Results of 2020 State and Local Tax Ballot Measures

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

12 min read

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

Election Day 2019 will feature notable tax-related ballot measures in California, Colorado, New Mexico, Pennsylvania, Texas, and Washington. Once the polls close tonight, beginning with Pennsylvania and Texas at 8 PM EST, we will begin tracking the results as they come in.

4 min read

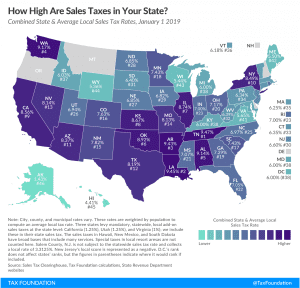

Sales taxes are levied in over 11,000 jurisdictions across the United States. In many cases, these local sales taxes can have a profound impact on the total rate that consumers pay.

12 min read

The role of competition in setting sales tax rates is often overlooked. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant.

13 min read

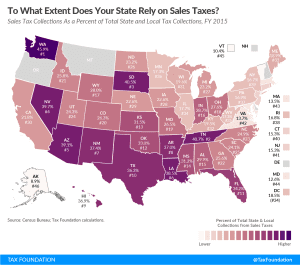

Sales taxes represent a major source of state and local revenue. Click to see how much your state relies on sales taxes and for a state-by-state comparison.

3 min readThe U.S. Supreme Court is hearing a case on the constitutionality of a South Dakota law requiring internet vendors collect online sales tax, but should Congress fix the problem first?

13 min read

In the South Dakota v. Wayfair online sales tax case, the U.S. Supreme Court should ensure that state sales tax laws don’t burden interstate commerce.

3 min read

In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate.

11 min read

The U.S. Supreme Court has agreed to take South Dakota v. Wayfair Inc., which could result in a ruling that settles the years-long debate over how to apply sales taxes to online retail activity.

1 min read

Due in part to historical accident and also to the proliferation of exemptions, the effectiveness of the state sales tax continues to erode. The median state sales tax, which should apply to all personal consumption, is nonly applied to 23 percent of personal consumption.

25 min read

Retail sales taxes are one of the more transparent ways to collect tax revenue. While graduated income tax rates and brackets are complex and confusing to many taxpayers, sales taxes are easier to understand; consumers can see their tax burden printed directly on their receipts.

11 min read