All Related Articles

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

The House Takes a Big Step Forward on Tax Reform

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

Eight Important Changes in the Senate Tax Cuts and Jobs Act

The Senate Tax Cuts and Jobs Act includes hundreds of structural reforms to the tax code. Here is a guide to the eight most important changes.

5 min read

Important Differences Between House and Senate Versions of the Tax Cuts and Jobs Act

This list, though not exhaustive, catalogues the major differences between the House and Senate version of the Tax Cuts and Jobs Act.

4 min read

Eight Important Changes in the House Tax Cuts and Jobs Act

The widely anticipated House Tax Cuts and Jobs Act includes hundreds of structural changes to the tax code. Here are the eight most important provisions in no particular order.

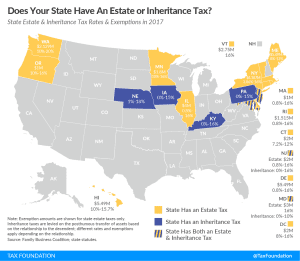

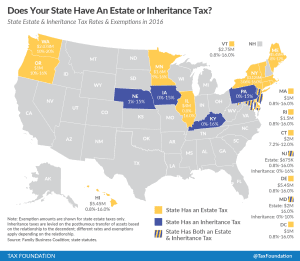

6 min readState Inheritance and Estate Taxes: Rates, Economic Implications, and the Return of Interstate Competition

Estate and inheritance taxes reduce investment, discourage business expansion, and sometimes drive wealthy taxpayers out of state. It’s little wonder that states are under pressure to reduce or eliminate them.

44 min read

Delivering Tax Relief to D.C. Taxpayers

2 min read

Trends in State Tax Policy

3 min read