Facts & Figures 2022: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

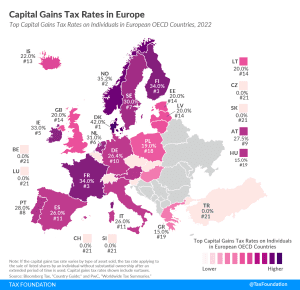

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax among European OECD countries, followed by Norway, Finland, and France.

4 min read

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

Twenty-one states and D.C. had significant tax changes take effect on January 1, including five states that cut individual income taxes and four states that saw corporate income tax rates decrease.

17 min read

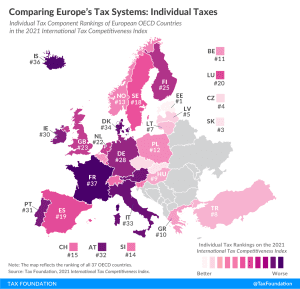

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

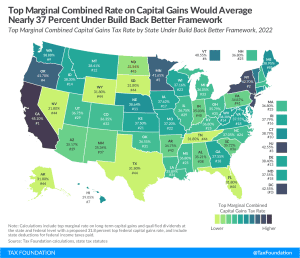

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

3 min read

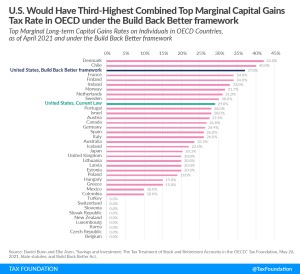

Under the new Build Back Better framework, the United States would tax capital gains at the third-highest top marginal rate among rich nations, averaging nearly 37 percent.

1 min read

Congress is debating new ways to raise revenue that would make the tax code more complex and more difficult to administer. The new proposals—imposing an alternative minimum tax on corporate book income, applying an excise tax on stock buybacks, and, at one point this week, a tax on unrealized capital gains for billionaires—are unreliable and highly complex ways to raise revenue.

10 min read

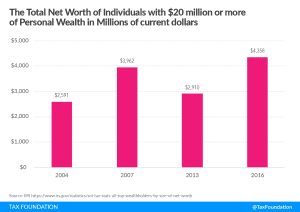

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

On May 4th, Gov. Jay Inslee (D) signed legislation creating a 7 percent capital gains tax, to take effect next year. On November 2nd, Washington lawmakers will learn what voters think about it.

5 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

As Congress considers President Biden’s proposal to tax unrealized capital gains at death, the history of previous efforts suggests it faces a perilous road ahead. Lawmakers must resolve tricky design and implementation details that derailed past attempts to change how capital gains are treated when assets are passed from one generation to the next.

4 min read

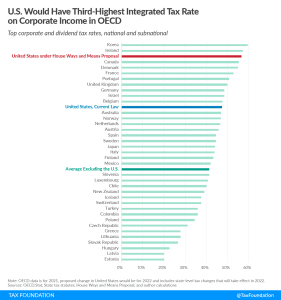

Under the House Ways and Means tax plan, the United States would tax corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent.

3 min read

The White House Council of Economic Advisors (CEA)’s recent report estimates the average federal individual income tax rate for the top 400 wealthiest households in the U.S to be 8.2 percent, lower than typically estimated for top earners.

4 min read

Congressional lawmakers are putting together a reconciliation bill to enact much of President Biden’s Build Back Better agenda. Many lawmakers including Senate Finance Committee Chair Ron Wyden (D-OR), however, want to make their own mark on the legislation.

5 min read