All Related Articles

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

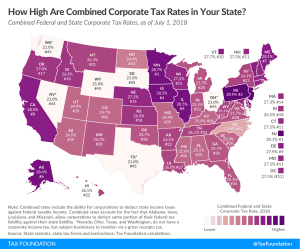

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income tax rate in the U.S., which combines the average of state corporate income tax rates with the federal corporate income tax rate, is 25.8 percent in 2019.

2 min read

Tax Trends Heading Into 2019

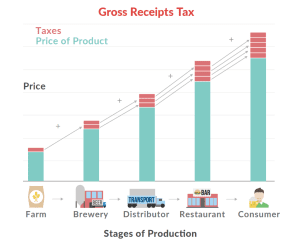

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

Results of 2018 State and Local Tax Ballot Initiatives

Ballot initiatives are often an afterthought on Election Day, but in many states, voters went to the polls to weigh in on significant tax policy questions. Here are the most recent results we’ve compiled for tax-related ballot measures.

5 min read