All Related Articles

Austria Is Mulling an Allowance for Corporate Equity

While not a short-term measure to alleviate the economic losses resulting from the current crisis, experience from other countries has shown that a tax allowance for corporate equity can be a sensible long-term policy that can strengthen Austria’s investment environment and improve financial stability.

6 min read

Tax Options to Promote Short-Term Recovery and Long-Term Economic Growth in Wisconsin

From a revenue standpoint, Wisconsin was better off than many states going into this crisis, but the policy decisions—including tax policy decisions—state policymakers make in the months ahead will have far-reaching implications for how quickly jobs and wages are restored in Wisconsin.

7 min read

Biden’s Plan to Boost Research and Development Should Include Cancellation of Upcoming R&D Amortization

As concern over American competitiveness and onshoring of innovative activity increases, presidential candidates and policymakers should keep in mind the tax increases scheduled to take effect in the coming years, including the amortization of R&D and phaseout of the broader expensing provisions.

3 min read

Did 1986 Tax Reform Hurt Affordable Housing?

Improving cost recovery for residential structures, while not a silver bullet for solving the housing crisis, would on the margin encourage more construction that would help push rents down across the board.

4 min read

Iowa Decouples from 163(j) and GILTI, Clarifies Non-Taxation of PPP Loans

Iowa’s HF 2614, which passed both chambers of the legislature and now waits for the governor’s signature, makes several changes to the state’s tax code, which, although they will affect revenue, will encourage economic growth and make the state’s tax code more competitive.

4 min read

Improving the Tax Treatment of Residential Buildings Will Stretch Affordable Housing Assistance Dollars Further

By updating the tax code to allow developers to more fully cover their investments, construction costs will fall, which, in turn, means that federal affordable housing assistance dollars will go that much further in helping low-income tenants.

3 min read

Why Neutral Cost Recovery Is Good for Workers

Studies have shown that accelerated depreciation helps increase wage growth. A recent report found that states that implemented accelerated depreciation in their tax codes led to a 2.5 percent increase in compensation per employee in manufacturing, relative to states that did not.

3 min read

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

Full Expensing is Good for the Short Run and the Long Run

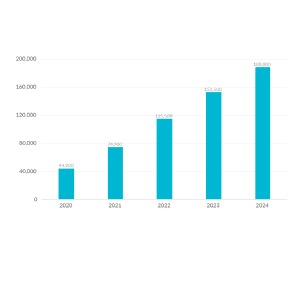

In the first year of enactment alone, we estimate the combination of full expensing and neutral cost recovery would increase full-time equivalent employment by more than 44,000 jobs. The cumulative impact by year five of the policy would be nearly 200,000 new jobs.

4 min read

Answering Four Questions About How Neutral Cost Recovery Works in Practice

A neutral cost recovery system lowers the short-term cost of the policy to the federal government while providing nearly equivalent economic benefits. While neutral cost recovery is not a new idea, there are several policy questions lawmakers will want to consider when designing this system.

6 min read

States Should Conform to These Four CARES Act Provisions to Enhance Business Liquidity

As policymakers continue evaluating their evolving revenue and spending options, the importance of enacting policies that enhance business liquidity must remain at the forefront.

9 min read

Weighing the Benefits of Permitting Business Credit Cashouts in Phase 4 Economic Relief

As lawmakers explore options for “Phase 4” coronavirus relief legislation, one idea that has received renewed attention is allowing businesses to cash out business tax credits. This proposal would be strengthened by also permitting acceleration of firms’ accrued net operating loss (NOL) deductions and designing the proposal so that firms can quickly convert these tax assets into cash.

4 min read

Tax Changes in California Governor’s Budget Could Stand in the Way of Economic Recovery

While other states are starting to think about the recovery, California is contemplating tax policies that would stand in the way of economic expansion once the health crisis abates. California’s shortfall is all too real, but tax policies which impede recovery are a hindrance, not a help.

5 min read

Reviewing the Benefits of Full Expensing for the Post-Pandemic Economic Recovery

One of the most cost-effective policy changes would be to make full expensing of machinery and equipment permanent and extend this important tax treatment to structures as well as for firms in a net operating loss position.

7 min read

Tracking State Legislative Responses to COVID-19

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

Tracking Economic Relief Plans Around the World during the Coronavirus Outbreak

Countries around the world are implementing emergency tax measures to support their economies under the coronavirus (COVID-19) threat.

51 min read

For Italian Banks: Converting Future Deductions to Present Tax Credits

During the coronavirus outbreak, Italy has been hit especially hard. Policymakers have introduced numerous measures to stem the spread of the virus and provide relief to businesses that are facing a severe downturn.

2 min readTax Policy to Bridge the Coronavirus-Induced Economic Slowdown

Tax policy can help by giving businesses current access to future tax “assets”—deductions and credits the businesses will be allowed or owed over time any way under current law—instead of making them wait.

5 min read

How the Federal Government and the States Could Help Save Small Businesses Through Temporary UI Tax Adjustments

Governmental responses to the coronavirus outbreak will require creativity and flexibility—and one aspect of that may involve temporarily rethinking how we structure not only unemployment insurance (UI) benefits but also the taxes that pay for them.

5 min read