All Related Articles

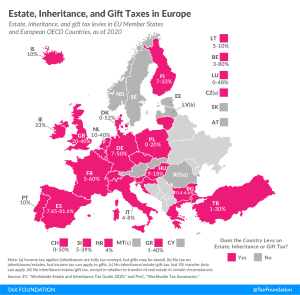

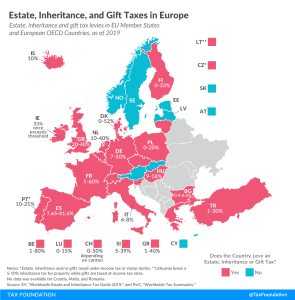

Estate, Inheritance, and Gift Taxes in Europe, 2021

Estate tax is levied on the property of the deceased and is paid by the estate itself. Inheritance taxes, in contrast, are only levied on the value of assets transferred and are paid by the heirs. Gift taxes are levied when property is transferred by a living individual. The majority of European countries covered in today’s map currently levy estate, inheritance, or gift taxes.

3 min read

More Tax Hikes Than Investment Projects?

Tax hikes implemented in the near term might undermine Spain’s economic recovery. Spain should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting private investment and employment while increasing its internal and international tax competitiveness.

5 min read

Common Tax Questions, Answered

Get answers to some of the tax policy questions we hear most often from taxpayers, businesses, and journalists. Learn everything from the basics of who pays taxes and the difference between credits and deductions, to how taxes impact the economy and what constitutes sound tax policy. Discover additional resources to explore each question and topic in more depth.

IMF Tax Proposals: Shrink Inequality or Sink Post-Pandemic Recovery?

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read

Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

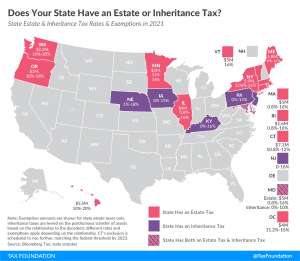

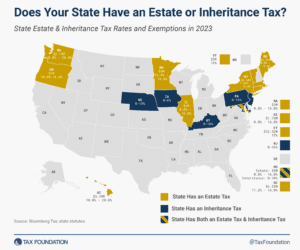

Estate and Inheritance Taxes by State, 2021

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Twelve states and Washington, D.C. impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness.

3 min read

2020 Spanish Regional Tax Competitiveness Index

The Regional Tax Competitiveness Index (RTCI) for Spain allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare. This Index has been designed to analyze how well regions structure their tax system. Additionally, it serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

Navigating the 2020 Tax Extenders in the Pandemic Economy

At the end of 2020, 33 temporary tax provisions are scheduled to expire at the federal level. These provisions generally fall under four categories: cost recovery, energy, individual, and other business provisions.

20 min read

Potential Regulatory Changes in Tax Policy Under the Biden Administration

President Biden may make greater use of regulatory changes to modify how tax law is interpreted and administered. There are several areas where a Biden Treasury Department, likely led by former Federal Reserve Chair Janet Yellen, may focus.

3 min read

Details and Analysis of President Joe Biden’s Campaign Tax Plan

What has President Joe Biden proposed in terms of tax policy changes? Our experts provide the details and analyze the potential economic, revenue, and distributional impacts.

23 min read

Tracking the 2020 Presidential Tax Plans

2 min read

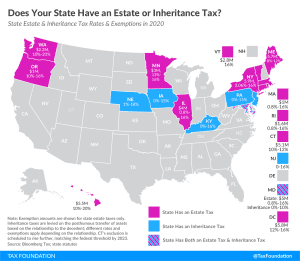

Estate and Inheritance Taxes by State, 2020

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

3 min read

Where Does Kamala Harris Stand on Tax Policy?

What tax policy ideas did Harris propose along the campaign trail, and how do they differ from Biden’s plan?

4 min read

Evidence Suggests that Tax Rates Influence Migration Decisions

Individuals respond to taxes by changing their behavior. Hence, when there are tax differences between countries, some might respond by moving to a lower-tax area. For higher-income individuals, the benefits of moving as a result of higher taxes are greater because they have more income or wealth at stake.

4 min read

The Three Basic Tax Types

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.

Not All Taxes Are Created Equal

Discover why there are better and worse ways for governments to raise a dollar of revenue. Compare the economic impact of the three basic tax types—taxes on what you earn, buy, and own—including three specific taxes within each category. Learn about the basics of “dynamic scoring,” one tool economists can use to compare the economic and revenue impact of different tax policies.