Boost Semiconductor Manufacturing by Removing Tax Barriers—Not Creating Tax Subsidies

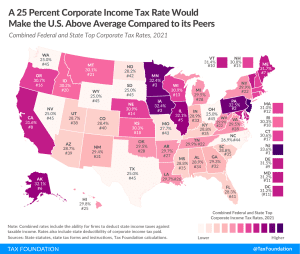

A bipartisan group of Senators introduced a bill to create a permanent 25 percent tax credit for investments in semiconductor manufacturing equipment and construction of related facilities—but their proposal would not address underlying bias against investment that exists in the tax code today.

3 min read