All Related Articles

Georgia Income Tax Reform Would Improve Standing Among Neighbors, Country

In a time of increased mobility and tax competition, a lower rate and simpler tax structure would help Georgia stand out among states. Lawmakers would be wise to consider reforming the state’s income tax to improve the state’s competitiveness.

3 min read

10 Tax Reforms for Growth and Opportunity

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

The Child Tax Credit Score

The expanded Child Tax Credit from the American Rescue Plan was touted as a once-in-a-lifetime achievement toward reducing child poverty. But it was passed as a temporary tax measure. Temporary tax policy makes tax filing confusing, and the IRS has shown that it isn’t able to keep pace with being a social administrator and a tax collector. We discuss what taxpayers need to know about the ever-changing Child Tax Credit and how it may impact taxpayers this spring.

Tax Season’s Greetings

The 2022 tax filing season is about to begin. With expected delays, pandemic-related troubles, and a backlog of over 8 million unprocessed returns from the 2021 tax filing season, Garrett Watson joins Jesse Solis to discuss what all these troubles will mean for taxpayers in what is shaping up to be a chaotic spring.

What the U.S. Can Learn from the Adoption (and Repeal) of Wealth Taxes in the OECD

Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

3 min read

Bumpy Tax Filing Season Ahead Due to IRS Backlog and Pandemic Tax Relief

The National Taxpayer Advocate argued the IRS telephone service “was the worst it has ever been” in 2021, with an answer rate of about 11 percent.

4 min read

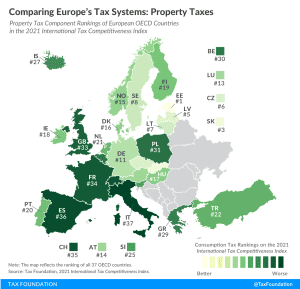

Comparing Europe’s Tax Systems: Property Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

Traveling for the Holidays? States Would Like the Gift of Taxes

In most states, you don’t have to visit for long before you start accruing tax liability.

5 min read

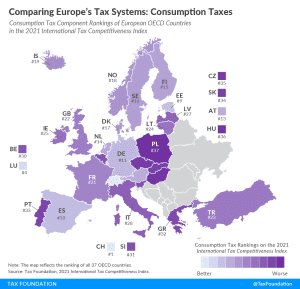

Comparing Europe’s Tax Systems: Consumption Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

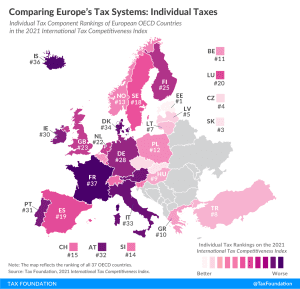

Comparing Europe’s Tax Systems: Individual Taxes

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

Norway’s New Budget Adds Unnecessary Complexity

Norway’s proposed reductions in income tax have the potential to increase disposable income for workers that can potentially raise consumption and contribute to economic growth. However, the increase of the wealth and indirect taxes is likely to step up the complexity of the tax system and create additional distortions.

3 min read

Despite Slip in International Tax Competitiveness Index, Germany Retains Top G7 Rank

More often than not, by looking at Germany’s tax code as an example, G7 countries can improve the stability of their revenues and the lives of those they represent.

5 min read

Pro-Growth Tax Reform for Oklahoma

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min read

Tracking 2021 Election Results: State Tax Ballot Measures

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

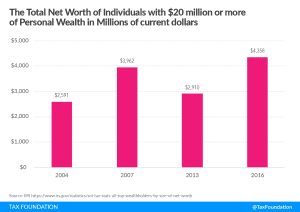

The Rich Are Not Monolithic and Taxing Their Wealth Invites Tax Collection Volatility

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

Movers and Shakers in the International Tax Competitiveness Index

The Index provides lessons for policymakers when they are thinking of ways to remove distortions from their tax systems and remain competitive against their peers. The further up a country moves on the Index, the more likely it is to have broader tax bases, relatively lower rates, and policies that are less distortionary to individual or business decisions. Going the other way reveals a policy preference for narrow tax bases, special tax policy tools, and rules that make it difficult for compliance.

5 min read

Proposal for Reporting Requirements for Financial Institutions Misses the Mark

Reducing the tax gap is a good idea, but the reporting requirements for financial institutions could be better-targeted at the problem at hand.

4 min read