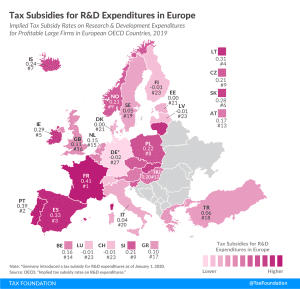

Reviewing the Benefits of Full Expensing for the Post-Pandemic Economic Recovery

One of the most cost-effective policy changes would be to make full expensing of machinery and equipment permanent and extend this important tax treatment to structures as well as for firms in a net operating loss position.

7 min read