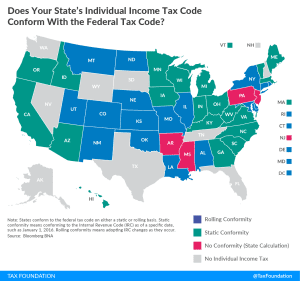

Does Your State’s Individual Income Tax Code Conform with the Federal Tax Code?

As the federal government continues to debate tax reform, states, and many taxpayers, are asking an important question: How is my state’s tax code impacted? The exact impacts won’t be known until the federal bill is finalized, but a good place to start is understanding the issue of conformity.

2 min read

Property Taxes in Arkansas

As Arkansas considers tax reform, expanding or increasing the state’s property tax, if used to finance other tax changes, would be worth exploring.

7 min read

JCT’s Dynamic Score is Positive But Underestimates Economic Benefits

The Joint Committee on Taxation (JCT) dynamic scoring estimate of the Senate’s Tax Cuts and Jobs Act confirms that tax changes impact economic growth. While JCT’s estimates are positive, there is reason to believe that the tax plan would produce even greater dynamic effects than its analysis shows.

3 min read

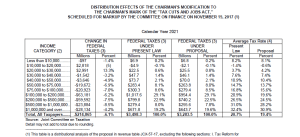

Understanding JCT’s New Distributional Tables for the Senate’s Tax Cuts and Jobs Act

Much attention is being paid to distributional tables released by JCT on the Senate’s Tax Cuts and Jobs Act, but their results don’t quite seem to show what some are suggesting. While the results appears to show a tax increase for some lower-income filers, this is due to the unique nature of the individual mandate and the premium tax credits available under the Affordable Care Act.

2 min read

The House Takes a Big Step Forward on Tax Reform

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

Overview of the Senate’s Amendment to the Tax Cuts and Jobs Act

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read

The Senate Tax Cuts and Jobs Act: The Impacts of Jobs and Incomes by State

See the state-by-state impact of the Senate Tax Cuts and Jobs Act for both new jobs and the boost to after-tax incomes for middle-income families.

2 min read

Small Pass-Through Businesses Would See Some Benefits Under the House Tax Cuts and Jobs Act

Even with large changes, many in the pass-through community are arguing that small pass-throughs don’t benefit since most or all of their taxable income falls below the 25 percent maximum rate. While correct on the small point, advocates miss the greater tax reform picture. Small pass-through businesses would still benefit from a number of other changes.

2 min read

Sales Tax Base Broadening: Right-Sizing a State Sales Tax

Due in part to historical accident and also to the proliferation of exemptions, the effectiveness of the state sales tax continues to erode. The median state sales tax, which should apply to all personal consumption, is nonly applied to 23 percent of personal consumption.

25 min read

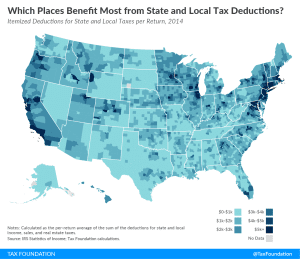

Eliminating the SALT Deduction Under the “Big Six” Tax Plan

The state and local tax deduction favors high-income individuals in high-tax states. Six states—California, New York, New Jersey, Illinois, Texas, and Pennsylvania—claim more than half of the value of the deduction.

2 min read