Morgan was a Policy Analyst with the Center for State Tax Policy at the Tax Foundation where she researched tax trends across the country. Morgan also managed the chartbook and weekly map programs for the state team. Her research has been featured in national and state-based publications, including the Associated Press, Bloomberg BNA, CNN Money, Fox Business, NPR, and the Washington Post. She has testified or presented to officials in four states: Kentucky, Maine, Minnesota, and Ohio.

Latest Work

Multiple Tax Proposals in Minnesota

4 min read

Facts & Figures 2017: How Does Your State Compare?

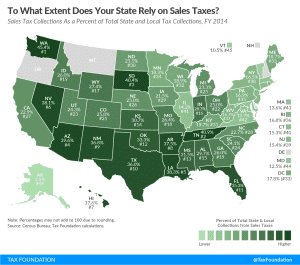

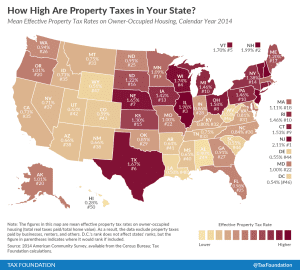

How do taxes in your state compare nationally? This convenient resource compares the 50 states on many different measures of taxing and spending, including individual and corporate income tax rates, business tax climates, excise taxes, tax burdens and state spending.

1 min read

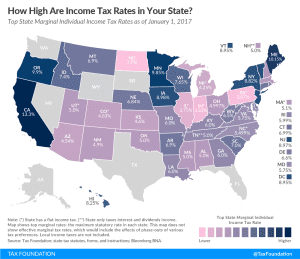

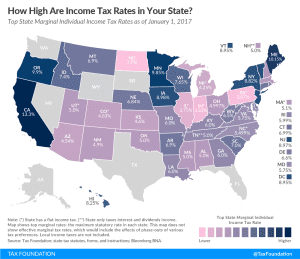

State Individual Income Tax Rates and Brackets, 2017

There’s a lot of variance in how states levy the individual income tax. In our newest study, we provide the most up-to-date data available on state individual income tax rates, brackets, standard deductions, and personal exemptions for both single and joint filers.

4 min read

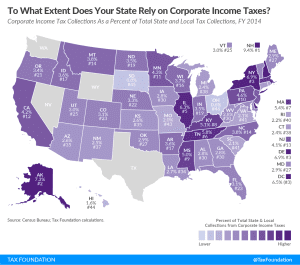

State Corporate Income Tax Rates and Brackets, 2017

Corporate income taxes are levied in 44 states. Though often thought of as a major tax type, corporate income taxes account for just 5.4 percent of state tax collections and 2.7 percent of state general revenue. Here’s how corporate income taxes compare across the states.

6 min read