Erica York is Vice President of Federal Tax Policy with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

Latest Work

Reviewing Elizabeth Warren’s Tax Proposals to Fund Medicare for All

Elizabeth Warren released a detailed plan on how she would fund Medicare For All, proposing a wealth tax, financial transactions tax, mark-to-market taxation of capital gains income, and a country-by-county minimum tax, among other reforms.

5 min read

Retail Glitch Awaits Congressional Fix

2 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

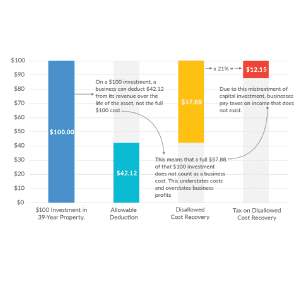

Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

While tax rates matter to businesses, so too does the measure of income to which those tax rates apply. The corporate income tax is a tax on profits, normally defined as revenue minus costs. However, under the current tax code, businesses are unable to deduct the full cost of certain expenses—their capital investments—meaning the tax code is not neutral and actually increases the cost of investment.

3 min read

Taxes on Capital Income Are More Than Just the Corporate Income Tax

The United States’ statutory corporate income tax rate is now more aligned with the rates of other nations . However, taxes on capital income, or corporate investment, are more than just the corporate income tax. Shareholder-level taxes, such as those on dividends and capital gains, also affect incentives to save and invest.

3 min read

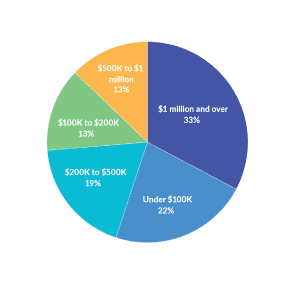

Pass-Through Businesses Q&A

Pass-through businesses are the dominant business structure in America. Pass throughs file more tax returns and report more business income than C corporations. Pass-through businesses are not subject to the corporate income tax, but instead report their income on the individual income tax returns of owners. This blog will address some frequently asked questions about pass-through structure and taxation.

4 min read

An Overview of Capital Gains Taxes

Capital gains taxes create a burden on saving because they are an additional layer of taxes on a given dollar of income. The capital gains tax rate cannot be directly compared to individual income tax rates, because the additional layers of tax that apply to capital gains income must also be part of the discussion.

14 min read

The First Filing Season under the TCJA

3 min read

Putting A Face On America’s Tax Returns: Summary

Who really bears the burden of federal taxes? How progressive is our current tax system and what role do taxes play in the debate over income inequality?

5 min read

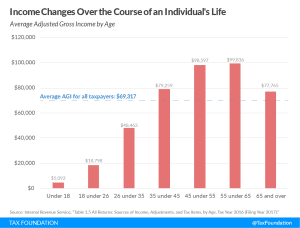

Average Income Tends to Rise with Age

Average income tends to rise dramatically as someone ages and gains education and experience. Viewing just one year of income tax data without digging any deeper misses some crucial context.

2 min read