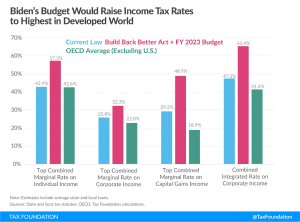

Biden Budget Would Raise Income Tax Rates to Highest in Developed World

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read