Erica York is Senior Economist and Research Director with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

Latest Work

Lessons from the 2002 Bush Steel Tariffs

3 min read

President Trump Announces Two Steep Tariffs on Steel and Aluminum

President Trump’s new tariffs on steel and aluminum will have negative consequences for downstream manufacturing companies, consumers, and other sectors in the economy.

4 min read

Sources of Personal Income, Tax Year 2015

Taxpayers reported $10.4 trillion of total income on their 2015 tax returns. This report breaks down the sources of this income: wages and salaries, business income, investment income, and retirement income.

9 min read

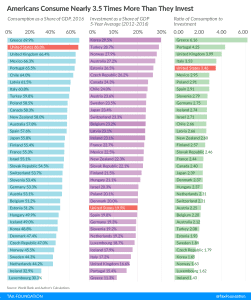

Americans Consume Much More than They Invest

Recent data show that Americans stand out for consuming much more than they invest, and this is due in part to the tax code’s bias against savings.

3 min read

Reviewing the Credit Union Tax Exemption

2 min read

President Trump Approves Tariffs on Washing Machines and Solar Cells

Tariffs on washing machines and solar cells, though designed to help U.S. manufacturing and protect consumers, will likely raise prices and distort markets.

3 min read

Other Federal Tax Changes in the New Year

Though the focus has been on the Tax Cuts and Jobs Act, there are other federal changes that took place on January 1, 2018 which are also worth reviewing.

3 min read

Retirement Savings Left Largely Untouched by Tax Reform

While rumors flew around Washington in the fall that the Tax Cuts and Jobs Act would dramatically impact retirement savings accounts, the plan has made only a few minor modifications.

3 min read

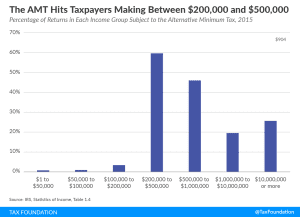

Under Conference Agreement, Fewer Households Would Face the Alternative Minimum Tax

The Tax Cuts and Jobs Act will temporarily reduce alternative minimum tax liability, but retain the complexity inherent to the tax.

4 min read