The Wayfair Sales Tax Ruling, Five Years Later

It’s the 5th anniversary of the groundbreaking Wayfair Supreme Court decision–a ruling that marked a new era of sales tax collection and changed how we think about taxation in the digital age.

It’s the 5th anniversary of the groundbreaking Wayfair Supreme Court decision–a ruling that marked a new era of sales tax collection and changed how we think about taxation in the digital age.

The logic that has prevailed for local sales taxes should apply equally to other taxes that localities impose on multijurisdictional businesses, including local tourism taxes. The evidence is clear that central administration of local taxes reduces compliance costs without sacrificing local revenue.

15 min read

Thirteen states have notable tax changes taking effect on July 1, 2021, which is the first day of fiscal year (FY) 2022 for every state except Alabama, Michigan, New York, and Texas. Individual and corporate income tax changes usually take effect at the beginning of the calendar year for the sake of maintaining policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.

11 min read

A landmark comparison of corporate tax costs in all 50 states, Location Matters provides a comprehensive calculation of real-world tax burdens, going beyond headline rates to demonstrate how tax codes impact businesses and offering policymakers a road map to improvement.

8 min read

After three years of deliberations, more than two-thirds of members in both the Senate and the House enacted tax reform and relief legislation Monday over the veto of Gov. Laura Kelly (D).

4 min read

Kansas has the revenue cushion it needs to provide tax relief to individuals and businesses and improve the structure of its tax code in the process. These pro-growth reforms would not only help taxpayers amid the pandemic but would also promote economic recovery and growth in a state that is lagging behind its competitors.

7 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

By failing to keep pace with modern consumption patterns, sales taxes have become less neutral, less equitable, and less economically efficient over time.

16 min read

Two states—Florida and Missouri—have held back on online sales taxes thus far following the landmark 2018 Supreme Court case, South Dakota v. Wayfair. Now, lawmakers in both states have filed bills to address the issue this session.

4 min read

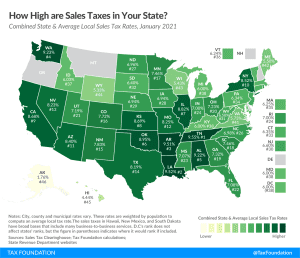

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

Twenty-six states and the District of Columbia had notable tax changes take effect on January 1, 2021. Because most states’ legislative sessions were cut short in 2020 due to the COVID-19 pandemic, fewer tax changes were adopted in 2020 than in a typical year.

24 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

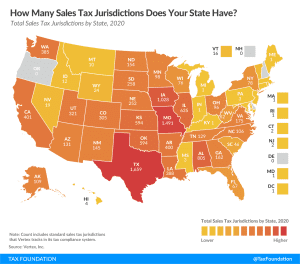

Following the Wayfair decision, states’ move to tax online sales has increased the importance of simplicity in sales tax systems, as sellers now have to deal with differing regulations in multiple states. There are over 11,000 standard sales tax jurisdictions in the United States in 2020

2 min read

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read