Erica York is Vice President of Federal Tax Policy with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

Latest Work

Reviewing the Tax Changes in Senator Bennet’s Real Deal

The “Real Deal” would increase the tax burden on saving, investing, and working in the United States, and reduce the global competitiveness of the U.S. economy.

3 min read

Economic and Budgetary Impact of Extending Full Expensing to Structures

Full expensing is one of the most powerful pro-growth policies in terms of revenue forgone. Given that structures comprise a large share of the private capital stock, improving their tax treatment would end a large bias against investment in the tax code.

14 min readGILTI and Other Conformity Issues Still Loom for States in 2020

Even two years after enactment of the federal Tax Cuts and Jobs Act (TCJA), many states have yet to issue guidance explaining how they conform to key provisions of the law, particularly those pertaining to international income.

27 min read

Lawmakers Agree to Let Extenders Live On

2 min read

Expensing Provisions Should Not Favor Physical Over Human Capital

Investments in worker training and education can increase productivity and economic output as growth in human capital accumulates, though the time horizon for these effects is longer than that of physical capital accumulation.

3 min read

Understanding Why Full Expensing Matters

Understanding the channel through which a tax policy change is expected to affect the economy is crucial. Absent this understanding, we are likely to reach the wrong conclusions on what sound tax policy looks like and what changes would improve the tax code.

4 min read

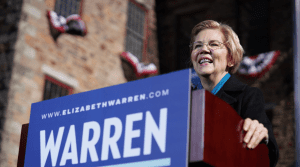

Illustrating Senator Warren’s Taxes on Capital Income

Taken together, these proposed tax changes would significantly raise marginal and effective tax rates and increase the cost of capital, all of which would lead to a reduced level of output and less revenue than anticipated.

5 min read

Reviewing Elizabeth Warren’s Tax Proposals to Fund Medicare for All

Elizabeth Warren released a detailed plan on how she would fund Medicare For All, proposing a wealth tax, financial transactions tax, mark-to-market taxation of capital gains income, and a country-by-county minimum tax, among other reforms.

5 min read

Retail Glitch Awaits Congressional Fix

2 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read