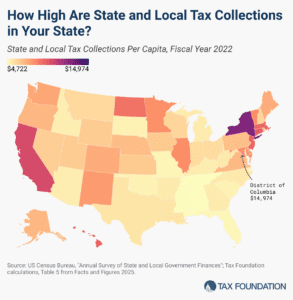

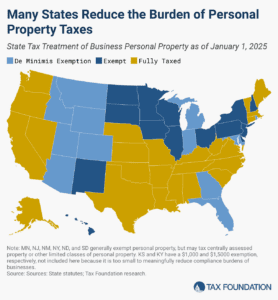

“One Big Beautiful Bill Act” Tax Policies: Details and Analysis

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read