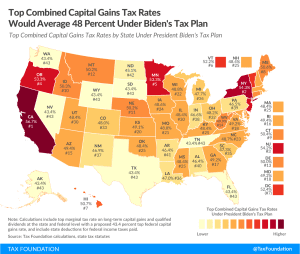

Reviewing Options to Raise Tax Revenue and the Trade-offs for Economic Growth and Progressivity

There’s a useful contrast between two revenue options related to President Biden’s infrastructure push. The president’s American Jobs Plan includes a proposal to raise the corporate tax rate to 28 percent. Meanwhile, historically, the gas tax is the main revenue source for transportation funding.

8 min read