Nicole Kaeding was Vice President of Federal and Special Projects at the Tax Foundation, where she researched federal and state tax issues. Her analysis has been featured in The New York Times, The Wall Street Journal, The Washington Post, National Public Radio, and numerous other national, state, and local publications.

Nicole has testified or presented to officials in 17 states and has testified before Congress.

Previously, Nicole was a budget analyst for the Cato Institute focused on federal and state fiscal policy, and the state policy manager for Americans for Prosperity Foundation where she oversaw the policy activities of AFPF’s 34 state chapters. Prior to working in public policy, Nicole managed retail banking locations for seven years in Indiana and Illinois.

She graduated from DePaul University with a master’s degree in Economics and Policy Analysis, and completed her undergraduate studies at Miami University majoring in Finance and Political Science.

Nicole lives in Arlington, Virginia with her husband and two children.

Latest Work

Stock Buybacks Don’t Hinder Investment Spending

Stock buybacks transfer capital from old established firms to new and innovative ones that need capital to meet their potential.

2 min read

The OECD Highlights the Economic Growth Benefits of Full Expensing

The Organisation for Economic Co-operation and Development (OECD) praised a measure in the Tax Cuts and Jobs Act (TCJA) passed last December.

2 min read

Taxing Patreon Contributions

4 min read

Help from Our Friends: What States Can Learn from Tax Reform Experiences across the Country

Important lessons can be learned from other state experiences with tax reform. While Kansas teaches us what not to do, Utah, Indiana, North Carolina, and the District of Columbia illustrate that smart, sensible tax reform is possible.

28 min read

Missing Some Context on Stock Buybacks

Stock buybacks made since the enactment of the Tax Cuts and Jobs Act doesn’t mean that workers won’t ultimately benefit through higher wages.

2 min read

Reforming Arkansas’s Income Taxes

1 min read

States Explore Taxing Carried Interest

3 min read

Oregon’s Chance to Limit a Flaw in the Federal Tax Code

Senator Hass’s proposal to limit the special pass-through deduction in Oregon is the right choice, protecting the state’s budget, while advancing sound tax policy.

3 min read

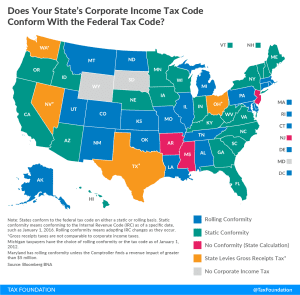

Does Your State’s Corporate Income Tax Code Conform with the Federal Tax Code?

Whether your state’s corporate income tax code conforms to the federal corporate income tax code matters a great deal for how the Tax Cuts and Jobs Act will impact revenue in your state.

2 min read

The Tax Cuts and Jobs Act: The Impacts of Jobs and Incomes by State

Overall, the Tax Cuts and Jobs Act is projected to add 339,000 new jobs to the U.S. economy and boost average after-tax incomes for middle-income families by $649.43. Here’s how jobs and after-tax wages will be impacted in your state.

2 min read

Prepaying SALT isn’t an Option

As the Tax Cuts and Jobs Act seeks to simplify the tax code, a last-minute provision closed a potential new tax-planning strategy germinating before the bill even passed.

2 min read