West Virginia Lawmakers Reach Deal on Tax Relief

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

With other states upping their game to attract ever-more-mobile people and businesses, lawmakers and the governor are not content to leave Tennessee’s business taxes in their current, uncompetitive form.

7 min read

When peeling back layers of the JCT report, it becomes clear that many tax expenditures are not “loopholes” or benefits for narrow special interests, but important structural elements of the tax code.

6 min read

A new tax expenditures report by the Joint Committee on Taxation (JCT) reveals two problematic developments: 1) policymakers have increasingly relied on the tax code to deliver benefits to individuals, and 2) the broad, neutral tax treatment of investment has shifted to targeted subsidies for businesses.

4 min read

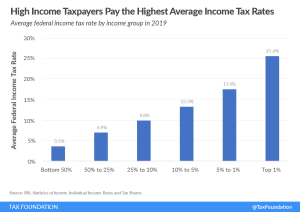

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

Spreading deductions for research investments across five years instead of one is an innovation killer.

Before EU policymakers rush to implement massive reforms, they should remember the goals of the Single Market, its international limitations, and the role of tax policy.

4 min read

A combination of long-standing IRS operational deficiencies, the agency’s temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog.

4 min read

Lawmakers should recognize both the growing importance of business R&D and the need to support it through a commonsense tax policy, namely a return to full and immediate expensing for R&D.

6 min read

As Chile looks to the future, the accelerated deductions for capital investment costs should be extended and made permanent while unnecessary tax hikes on individuals and capital should be avoided. Policymakers should focus on growth-oriented tax policy that encourages investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

4 min read

The tax treatment of research and development (R&D) expenses is one of the biggest issues facing Congress as the year winds down.

5 min read

Even though tariffs are invisible, their effects clearly are not. They might be sold as a tool to strengthen the economy, but tariffs are just taxes that make everyone worse off.

While there is disagreement about the amount of interest that should be deductible, it’s clear that the limit based on EBIT makes the U.S. an outlier compared to other countries across the OECD while raising the cost of new investment.

7 min read

In times of high inflation, states should consider adopting permanent full expensing because it boosts long-run productivity, economic output, and wages.

7 min read

Two weeks after the 2022 midterm elections, it’s becoming clearer where tax policy may be headed for the rest of the year and into 2023. In the short term, Congress must deal with tax extenders and expiring business tax provisions that may undermine the economy.

5 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

the Inflation Reduction Act gives us a glimpse into a future where the U.S. and EU opt for protectionist tax and trade policies rather than implementing principled tax policies and reducing trade barriers between allies.

5 min read

Since 2020, Spain has dropped from 26th to 34th on the International Tax Competitiveness due to multiple tax hikes, new taxes, and weak performances in all five index components.

7 min read

A border-adjusted carbon tax that uses some of the revenue for pro-investment tax reform could improve U.S. more competitiveness while also addressing concerns with a carbon tax.

29 min read

The business tax changes originally introduced in the TCJA are scheduled to increase tax burdens on businesses at a time when economic headwinds and broader uncertainty are higher than they have been in decades.

12 min read